Some people are terrible with numbers. If you tell a client that a retirement expense is $100,000 in future dollars based on a 3% inflation rate, there's a chance they'll look at you as if you are speaking Swahili. Sprinkle in a pinch of financial jargon and most clients are completely lost.

Retirement health care costs might be the poster child for client confusion. Not only are published estimates wrapped in financial lingo, but the estimates are alarmingly high — a recipe for total client cognitive meltdown.

To add to the bewilderment, organizations publish estimates of retirement health care expenses in a myriad of formats: Future dollars vs. current dollars, reported vs. estimated results, median values, percentiles, averages and more. This is confusing enough for financial professionals, let alone the casual reader.

For clients to sort it all out, it helps to present the information in manageable doses.

SPELL IT OUT IN REAL DOLLARS

The impact of a $500 monthly expense is much easier for most people to understand than an incomprehensively high total lifetime number. Projecting real monthly health care expenses will also help to cut through the confusion of contrasting estimates from other sources.

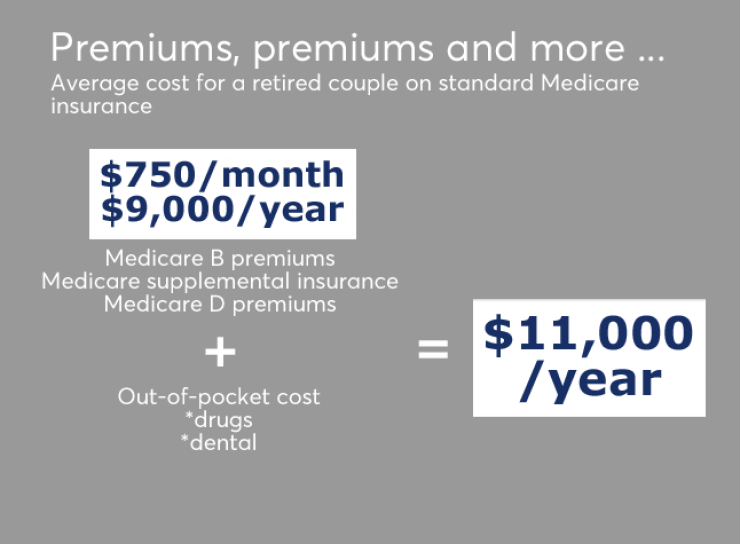

Start by demystifying the three most common health care costs for retirees on standard Medicare insurance. These include:

- Medicare B premiums (automatically deducted from Social Security payments)

- Medicare Supplemental Insurance

- Medicare D premiums (also deducted from Social Security).

For someone on Medicare C (Medicare Advantage), the cost estimates will be different.

Medicare B covers all physician costs. Most people today are paying premiums of around $122 a month ($244 for a couple). The cost goes up for individuals with the highest income level. Medicare Supplemental Insurance (aka Medigap Insurance), covers most Medicare deductibles and co-pays and is optional, but highly recommended. It averages about $200 per month for one person ($400 for a couple). Medicare D (drug coverage) is approximately $50 a month for an individual ($100 for a couple).

The cumulative cost for all three is $750 a month for a couple, or $9,000 for the year. Add out-of-pocket drug costs and out-of-pocket dental expenses and clients are snugly in the neighborhood of paying $11,000 a year at today’s prices per average couple. Although this might seem like a surprisingly high number, many families don’t realize that they now spend close to that amount annually on groceries.

While the sector has been in a slump, advisors who go beyond the recent returns can show clients how these funds have bested the S&P 500 over time.

-

Often under-used, HSAs can be a powerful tool for clients.

October 9 -

When looking for concierge healthcare and health insurance advice, financial advisors often find that support from specialized health consultants.

September 17

Be sure to use a realistic inflation rate. Healthview is currently estimating a health care inflation rate of 6% for the next 10 years — well above average estimated consumer inflation. Clients also need to understand that any potential long-term care costs are not included in any of these estimates.

KEEPING COSTS DOWN

There are some ways to potentially lower costs.

Stay healthy. Easier said than done, but the savings can be substantial. Projected lifetime cost differentials between median and high prescription drug needs is about $140,000 for a 65-year-old couple, according to Healthview.

Consider Medicare C (Advantage). Medicare C is essentially an HMO partially funded directly by the program that one can use instead of standard Medicare. It is often cheaper overall. Premiums are usually very low (even zero), but are very dependent on region. Out-of-pocket costs are often higher, however, and there is limited in-network physician access.

Modify income for higher-net-worth couples. Couples with retirement income of more than $170,000 may incur significant Medicare surcharges ranging from 35% to 200% of their Medicare premiums. Planning strategies such as relocating assets through Roth conversions or other ways to moderate income could limit extra costs.

Reviewing a client’s personal health can also help. Lifetime health care expenses for different individuals can vary dramatically. Carolyn McClanahan, a CFP and a physician, as well as a Financial Planning contributor, stresses that these issues are more nuanced and amenable to smart planning than many advisers realize.

Advisers might reflexively use the same life expectancy numbers for all clients — whether they choose an average life span, 100 years, or some other metric. However, an obese diabetic client with heart disease should not anticipate the same health care costs as a health nut with a family history of longevity.

Foreign travel for higher-cost medical procedures is also an option in some situations. Even more common are the throngs of retirees who spend winters in Arizona and cross the border into Mexico for dramatically inexpensive dental work.

In general, $11,000 a year, inflated for future years, is a reasonable starting number to use for most clients’ retirement health care expenses. Modify this to the degree their situation varies from the norm.

Though these estimates might surprise many clients, they will be better prepared for the future by addressing the numbers head on and planning accordingly. It is a safer bet than ignoring them and hoping for the best.