A National Planning firm with more than $300 million in client assets chose a broker-dealer with about 275 advisors instead of one with more than 14,000.

The seven advisors of McLane Advisors bolted for USA Financial after LPL Financial acquired National Planning’s assets, USA announced this week. The Houston-area firm

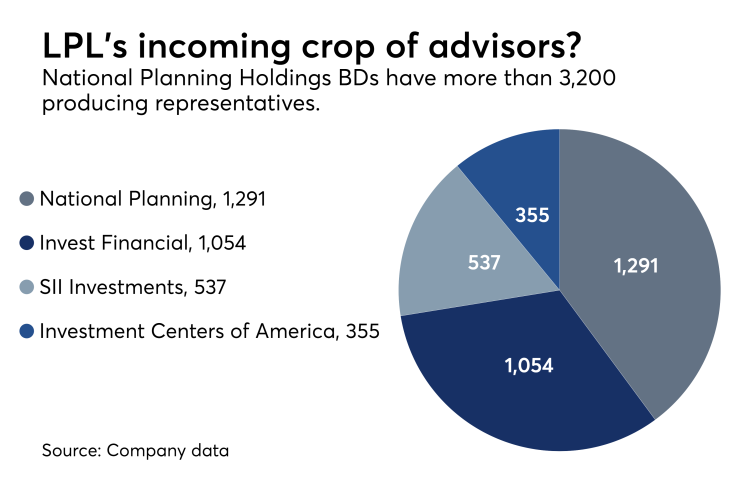

The assets of McLane’s former BD and three other National Planning Holdings-owned BDs will move onto LPL’s platform after

“We thought we would get better service and better communication,” says Matt McLane. “We had never been with a smaller firm like that, and we liked the idea of it.”

-

The team marks at least the second to opt for a smaller IBD over the nation’s largest.

October 19 -

The move marks the latest in a frenzied period one recruiter describes as “a feast.”

October 19 -

IHT Wealth Management now has $2.4 billion in client assets.

October 19

Independent and regional firms have been maintaining strong appeal with new recruits.

‘APPLE IN A SEA OF ORANGES’

The firm formally left National Planning last week, according to FINRA BrokerCheck. Representatives for National Planning and LPL declined to comment on their exit.

McLane’s grandfather, Frank Sr., founded the firm in 1954. Matt McLane works there with his father, Frank Jr.; his uncle, Todd; his brother, York; his cousins, Chad McLane and Daniel Ure; and his father’s longtime business partner, Jim Schulmire. They joined National Planning from FSC Securities in 2009.

The Tomball, Texas-based practice focuses primarily on actively managed variable annuities, but it began offering full separate advisory services in the last 12 months, Matt McLane says. Most of its clients are retiring police officers, firefighters and other municipal employees from around Texas.

“We’re kind of a unique office,” Matt McLane says, comparing the practice to “an apple in a sea of oranges.”

Matt and Chad McLane had been exploring a possible BD change before the LPL deal, he adds. He praises LPL’s outreach to his firm. However, he says the nation’s biggest IBD was too large for McLane, and its technology and broker-dealer fees were too expensive.

GROWING HYBRID FIRM

McLane’s new BD, the suburban Grand Rapids, Michigan-based USA Financial Securities, comprises one of USA Financial’s five affiliated companies. USA also has an insurance and annuity distributor, a money manager, a cross-platform marketing and tech provider and a financial media firm.

About 60 in-house staff members work at USA Financial, and the firm manages about $3 billion in client assets, according to USA. The firm has seen an uptick in recruiting since the fiduciary rule, as more advisors look to make a transition to full RIA status under its auspices, says COO Matt McGrew.

USA expects to add about 40 new advisors to its ranks in 2017, according to chief sales officer Justin Long.

“We could have added 120 this year,” Long says. “We’re very, very selective. We want to be around long term.”