Wealth management has a case of déjà vu.

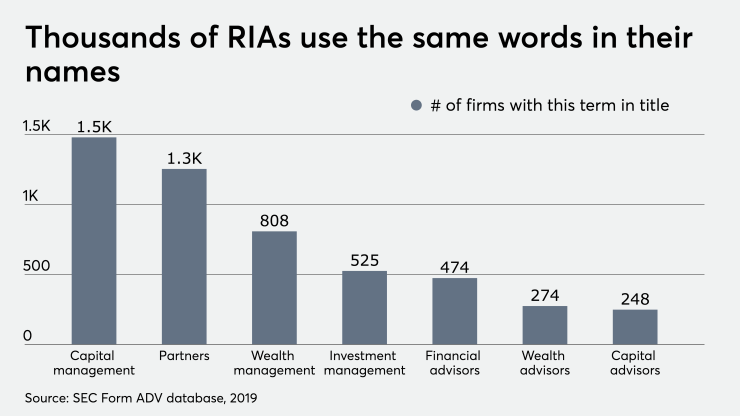

In an industry with tens of thousands of small advisory firms, many of the same boilerplate words and phrases crop up again and again in company names: Capital management. Partners. Wealth management. Capital Partners. Apart from giving a fledgling company a generic feel, such reptition can bury advisors online — or even become a trademark liability.

The redundancy is often an intentional choice, according to Amy Parvaneh, a former Goldman Sachs advisor who founded Select Advisor Institute, which does brand consultancy for RIAs.

“In this business you don’t want to be cute; you don’t want to be poetic,” she says.

A look at the 14,300 RIAs Form ADVs filed with the SEC in 2019 bears this out. Over 1,400 firms used “capital management” in their name last year; more than 1,250 used “partners;” 808 contained “wealth management,” and so on. And many of them are using the same terminology to describe themselves.

A downside of a generic firm name is the challenge of standing out on Google, according to Parvaneh.

“You don’t want your firm name to compete with so many others, especially if your competitors have much stronger digital marketing,” she says.

Another potential pitfall: Advisors who tack on “wealth management” or “financial advisors” to their name have faced legal challenges, according to David Canter, the head of Fidelity’s RIA division and who was once an advisor services attorney.

Canter says he’s seen RIAs on Fidelity’s custody platform receive cease-and-desist letters after minting their firm with a name already in use. Choosing a name is “not something that should be taken lightly,” he says.

But firms that understand the importance of [standing out], or are looking to grow, sometimes re-evaluate their names, Parvaneh says.

Existing firms that rebrand do so for strategic reasons, but it’s also personal, according to two RIA executives who recently made a name swap.

Matt Kilgroe, who launched an RIA earlier this year after breaking away from UBS, didn’t want the name of his practice — Kilgroe, Frantzis, Quinty & Associates Wealth Management — keyed to individuals in the firm.

“Ideally your firm's around long enough to see that person retire — and then what do you have?” Kilgroe says.

After more than six months trying to coin an alternate name, Kilgroe and his team of 13 hired a marketing company, which landed on the brand Cyndeo Wealth Partners. The name stems from “syndeo,” the Greek word for connect, a tribute to business development director Pete Frantzis’ Greek roots — with a letter swap to avoid trademark issues.

For Scott Hanson, CEO of $8.6 billion RIA Allworth Financial, the firm’s M&A focus was a key part of the firm’s decision to rebrand from Hanson McClain Advisors in 2019.

“We're looking for people who will give up some control of their business; who will give up their brand,” Hanson says. “The fact that we've done all those things as well for a larger purpose — that resonates.”

Changing a company’s name isn’t easy, according to Parvaneh. While coining a new moniker typically takes about two weeks, advisors have to replace Form ADVs, change websites and craft new materials, all of which can take six months or longer.

However, there’s a time and place for a traditional eponymous firm name, according to Hanson, who recalled when he and his partner, Pat McClain, were first starting out.

“It gave us a bit of cache having our names on the door,” he says.