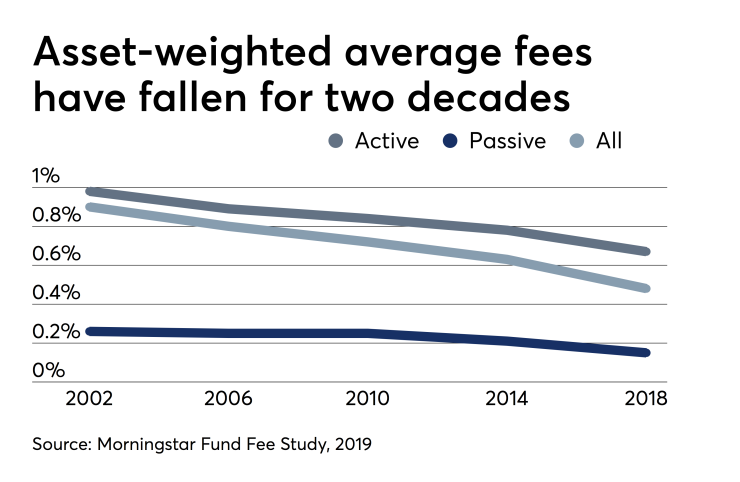

Fund fees continue to fall — and financial advisors can take some credit.

After nearly two decades of steady decline, the average asset-weighted fee in 2018 fell to .48%, three basis points less than the previous year, according to Morningstar’s 2018

Financial planners’ transition from commission-based pricing to a fee-based pricing model, has played a role in the price decline, according to Ben Johnson, director of passive funds research at Morningstar.

“In order to make more room for their fees, [advisors] have to squeeze those fees out of the products they use to build portfolios,” Johnson says.

Many advisors regard selecting lower priced funds consistent with a client’s best interest. “If you’re a fiduciary do you want to charge a fee on top of a fee?” asks Lori Zager of 2X Wealth Group, a team at Ingalls & Snyder.

Clients saved an estimated $5.5 billion in fund expenses last year, according to Morningstar’s study, the second largest year-over-year decline since 2000. The average payment an investor made in open-end mutual funds and ETFs was .48%, down three basis points from 2017.

In addition to pressure from advisors, fee compression has stemmed from a variety of factors aside from a push from advisors, including competition among asset managers as well as client awareness.

Clients have come to the realization that, just because a fund costs more, it may not be a better product, according to Johnson.

“We tend to think the more we pay for something, the more we are going to get, the higher quality we are going to get from that item,” he says. “When it comes to investment products, they tend to flip conventional notions of money on their head.”

Advisors are also paying more attention to how they select share classes. Share classes with embedded costs, such as loads and 12b-1 fees, are losing popularity, according to the Morningstar study.

-

Fund companies could launch a new type of product that does not have to reveal its assets.

April 9 -

Still, some products with higher yields also have higher Sharpe ratios. Could that indicate better risk-adjusted performance?

April 15 -

The famed investor recommends 90% large-cap U.S. stock and 10% short-term government bonds. Is it a crazy idea?

April 3

Regulators have also been focusing on share class selection, advising broker-dealers and firms to closely watch what they are recommending to clients.

FINRA and the SEC have leveled more

In general, clients are becoming more savvy with the price tags on their portfolios.

“If there was anything surprising, it is just how shrewd clients have become when it comes to what they are paying for funds,” Johnson says.