The Department of Labor’s fiduciary rule will spur mutual funds to launch more than 3,500 shares of a new class of low-fee offerings for IRA investors, according to a study.

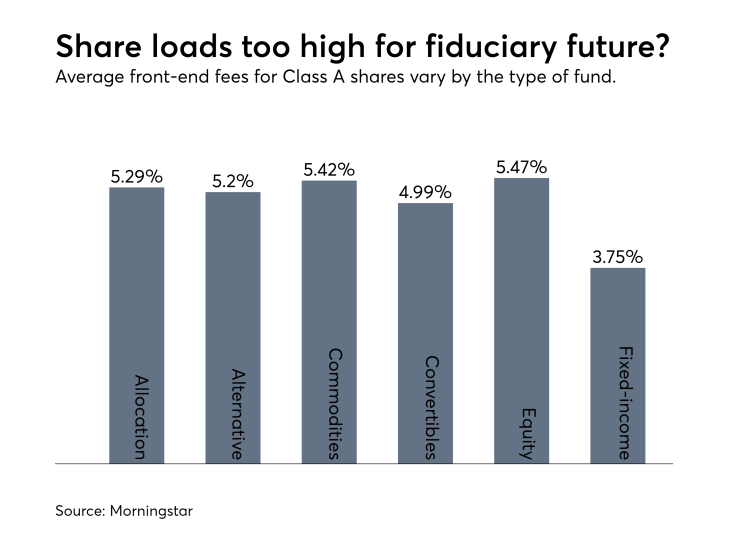

Maximum front-end loads for the most common type of share sold through a broker, Class A, cost an average of 4.85% of the investment, according to a Morningstar report. In contrast, new Class T shares will cost 2.5% or less, and another new class, so-called “clean” shares, would eliminate the fees entirely, the research firm found.

The T shares, which come from the word “transactional,” allow advisers to continue collecting commissions while in compliance with the rule. Clean shares, on the other hand, open more options for fee-only fiduciaries.

The investment research firm submitted the white paper to the DoL last week, following the Labor Department’s announcement that it would

“We do think that T shares really inherently reduce certain conflicts of interest,” he says. “A delay does give everyone more time to prepare. This is a complex rule.”

-

Mutual fund providers sought to use digital platforms as new distribution channels for their funds, but new guidance upends a strategy that would rely only on proprietary products.

November 2 -

Some providers are offering access to the industry through bundles of shares focused on businesses that run everything from airports to cell phone towers.

February 14 -

The research giant says it aims to lower costs by removing a layer of fees paid to third-party managers.

March 14

LOWER FEES, HIGHER RETURNS

The possible outright repeal of the rule has not derailed mutual funds’ efforts to tap into the current trend toward lower-cost passive investments like ETFs, according to the white paper.

The funds will introduce more than 3,500 new T shares in coming months, Morningstar found. The firm came up with the figure by examining SEC disclosures from the mutual funds and more than 3,000 Class A shares. The report did not have specifics on the number of new clean shares slated for offerings.

A Morningstar spokeswoman declined to comment on whether

T shares could add roughly 50 basis points to investors’ returns, with 20 coming from the lower fees and 30 coming from investing in better-performing funds, according to the study. On the other hand, wealthier investors pay loads on A shares that are well below the average rate, and advice merits a premium, Szapiro says.

“You can’t just look at one side of the equation,” Szapiro says. “It’s fees on one side and the value to the investor on the other.”

Yet an investor rolling $10,000 into an IRA using a T share instead of an A share would save about $235 right away and an extra $1,789 for every $10,000 invested over 30 years, Morningstar found.

“In the long term, we expect further innovation in share classes to provide more flexibility to advisers and better outcomes for investors,” Szapiro wrote in a letter to the DoL on April 13.

The agency received about 193,000 comments on the delay before officially

“I think everybody is in wait-and-see mode right now,” Szapiro says.