A former global head of diversity at Morgan Stanley is suing the company for alleged race discrimination, sharply criticizing her ex-employer’s treatment of Black employees and its use of confidential arbitration to settle disputes.

Marilyn Booker, who was terminated from the firm in 2019, says her efforts at improving diversity at Morgan Stanley went unsupported by company leaders, and were at times undermined, according to her lawsuit filed this week. She points to severe underrepresentation of minorities among Morgan Stanley’s management and advisors.

“Clearly there has been absolutely no progress with respect to Morgan Stanley’s diversity efforts under [CEO James] Gorman’s leadership,” Booker’s lawsuit says

Morgan Stanley disputes the allegations.

The discrimination lawsuit is the most recent of several filed against major financial services companies, raising questions about how much progress the industry has made on diversity and inclusion.

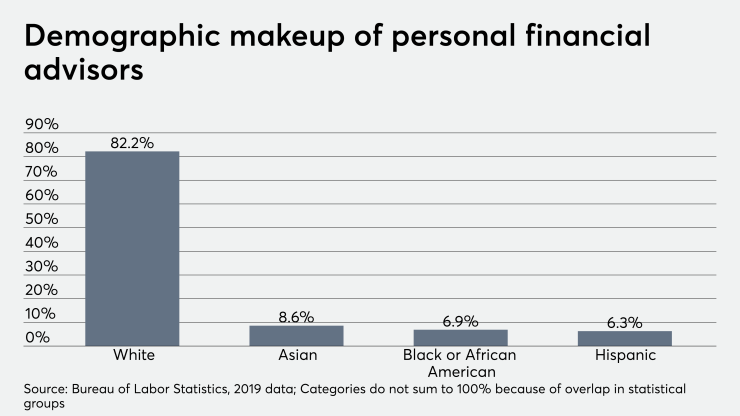

Despite years of effort and pledges from wealth management leaders to enact changes in an industry long plagued by accusations of racism and sexism, the financial advice business remains a largely white profession.

Eighty-two percent of advisors were white in 2019, compared to 6.9% Black and 6.3% Hispanic, according to data from

“We started with 40 people just marching, and it turned into 15,000," an advisor says.

Obtaining accurate demographic data on race and ethnicity in wealth management is difficult. The Bureau of Labor Statistics uses a broad definition of personal financial advisors that includes professionals in adjacent industries. The CFP Board has shared its data, but that only reflects people who hold CFP certifications (a mere 3.8% of planners are Black or Hispanic,

Few wealth management firms publicly share data. Morgan Stanley said in a statement that it has “made steady progress” on diversity. It declined a reporter’s request to share demographic data.

Morgan Stanley was sued 2018 by a former manager and advisor, who is Black and accused the firm of discrimination. In 2007, the company settled for $16 million a bias lawsuit filed by Black and Latino advisors. Other major wealth management firms have faced similar allegations. In 2016, Wells Fargo agreed to pay $35 million to settle discrimination claims.

In her lawsuit, Booker says the firm has failed to live up to its commitment to improve diversity at the company.

She claims Morgan Stanley has about 100 Black financial advisors (the company has about 15,400 total advisors, according to its latest earnings report). Booker also points to a lack of diversity at the upper echelons of the company. Just one board member is Black and, Booker says, less than 3% of the firm’s 1,382 managing directors appointed since 2012 have been Black.

“Such a gross disparity is appalling,” her lawsuit says.

Arbitration and discrimination

Booker’s lawsuit also takes aim at Morgan Stanley’s use of mandatory arbitration for employee disputes — a practice that has come under intense criticism at other firms with regard to sexual harassment disputes.

Booker wants Morgan Stanley to take similar action.

“Forced arbitration as a term of employment means that Black employees that experience discrimination because of the color of their skin have no choice but to hide their legal claims from the public, causing many to decline to even press their complaints knowing how the odds are already grossly stacked against them,” her lawsuit says.

Morgan Stanley has faced

"Morgan Stanley has no genuine intent to reform, to provide equal opportunities to African Americans, or to abide by the spirit of its agreement" to settle the racial discrimination claims, Lockette said in his lawsuit. At the time, the company disputed the allegations.

Booker, who filed her suit in a federal court in New York, says in court documents that unless the firm abolishes mandatory arbitration then, “any purported claim to ‘meaningful efforts’ to fight against racism means nothing.”

Booker had worked at the firm for about 26 years, serving as its head of diversity from 1994 to 2010 when she was moved to another department and eventually put in charge of an urban markets group. She was tasked with helping to build inroads in minority communities, but claims she was undermined by a lack of meaningful leadership and budget cuts.

The

Booker says that an effort to create a mutual fund to market to Black and minority communities was met with resistance. She claims to have enlisted the support of Steve Harvey, a comedian and host of the TV show Family Feud. But a Morgan Stanley executive allegedly told her that Harvey was not “consistent with our brand or our audience,” according to the lawsuit.

She also says that as she became more vocal about the need to support Black employees and Black causes, her ability to enact change decreased. As head of the urban markets group, her budget was 71% lower in 2019 than what it had been when she took on the role in 2011, according to her lawsuit.

She was let go in December without an explanation as to why, the lawsuit says.

The firm disputes her allegations, and intends on vigorously defending against the claims “in the appropriate forum,” a spokeswoman said in a statement.

“We are steadfast in our commitment to improve the diversity of our employees and have made steady progress – while recognizing that we have further progress to make. We will continue to advance our high priority efforts to achieve a more diverse and inclusive firm,” the spokeswoman said.