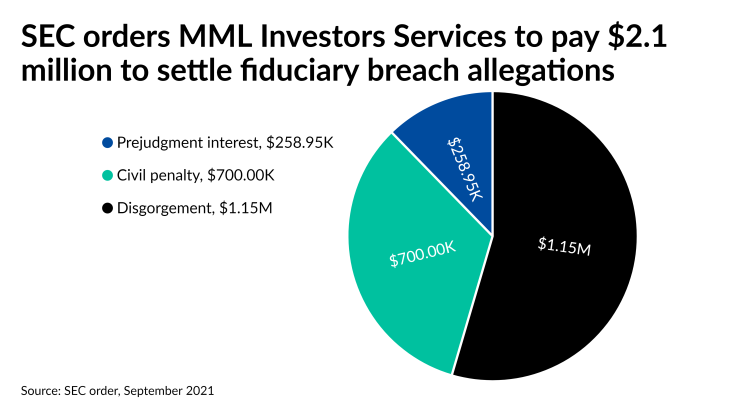

As wealth management braces for the Biden administration to ramp up enforcement, one of the largest firms agreed to settle an SEC case with its second million-dollar payment.

MML Investors Services, the broker-dealer and RIA owned by insurer MassMutual, breached its fiduciary duty by failing to adequately disclose the conflicts of interest of third-party revenue sharing payments from its clearing firm and violating clients’ right to best execution with respect to the price of their mutual fund share classes,

The agreement covers conduct dating back to 2015 at MML and MSI Financial Services, the wealth manager that MassMutual purchased in 2016 as part of its $165-million

Form ADV brochures filed by the firm starting in January 2020 reflect that MML “will periodically review the universe of share classes that it offers and recommend only one share class that MML believes offers the most favorable expenses,” the settlement states. “When, as a result of this periodic review, MML determines that a more favorable share class is available, MML will convert any holders of more expensive share classes to the more favorable share class.”

MassMutual’s wealth manager accepted the settlement without admitting or denying the SEC’s findings. At $1.24 billion in annual revenue, MML is the No. 8 firm in Financial Planning’s

“MML Investors Services takes this matter very seriously and cooperated fully with the SEC,” MassMutual spokeswoman Paula Tremblay said in a statement. “Similar to other industry participants, we have reimbursed impacted accounts and are pleased to have resolved this matter.”

The case came as the industry awaits the next move from Gensler’s SEC. The regulator provided a hint about its possible plans with

Under Gensler’s team, the SEC and FINRA are moving away from the emphasis on disclosing conflicts of interest, Christine Lazaro, director of the St. John’s University School of Law’s Securities Arbitration Clinic, said in a panel held by the Institute for the Fiduciary Standard last week. The regulator “has not always enforced its rules in a way that is consistent with true fiduciary principles,” Lazaro said.

“The SEC is beginning to acknowledge that, if it is going to consider an investment advisor to be a fiduciary, it must expect more from them,” Lazaro said. “I expect we're going to see the SEC shift its focus from an expectation of disclosure to an expectation of adherence to fiduciary principles that is putting the investors' interests first and not simply informing them when the advisor hasn't.”