Buy American? Dive into emerging market equities? Advisers are at odds on where to allocate client assets.

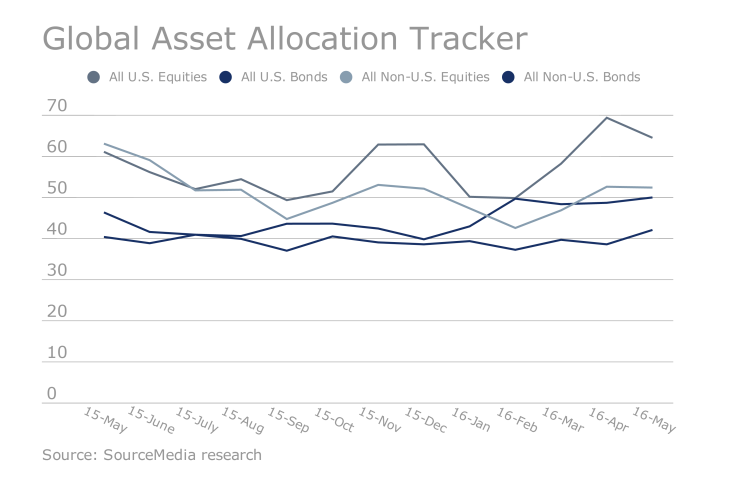

Advisers report allocating less client funds to domestic equities, while allocations to global equities remained relatively unchanged, according to the Global Asset Allocation Tracker, which surveyed 326 advisers.

One wealth manager says he feels that, in this current environment, with a stronger U.S. dollar than in years past, it's time to invest more funds in global equities, adding that "no matter how much you have in international, you probably [have] to have more."

Other advisers are going in the other direction, put off by negative economic signals in countries such as China.

"We have come full circle in these past 12 months," a planner says. "Back to [the] U.S., and forget global for the most part. Things are simply looking too interesting here, and [more] risk-appropriate, I might add. It's time to buy U.S. Places like Brazil, fuhgeddaboudit!'

Advisers say clients are equally divided, with some seeing the strong dollar as a signal to invest abroad while others are put off by China's slowdown and additional global concerns.

"Clients are still concerned about emerging markets, so they are reducing their exposure slowly — even though those markets have done better recently," a wealth manager says.

In general, advisers reported they were not upping allocations to domestic or global bonds, citing interest rates and central bank policies. One adviser laconically summed up his position thus: "Not a good time for bonds."