Some of the most disruptive business models that the world has ever known have succeeded through the use of cross-subsidies — the act of giving away for free something that consumers were previously paying for.

For advisors, cross-subsidy models introduce the potential for numerous disruptions in the coming years. One example is of an RIA custodian that gives away the actual custody services, trading and execution — and gets paid for its technology platform instead. Another example: Model management software that makes it feasible to buy index ETFs without the need for a mutual fund or ETF itself.

There’s no shortage of thinking about how to price traditional components of our work.

The challenge of disruptive cross-subsidy models is that they still require finding someone willing to pay for a key component of value. Still, when a firm identifies the single most valuable component of a solution and gives everything else away to support that core value, the payoff can be sizeable.

And as the following examples show, it may be high time for the industry supporting advisors — and the advisor business model itself — to experience such a disruption.

TECHNOLOGY’S ROLE

With the ever-accelerating pace of technological change, it seems that more and more industries are being disrupted.

In practice, it’s somewhat messier. While companies like Uber, Airbnb and Amazon have had rapid disruptive impact, other innovations — such as the robo advisor movement, which still has less than 1% market share after six years — turn out to merely win an incremental share of the market, rather than disrupt it outright.

Some of the biggest disruptions though, come when industries collide. This creates the potential for the economies of one industry to fundamentally disrupt the pricing and business model of the adjacent industry — in some cases, where one competitor literally gives away its solution for free, because the company has other ways of making money.

In some cases, this is a classic loss leader or freemium approach to marketing, dating back to when King Gillette famously

In other situations, the model is not one of loss leaders, where a disruptive offering is given away for free because it’s expected to be profitable later. Rather, it may be a cross-subsidy model, where a solution is free and remains free because there is some other aspect of the business that generates revenue.

For instance, radio, television and most newspapers have historically been free because they were cross-subsidized by the advertisers who were willing to pay the entire cost of the business for the opportunity to get in front of a desirable audience.

Clearly, the cross-subsidy model is applicable to many industries and domains. Chance the Rapper has managed to become a financially successful musician by giving away his music for free, because he makes his money from those who

That said, such disruption is perhaps most commonly seen in technology sectors. Google disrupted Garmin and other in-vehicle GPS navigation devices by giving away a superior Google Maps product for free. Since it was financially supported by the rest of Google’s business model, Maps forced Garmin to focus on

In practice though, cross-subsidy models can be challenging to establish because someone still has to pay, and it may require at least one group of customers to pay for something they’re not accustomed to paying for in order for someone else to get it free. Thus, Google Maps couldn’t disrupt Garmin until it established the validity of online advertising to make other companies willing to pay to subsidize Google Maps in the first place.

Nonetheless, the disruptive potential is tremendous, and has long existed in the financial services industry as well. Look no further than RIA custodians who give away free custody services to RIAs, not to mention bundled technology — from Fidelity’s full Wealthscape platform to TD Ameritrade’s iRebal software, alongside the whole VEO platform itself — because RIA custodians get paid via business cross-subsidies from securities lending and order routing to earning a spread or net interest margin on cash.

This raises the question: What other disruptive possibilities may emerge in the advisory industry from here?

GIVE IT AWAY?

Arguably, one of the first and best disruptive possibilities is for the RIA custodial business model itself. Historically, it’s been great that RIAs have been able to get RIA custody services for free, but because of the cross-subsidies that already exist, those current cross-subsidies are becoming increasingly tenuous, opening the door to new models.

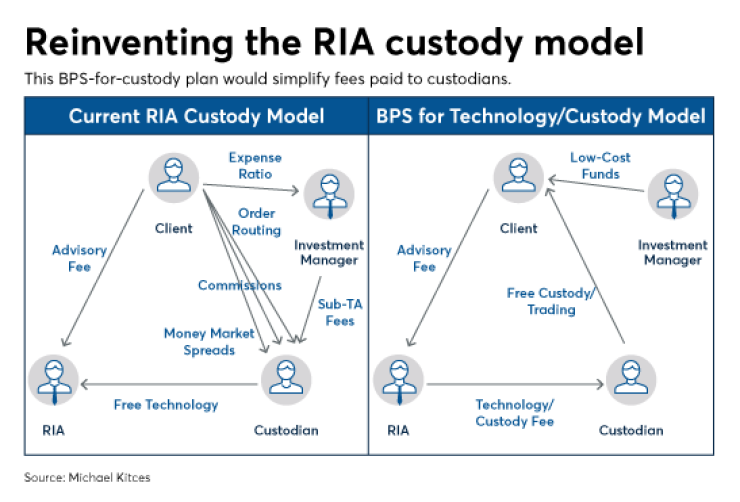

In practice today, the overwhelming majority of RIA custodian revenues come from just a few narrow cross-subsidy buckets, earning a spread on money markets or net interest margin on cash deposits via an affiliated bank; securities lending and margin lending; trading commissions; order routing; and shareholder servicing and sub-TA fees — or sometimes, other sponsor or shelf space fees — paid by asset managers to be on the custodial platform.

The fundamental challenge is that as fiduciaries and as businesses simply trying to demonstrate value to their own clients, RIAs have spent years

And the issue has recently been coming to a head, whether it’s controversy around

The end result of each: RIA adoption of Institutional Intelligent Portfolios

Ultimately, as with any business, RIA custodians are entitled to get paid, but the need to drive the current set of cross-subsidies is increasing tension between RIAs and their custodians, even as the platforms build out more and more technology tools that make it absolutely essential to use an existing custodian to run your business as an RIA anyway. This means it may only be a matter of time before some RIA custodian tries a new disruption: charging basis points for the technology, and just giving away all the custody services.

Some advisors might note that paying basis points for technology seems very cost-ineffective, especially for larger firms, compared to paying the fixed monthly or annual costs of many software providers today. Yet the reality is that most RIA custodian cross-subsidies are already in basis points, from the spreads on money markets to the shareholder servicing and sub-TA fees of mutual funds and ETFs.

In essence, most of the RIA custody model already boils down to getting paid basis points on assets on platform, and measuring the profitability of advisors based on their custodian-revenue/assets ratio.

The distinction, however, is that a straight bps-for-custody model reduces many of the other conflicts between RIAs and their custodians, from the pressure to keep cash on platform to fighting about the cost of ticket charges — which should vanish entirely in a bps-for-custody model — to the ability to get the true lowest-cost version of funds e.g., DFA funds without ticket charges, Vanguard ETFs without shareholder servicing fees or American Funds F-3 shares).

In fact in many cases, the clients would end out with approximately the same all-in cost anyway. After all, the whole point of the model would not necessarily be to raise the custodian’s revenue/assets pricing, but just to simplify it, make it more transparent, reduce the inherent conflicts so RIAs and custodians can grow more effectively together, and focus on the real value proposition — i.e., the technology — and not the commoditized, basic custody service components.

This bps-for-custody model exists to some extent already, with the availability of asset-based wrap fees in lieu of trading commissions, but the real opportunity is to expand asset-based wrap fees into a full-platform fee that allows the custodian to give everything away in the custody business — including the trading fees — in exchange for a robust technology layer that the advisor uses to run their business.