After nearly 30 years regulating Wall Street firms, Susan Axelrod is about to join one of the biggest brokerages she helped oversee: Merrill Lynch.

Axelrod, formerly a top executive with FINRA, will join Merrill Lynch Wealth Management in May, stepping in as the unit's chief supervisory officer and reporting directly to Andy Sieg, who heads up the Bank of America wealth management unit.

Axelrod

Now, she'll oversee regulatory and risk management operations at Merrill Lynch. The company had about 14,500 financial advisors and approximately $2.3 trillion in client assets as of Dec. 31.

"As our advisors continue to build their practices in an evolving regulatory environment, Susan will be an essential partner helping us drive responsible growth and improve how we operate," Sieg says in a statement.

A spokeswoman for Merrill Lynch declines to elaborate on Axelrod's specific responsibilities, or to address the charge that her hire fits into a familiar pattern of former regulators landing plum jobs with the firms they used to oversee.

"When I first saw that the very first thing I thought was the revolving door is in full effect," says Andrew Stoltmann, a Chicago arbitration attorney and president of the Public Investors Arbitration Bar Association. "She is eminently qualified, she has a fantastic reputation, and I certainly don't begrudge her for taking a well-paying job, but it's the quintessential exhibit A for showing the revolving door between regulators and Wall Street."

Axelrod will replace Merrill's former supervisory chief Michelle Carter, who earlier this month assumed a new role heading up business planning, governance and controls at U.S. Trust, another unit of Bank of America.

When asked for additional comment on the new hire, a Merrill Lynch spokeswoman referred back to statements from Axelrod and Sieg.

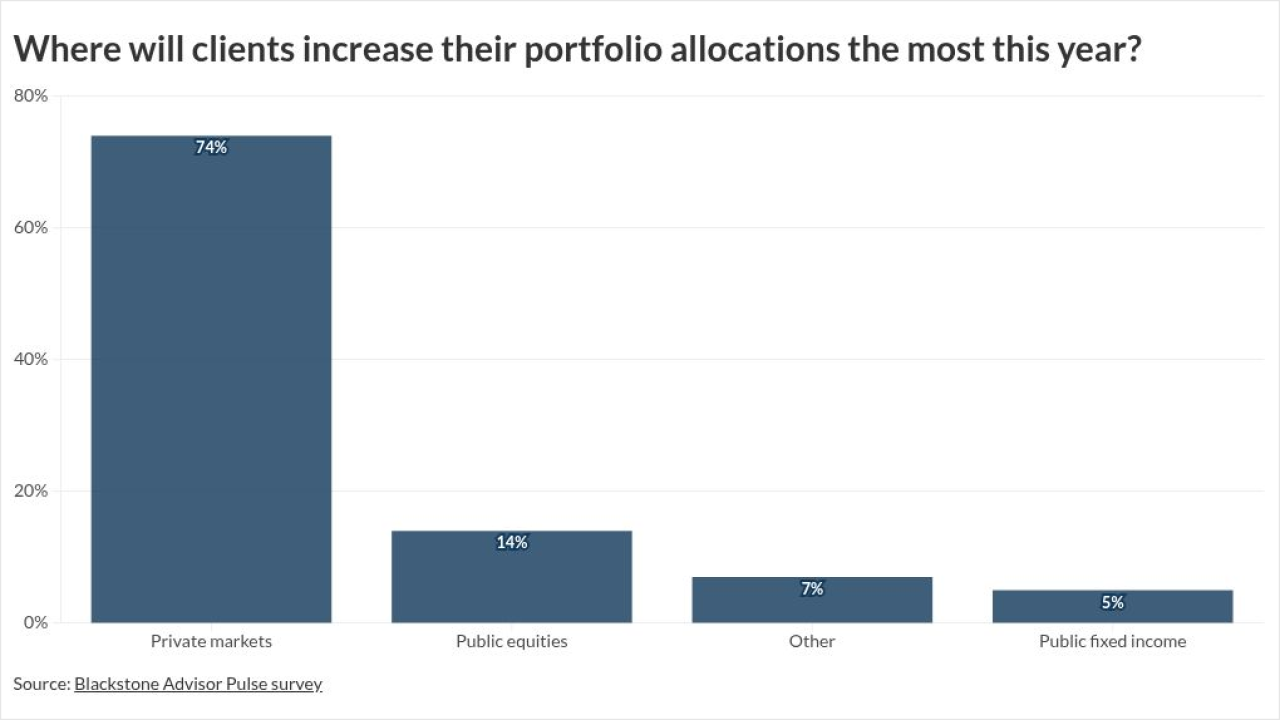

Retail investors increased their allocations to private equity, private credit by a whopping 36% last year as advisors look for diversification and strong returns.

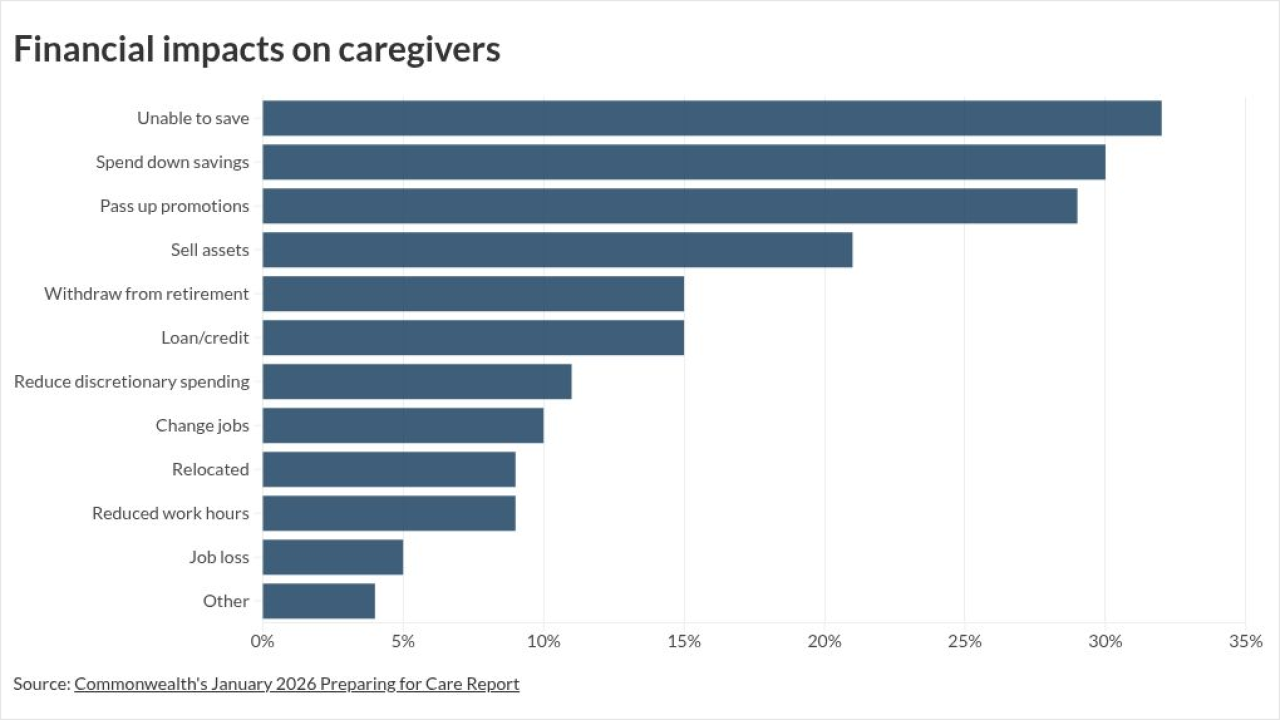

Financial advisors have critical roles for modifying financial plans to cover costs and long-term plans when clients find themselves faced with caring for a family member.

Wescott and Moneta Group present helpful examples of paths for financial advisors and other employees that experts say are essential for growth.

In her statement, Axelrod touts her own work in advocating for stronger investor protections at FINRA, where she most recently served as executive vice president for regulatory operations. Her resume at FINRA includes the establishment of a

"I've built my career around protecting investors and I'm proud to be joining a firm focused on doing the right thing for clients and improving their financial lives," Axelrod says.

Stoltmann takes a more cynical view.

"The reason why Merrill hired her is to shepherd the firm with its dealings with FINRA and all of her previous co-workers at FINRA. Claiming anything else is disingenuous," he says.

"It's paying very well for a high-level fixer to deal with FINRA. And look, there's nothing unethical about it. It's been taking place for a hundred years, but there are concerns about a revolving door between regulators and banks," he adds. "It's kind of Groundhog Day ― we've just seen it for so long."