Raymond James grabbed a Merrill Lynch duo with $400 million in client assets in at least the third wirehouse breakaway to the firm’s independent channel so far this year.

David Anderson and George Hall of 1808 Capital Partners joined the broker-dealer’s independent arm in Greensboro, North Carolina, Raymond James announced Wednesday. The pair went indie with the practice founded by Anderson’s father, who recently retired after working at Merrill Lynch for 50 years.

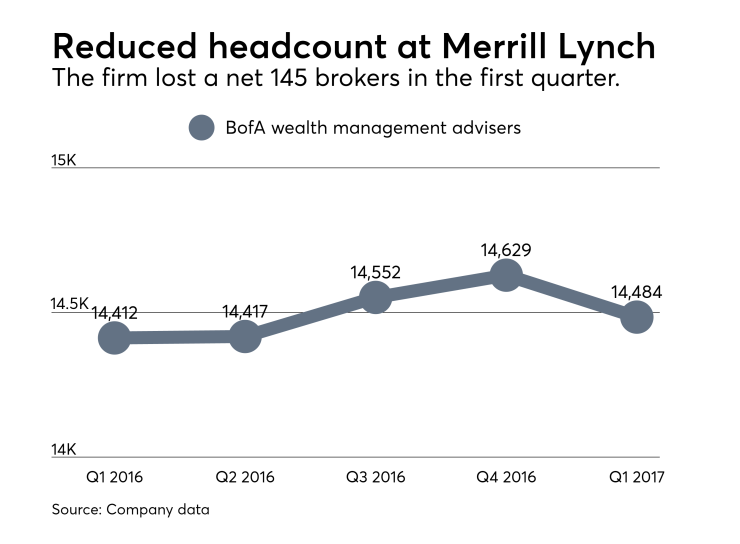

Merrill’s parent, Bank of America, disclosed earlier this week that it

Raymond James’ independent channel has reaped the benefits of the shrinking headcounts.

A look at starting payouts for wealth managers under 2017 compensation plans.

Anderson and Hall opted for Raymond James because of the “client-centered culture, the client experience they offer and the depth of resources available to advisors like us,” Hall said in a statement.

“Building on a legacy business, we have added a younger generation of clients, some children of long-term clients, and having the right expertise and support to continue serving our existing clients and their families — as well as the next generation — was paramount.”

A spokeswoman for Bank of America declined to comment on the team’s departure.

-

The settlement is the third major regulatory payment the BD has incurred in the past year. A branch manager associated with the Jay Peak case has also left the firm.

April 17 -

The group includes a father-daughter duo who have worked together for 25 years.

April 13 -

The ex-Morgan Stanley advisers say their niche practice, which is geared toward women and divorcees, will be better supported by Raymond James' platform.

March 23

Anderson and Hall started at Raymond James on March 9, according to FINRA BrokerCheck. They report to Southeast Regional Director Jodi Perry. Celeste Allen also came aboard at Raymond James from Merrill, as the team’s client relationship manager.

Hall began his career at Merrill in 2006, while Anderson joined the wirehouse in 2001. Their clients include business owners, families and healthcare professionals, as well as endowments and foundations.

The headcount at Raymond James Financial Services, the company’s independent arm, grew by 227 brokers last year to 4,143, according to the firm’s latest earnings report. LPL Financial added 323 advisors in 2016 to reach 14,377, while Ameriprise’s franchise arm contracted by 38 advisors to 7,668.

All three firms will disclose their first-quarter earnings next week. The tepid wirehouse recruiting figures did not put a dent in the firms’ first quarter profits. Merrill Lynch’s profits increased by 4%, Wells Fargo’s surged by 22% and Morgan Stanley’s jumped by 24%. UBS will report its earnings next Friday.