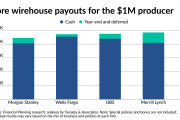

As wirehouses seek to stem the flow of breakaway brokers, two major wealth managers unveiled compensation grids for next year designed for modernization and stability.

Wirehouses and other wealth managers in the employee financial advisor channel made tweaks at the margins of their compensation grids,

In an illustration of how closely firms that are part of publicly traded financial giants guard any competitive information about their advisor recruiting, neither firm’s earnings disclose the exact number of advisors that will be subject to their particular compensation grids, nor did they make any executives available for on-the-record interviews. For recruiter Danny Sarch of Leitner Sarch Consultants, the key takeaway is that firms are largely keeping things the same.

“The trend is to not anger your advisors with changes during Covid times,” Sarch said in an email. “Working from home because of Covid has shown a substantial number of advisors that they can do quite nicely without being in an office. While there are many who yearn for an office environment, the wirehouses fear that this will accelerate the trend towards independence.”

Indeed, many advisors and recruiters — as well as independent rivals — have cited remote work during the pandemic

Besides those two modifications, Merrill Lynch will begin calculating each advisors’ pay based on the prior 12 months of production, rather than tying it on a retroactive basis to their revenue for each calendar year. Other than in those three areas, there won’t be any significant variation in the grid next year, according to the firm.

Most or all of Merrill advisors’ compensation will start at a higher level due to the firm using their trailing 12-month production instead of the retroactive calculation, Sarch said, noting that the firm’s switch on inherited accounts could have an impact as well.

“This, I’m sure, is a reaction to the number of advisors who have left and an attempt to incent the inheriting advisors to work harder to retain those clients,” Sarch said.

He said it’s “long overdue” for J.P. Morgan Advisors to have a formal succession planning process for advisors under the new compensation system. J.P. Morgan Chase CEO Jamie Dimon and Kristin Lemkau, its CEO of U.S. Wealth Management,

“As part of Jamie’s and Kristin’s commitment to grow this business we took on the task to review an outdated 20-year old compensation plan,” Sieg said in a memo to advisors. “What we landed on is a transparent and competitive plan that seeks to attract and retain the best talent, strongly incentivizes top performers and provides stability and continuity to your clients. The modernized plan applies the right incentives to grow your practice; it properly addresses your team structures and is driven by revenue production.”

Like Merrill, J.P. Morgan Advisors will link monthly payouts to revenue from the past 12 months. The firm is also adding a “length of service” award for high performers to be paid in restricted stock units, a “flows” award to representatives with big retail client in-flows and a new teamwork incentive that gives all qualifying team members the same grid rate as the largest producer.

Furthermore, the firm has launched a voluntary succession plan program for retiring advisors to ensure an orderly transition for their clients and provide incentives for other brokers. Another program that’s in pilot and slated to roll out to all of the firm’s markets will enable the brokers from J.P. Morgan Advisors to partner with the branch-based teams at Chase Wealth Management “on select opportunities, specific to single client needs,” Sieg said.