Merrill Lynch revealed its internal diversity statistics for the first time, setting the firm apart from an industry in which disclosure of such data is limited.

In recent years, wirehouses and RIAs, CEOs and advisors, trade groups and planning associations have repeatedly made calls and efforts to improve diversity within the profession. Demands for change have been heightened in light of nationwide anti-racism demonstrations following the killing of George Floyd.

Merrill Lynch’s disclosure of its diversity data is a window into whether one of the industry’s leaders is making progress. Few firms in wealth management share such information publicly.

Women make up 21% of the roughly 17,000 advisors who work in Bank of America’s wealth management division, the firm's numbers show. That figure is up from 18% for the period five years ago.

People of color comprise 23% of the workforce, up from 15.5% compared to five years ago, according to the company.

More specifically, Black and African American advisors comprise 4.5% of Merrill’s thundering herd, up from 2.5%. Hispanic and Latino advisors comprise 9%, up from 6%.

Andy Sieg, head of the wirehouse, said in a statement it is a “moral and commercial imperative” that the business reflect the communities it serves. The firm has emphasized accountability for improving diversity at the management level, he said. Over the past 18 months, just over half the company’s new advisor hires have been diverse, according to the firm.

“We’re making progress, and feel confident we have the right people and strategy in place to get to where we need to go — which over time includes a workforce within the Merrill business more closely aligned with the diversity of Bank of America overall,” Sieg said.

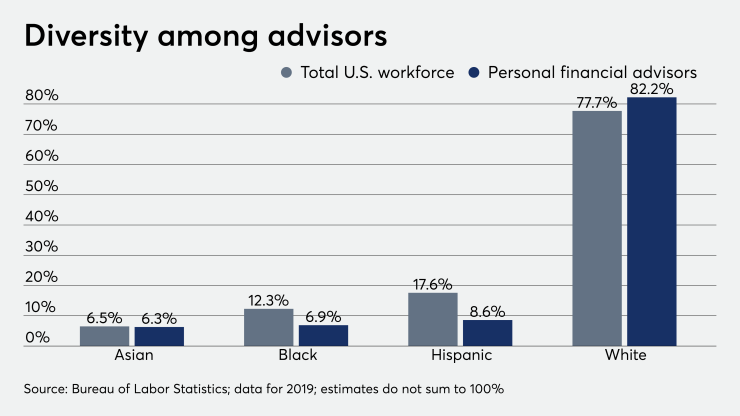

Obtaining accurate demographic data for the profession as a whole is difficult. Research groups that track wealth management don’t collect such information. The

Of the U.S. population, 13.4% is Black and 18.3% is Hispanic,

The robo advisor hopes transparency on employee demographics will encourage change.

The financial advisory profession has long been dominated by white males and has been criticized for racism and sexism. In recent decades, firms such as

Earlier this year, Morgan Stanley’s ex-diversity chief sued the wirehouse for alleged discrimination and claims in her lawsuit that just 100 of the company’s 15,400 advisors are Black. Morgan Stanley has denied the allegations and declined to disclose data on diversity among its financial advisors.

Firms and industry organizations have stepped up efforts to improve diversity in recent years. The CFP Board’s Center for Financial Planning, for example, offers seminars and training to encourage women, Black, Hispanic and other Americans of diverse backgrounds to join the profession. The center has also held