The competition was intense: around 40 acquirers wanted to buy Traust Sollus Wealth Management.

The winning suitor was Mercer Advisors, the private equity-backed aggregator that has already acquired two other advisory firms this year. Mercer's AUM has jumped 93% to $10 billion since Genstar Capital bought the RIA from fellow PE firm Lovell Minnick Partners in 2015.

“We had 40 firms that showed interest,” says Al Zdenek, Traust Sollus' president and CEO. “The roll up firms that we saw just didn’t have the same approach and culture. We didn’t want to be part of a hodgepodge of firms that they would eventually sell. We wanted to be part of a firm where our people had a chance to grow.”

A wealth management firm with $410 million in AUM, Princeton, New Jersey-based Traust Sollus manages mostly HNW accounts, according to its latest Form ADV.

The move marks the Mercer's

Traust Sollus manages more than 150 clients in total, the majority of which are high-net-worth, and has approximately 25 employees, according to their Form ADV. The firm was originally founded as a CPA by Al Zdenek Jr. in 1982 and maintains tax planning specialties, according to the firm. All of their advisors are CPAs, Zdenek says.

The Mercer deal is the latest in a fast-moving 2018

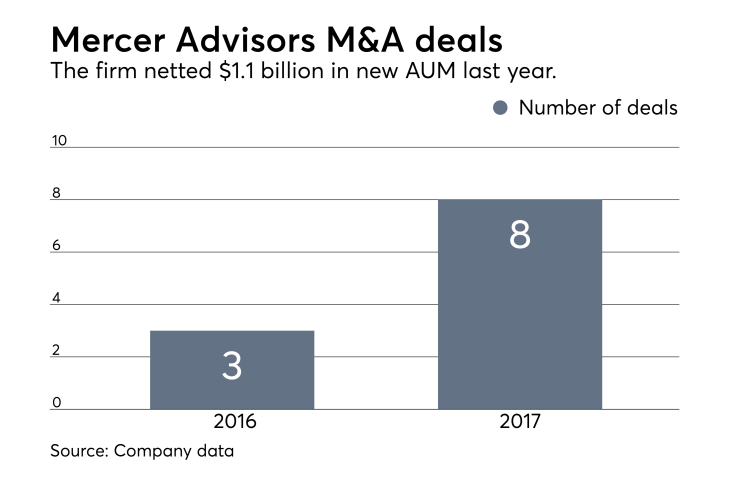

Mercer, which is based in Santa Barbara, California, completed eight M&A transactions in 2017 amid years of accelerating growth. Mercer hired Dave Welling as its CEO last year, freeing up former CEO Dave Barton to focus on leading its M&A deals.

The move expands Mercer’s footprint in the Northeast, Barton says.

“You cannot deliver clinic style financial care for a single location to clients located far away just as a hospital in Columbus, Ohio cannot treat a patient in Princeton, N.J.,” Barton says about the acquisition. “Our high touch, high service, Family Office business model requires both a local presence and multi-disciplinary professionals to service the complex needs of our HNW and UHNW clients."