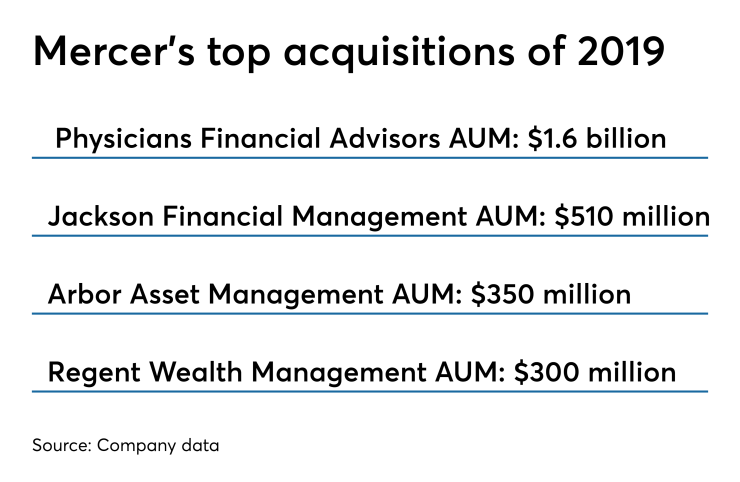

Mercer Advisors, one of the RIA industry’s most active buyers, has completed its sixth RIA acquisition this year. The aggregator, which has been put up for sale by private equity owner Genstar Capital, has added over $3 billion in assets to its portfolio since the start of 2019.

Mercer’s latest addition, Regent Wealth Management Group, focuses on high-net-worth clients and has $300 million in AUM. Regent is based in Woodbridge, Connecticut, and will be the third Mercer office in the state and its 11th in the Northeast region.

Mercer now has 43 offices and manages more than a total of $16.5 billion in AUM. In 2018, a year that saw record M&A activity, RIAs accounted for 72% of deals, according to a report by FA Insights — and

Though Mercer was the most active buyer last year, Focus Financial, mostly through sub-acquisition by its partner firms, leads the pack this year with 16 deals so far.

In June, the Denver-based firm

Regent was founded by Alan Weiss in 1987. In a statement, Weiss cited Mercer's fiduciary status and fee-only pricing model as the reasons for the move. According to its Form ADV, the firm also charges by percentage of AUM.

"When I spoke with David Barton ... I knew we found the right partner," Weiss said in the statement, adding that Mercer's vice chairman and former CEO had convinced him the firm was a good fit for him and his clients.

Mercer has been on the sales block for the past two months. Industry sources say owner Genstar hopes to duplicate the success of Mercer’s rival aggregator United Capital, which was