With the bull market of the prior decade over and the rising

Client portfolios flush from the booming stock market between 2012 and 2021 and

After a "difficult and challenging" 2022 for stocks and bonds, McKinsey Toronto Partner Jonathan Godsall and the other authors of the report offered seven steps for financial advisors and registered investment advisory firms to take amid the volatility

"Firms that have been making the necessary investments to prepare for this kind of a downturn really did succeed quite well," Godsall said in an interview. "We expect further volatility."

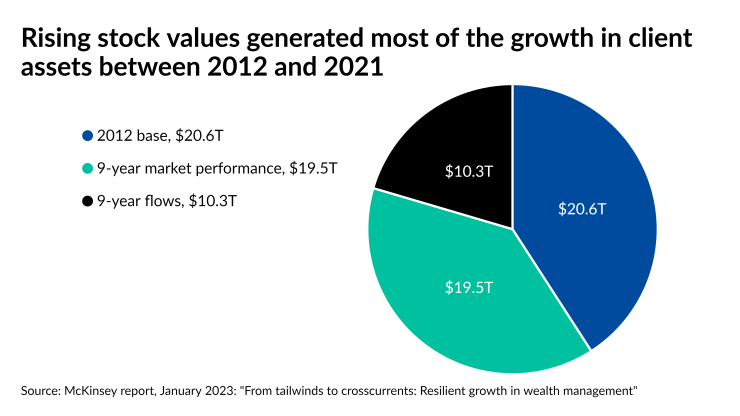

The wealth management industry's expansion in recent years has set records. Client assets in the U.S. hit a new high of $50.4 trillion at the end of 2021, and industry profits soared to a record $58 billion, according to McKinsey. But the decade-long bull market — appreciation in the capital markets drove 70% of asset growth between 2012 and 2021 — is to credit, not organic growth from new clients who came on board directly, and not through a firm's acquisition. Meanwhile, expenses rose to an all-time high of $186 billion.

"The growth in the size and complexity of the industry's cost base represents a vulnerability for wealth managers," according to the report. "In a decade-long bull market, strong growth masked some underlying issues in the industry, and many firms have not capitalized on the opportunity to expand margins through more scalable infrastructure and new business models."

Godsall predicted that a majority of wealth management firms will seek to slash their operating expenses by 5% to 10% and that opportunistic buyers will find more attractive prices among sellers. The report recommended that firms seek out a combination of resilience and growth, which Godsall said need not be "an oxymoron."

Many of McKinsey's ideas rang familiar to Frank Smith of Private Advisor Group, where he

That scale, along with an investment

The financial planning profession is confronting "a tremendous amount of adversity" from more regulatory oversight and market losses, which will lead some advisors to "recognize that it takes people, processes and technology" to navigate the choppy terrain, Smith said.

"If they're coming to the realization that they can't do that on their own, there are opportunities available to them like our firm," he said. "We're fortunate that we have the scale to help firms do that."

Each of the seven ideas below comes from McKinsey's study, "

- Deepen client relationships proactively

Digital tools enabling frequent email reach outs to clients and additional one-on-one meetings with customers boost client satisfaction scores and potential business, according to McKinsey.

"This is especially relevant in the current macroeconomic climate, which has created anxiety for clients, many of whom have built financial plans based on obsolete macroeconomic assumptions," the report said. "Wealth managers that are proactive now and help their clients navigate the current environment have a chance to win their loyalty."

- Cut expenses

Advisors and wealth management firms should look closely at their "most labor-intensive processes" in areas such as asset movement, account opening and client onboarding to identify technology and outsourced solutions that reduce the structural costs of the business, according to the report. Short term restructuring expenses pay dividends in the medium to long term.

"Wealth managers should be willing to commit to a bolder approach on structural costs — one that involves a fundamental reengineering of their operating models, often enabled by technology," McKinsey's report said. "This can enable them to unlock a far deeper pool of resources while also building scale advantages that will make them more competitive in a recovery."

- Keep prices the same

Advisory practices ought to avoid the idea of so-called sympathy pricing discounts that many advisors deployed during the financial crisis with the idea of growing their client base by pushing fee rates below those of competitors, according to McKinsey.

"The impulse is understandable, but fee reductions did not lead to better outcomes," the report said. "Research at the time suggested that advisors not only fell short of the incremental growth they hoped for but also locked themselves into lower fee arrangements for years to come."

- Invest in lead generation

Few wealth management firms have created the kind of "institutionalized lead generation system" that supplies lists of prospective clients through advanced analytics, according to McKinsey. As a client with $1 million with assets will pay roughly $50,000 to $70,000 in advisory fees over a decade, an investment of $15,000 to $20,000 for the lead to that prospect more than pays for itself.

"This is especially pertinent in times of volatility, which are typically followed by accelerated money in motion," according to the report. "The benefits of a robust lead generation system are many. Accelerating organic growth can make the firm more attractive in the eyes of highly sought-after advisors. It also can make the client relationship with the firm stickier, lower compensation as a percentage of revenue and create new avenues for strategic M&A."

- New business lines close to core

To create more sustainable growth that is less tied to stocks and bonds gaining value, firms should seek out new business lines that complement their core services.

"These can take many forms, such as developing new, often digitally enabled business models to serve existing or new client segments, providing value-add services to a fast-growing RIA segment or tapping into adjacent revenue streams like banking, asset management, retirement or payments, according to the report. "The exact focus will be specific to each firm, but success factors are universal."

- Targeted M&A opportunities

Ongoing consolidation in the wealth management industry at large and "in the vibrant RIA market" in particular gives firms an opportunity to add scale and enter the adjacent fields, according to McKinsey.

"Wealth managers will likely pursue transactions to acquire capabilities that will be key for growth," the report said. "Many such deals — for example, startups focused on digital advice or planning, digital assets, retail alternatives and wealth technology — now come at more attractive valuations than a year ago."

- Identify growth priorities

Downturns require advisory practices to spend their limited resources on the most promising areas of investment for growth, all while pulling back from the ones that aren't paying off, according to the consulting firm.

"Double down on highest-potential growth initiatives and cull the rest," the report said. "For example, a wealth management organization might accelerate the upskilling and upscaling of advisors (including establishment of the necessary support infrastructure), enabling them to serve the wealthier households while the company creates scalable centralized offerings to provide high-quality service to lower-wealth households."