A former MetLife team left MassMutual’s broker-dealer for Commonwealth Financial Network after going through both a merger and an acquisition, resulting in their affiliations with three different IBDs in the past four years.

Partners Bill Verhagen, Christopher Harmon and Ian Essling of Innovative Financial Solutions, which manages nearly $500 million in client assets, completed two and a half years of due diligence after MassMutual’s

The Bloomington, Indiana, and Palm Coast, Florida-based team

The practice selected Commonwealth out of a number of suitors because of their shared philosophy that advisors and IBDs alike should work hard every day to earn their clients’ business, according to Verhagen.

“Unlike many of the advisors that affiliate with an insurance-based broker-dealer, we were always pretty independent,” Verhagen says. “At any point along the way, we could unplug from one group to plug into another as seamlessly as possible. That always comes from our approach with clients. We’ve historically made it very easy for clients to fire us.”

-

The two LPL rivals show confidence in their current paths, but they both now have important vacancies to fill.

July 10 -

The No. 4 independent broker-dealer has unveiled two major recruiting grabs from its rivals in two weeks.

May 22 -

The firm broke off from its OSJ and followed four others of its type in leaving the No. 1 IBD after a change in its RIA rules.

May 15

J.D. Power’s annual survey reveals the importance of leadership and culture, along with differences among male and female representatives.

In making the move to Commonwealth, the team will also avoid having to change their custodian from Fidelity’s National Financial Services.

Representatives for MassMutual had no comment on their exit from the firm. MassMutual is the parent firm of MML Investors Services, the team's prior IBD and the one that

Innovative Financial includes one other advisor, Mark Kraus, and a staff of eight employees. The firm uses an outside RIA for its hourly business, but its roughly $400 million in advisory assets under management will go to Commonwealth’s corporate RIA.

The team officially joined the IBD on Aug. 10, according to FINRA BrokerCheck. The practice started in Bloomington in the late 80s by serving faculty and administrators from the University of Indiana, but it now has clients in 34 states, Verhagen says.

Verhagen and Andrew Daniels, Commonwealth’s managing principal for business development, both cite the IBD’s recent designation as the top-rated firm in the space

“Our recruiting process is one of careful evaluation for fit at all levels on both sides,” Daniels said in an email. “Sometimes I wish it moved faster, but taking care in truly knowing ‘who you’re going to marry’ tends to lead to the best and most successful relationships.”

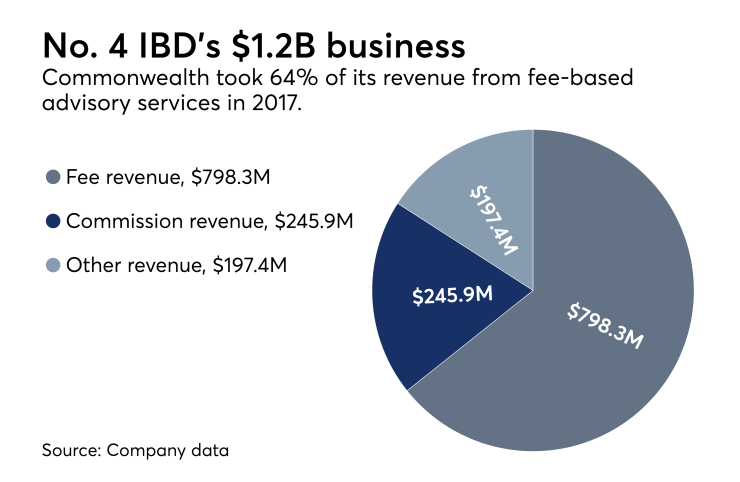

In making the move to Commonwealth from MML Investors, Innovative Financial changed from the No. 5 IBD to the No. 4 firm, respectively. Commonwealth’s revenue jumped 16% last year to $1.2 billion, while MML’s expanded by 186% to more than $1 billion due to the completion of the MetLife transition.