Shutting down four independent broker-dealers is easier said than done.

The doors of National Planning Holdings’ four IBDs remain open, despite the network’s best efforts to close them for good after LPL Financial

SII Investments reached a settlement on Sept. 7 with one state regulator to withdraw its registration, but it still has pending terminations in three other states, FINRA BrokerCheck shows. NPH’s other firms also have yet to complete their FINRA terminations and pending requests in two states.

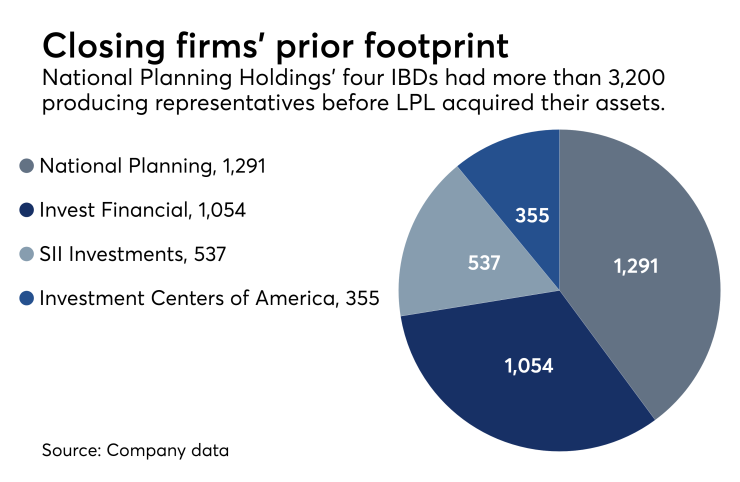

The firms stopped doing business in early July, following the acquisition of their assets last August by No. 1 IBD LPL Financial. Over the last year, NPH’s 3,200 advisors have either migrated to LPL or moved on

Massachusetts Secretary of the Commonwealth William Galvin allowed SII to withdraw from the state while paying a $50,000 fine plus restitution and disgorgement of commissions in connection with sales of nontraded REITs. The state had

Overall, in the acquisition, the asset purchase agreement gave LPL the right to recruit NPH’s advisors, but it didn’t leave LPL on the hook for past compliance liabilities at the NPH firms,

Galvin’s settlement represents only the latest issue that needed to be resolved by the firms prior to their shutdown. NPH also

The firms requested termination from FINRA and the states effective July 9, according to their BrokerCheck files, and Investment Centers’ file states clearly that it has ceased doing business. The four IBDs maintain their FINRA registrations, though, and their licenses in Arizona and Nevada.

Investment Centers, the smallest of the four IBDs, must still pay 34 clients in relation to

-

The regulator accused the four firms and the Advisor Group network of supervisory failures in sales of L-share VAs in separate but near-identical cases.

July 30 -

The case marks the second one this month involving the newly acquired IBD.

September 25 -

The IBD aims to be a 17,000-strong firm, but not every advisor will want to join up, experts warn.

August 22

Planners ranging from sole practitioners to the largest OSJ enterprises welcomed the CEO’s comment that the firm's culture was not aligned with its strategy.

A spokeswoman for Jackson National declined to comment, and a spokesman for LPL had no immediate comment on whether LPL is the firm receiving the funds or among several firms getting the payment. A FINRA spokeswoman also declined to comment beyond what’s available on BrokerCheck.

Representatives for state securities regulators’ offices in Arizona and Nevada didn’t immediately respond to requests for comment on the firms’ licenses in their states.

Regulators in Vermont, where SII is also still registered, noted that state law makes BD terminations effective 30 days after filing a request. SII will be terminated with an official date of Aug. 10 when the request is processed, according to Amanda Smith, the administration and registration manager in the securities division of the state's Department of Financial Regulation.

Ann McDougal, Arkansas’ deputy securities commissioner, said SII’s request for termination was still in process on Friday. No regulatory cases have been filed against the firm, she added.

SII has withdrawn as a BD in Massachusetts under the order from Galvin’s office, and a spokeswoman for his office, Debra O'Malley, confirmed that the other three firms terminated their licenses in July. Galvin had accused the firm’s registered representatives of miscalculating clients’ liquid net worth.

Some of the firm’s reps failed to exclude clients’ holdings in annuities, which carry surrender charges for cancellation over certain periods, in adding up their liquid net worth, according to the consent order. State law prohibits nontraded REIT purchases greater than 10% of a client’s total liquid net worth.

The company’s own policies also restricted purchases to no higher than 10% for any single nontraded REIT, and no more than 20% in any nontraded REITs, the order states. A 63-year-old nurse invested 35% of her liquid worth in a nontraded REIT under SII in 2014,

“SII puts its own interests ahead of the customers — yet another example of the need for a strong fiduciary rule to be adopted," Galvin said in a statement, accusing the firm of adding up clients’ assets incorrectly “in order to sell them high-commission nontraded REITs.”

Under the agreement, the regulator censured SII, required the firm to pay the administrative fine and obligated it to hire an independent consultant to identify clients eligible for rescission payments. O’Malley did not have an estimate on the possible amount of the restitution.