Mariner Wealth Advisors’ frenetic acquisition pace of 2019 shows no sign of letting up.

The Overland Park, Kansas-based RIA has made its sixth purchase of the year, buying Singer Xenos Schechter Sosler, an advisory firm in Coral Gables, Florida, with more than $1.3 billion in assets under management. And Mariner CEO Marty Bicknell says he’s not done yet, as he hopes to complete approximately six more transactions by the end of the year.

The deals — and Mariner’s pace — are emblematic of the frenzied RIA M&A market.

According to consulting firm DeVoe & Company’s RIA Deal Book statistics, the year’s first quarter saw a near-record number of independent advisory firm sales.

DeVoe recorded 31 transactions, just one shy of the all-time record for the quarter and well above the 24 deals the first quarter usually averages. What’s more, RIAs like Mariner were the predominant buyers in the quarter, according to DeVoe, accounting for nearly 60% of transactions.

Despite a heated M&A market Bicknell says valuation multiples for firms with less than $2 billion in assets “haven’t moved very much.”

Mariner offers sellers up-front, all-cash deals.

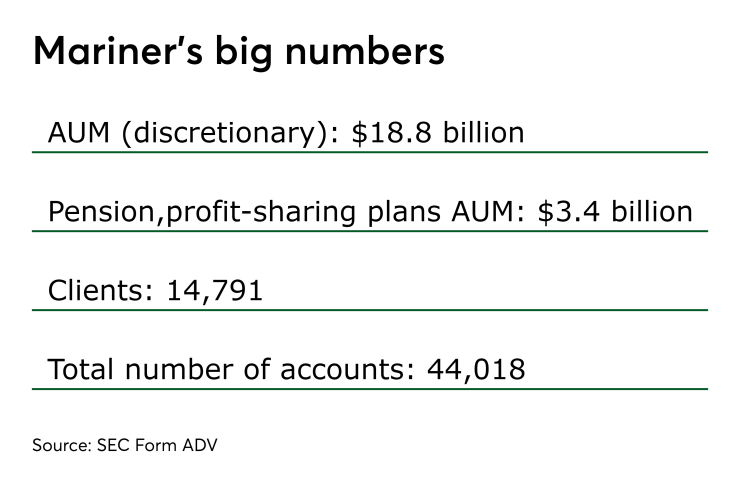

While average industry multiples for firms with between $500 million and $2 billion in AUM usually range from around eight to 10 times a seller’s EBITDA, Mariner often pays a multiple of six to eight times EBITDA, Bicknell says. As a result, Mariner, a classic strategic buyer with $22 billion in AUM, is able to compete for those firms despite intense competition from well-funded private equity firms and RIAs backed by PE funding.

How?

Mariner offers self-funded, all-cash deals up-front with no three- to five-year payouts, according to Bicknell. He also credits the firm’s growth record, operator-owned pedigree and giving sellers who remain with the RIA an opportunity to participate with such incentives as phantom stock.

Singer Xenos marks Mariner’s first foray into Florida.

“Mariner’s model resonates in the market because the firm not only has the scale of a mega-RIA and is an experienced acquirer, but because Marty is also an RIA principal, like the seller,” says David DeVoe, managing partner of his eponymous firm.

-

The sale of an asset management firm gives Mariner a capital source to buy RIAs. Lots of them.

October 20 -

Mariner Wealth's and Mercer Advisors' deals for RIAs totaled over $3 billion in AUM in just two weeks.

November 19 -

Capital is pouring into the RIA market, resulting in more deals, more competition and higher prices.

January 1

Bicknell announced Mariner’s return to the acquisition game

Singer Xenos marks Mariner’s first foray into Florida, with partners Marc Singer, Faith Xenos, Neil Sosler and Jay Schechter all saying they will stay with the firm. Bicknell says Mariner’s primary acquisition criterion is acquiring talent based on a firm’s historic organic growth, rather than its geographic location.

But the landscape on which Mariner is playing may be about to change, says Steve Levitt, managing director and founder of Park Sutton Advisors, who represented Singer Xenos.

While the M&A market currently is favorable to sellers, Levitt expects that to shift in 12 to 18 months when sellers begin to outnumber buyers.

"Multiples aren’t going to stay high forever,” Levitt says. “It’s an aging business and as clients get older, firms will be worth less.”