The wealth management industry is about to undergo "seismic changes" that could include a wave of client departures.

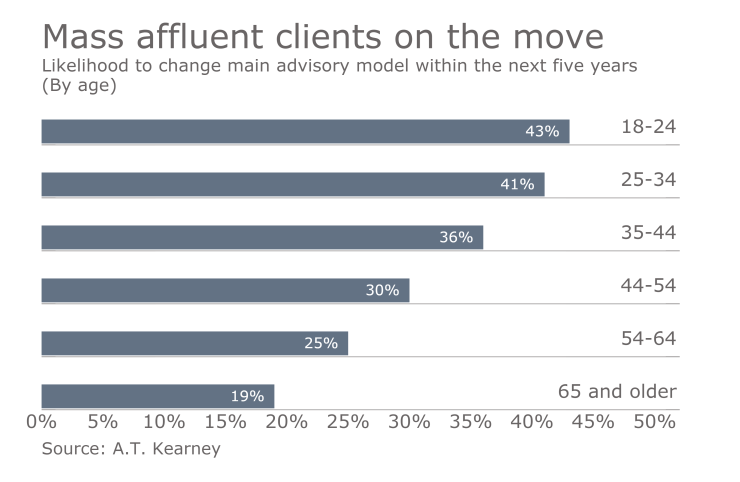

One in four mass affluent investors says they will switch advisory models in the next five years, according to a new study by consulting firm A.T. Kearney.

This may come as a surprise to many advisers and firms – most of the clients polled say they're happy with the advisory model they currently use, according to the survey.

But an astonishing 63% of clients say they don't really know how much they are paying for the financial advice they are receiving.

"That is an astounding level of vulnerability we all have," said Bob Hedges, partner global head of financial services at A.T. Kearney. "If these people find out, what will they do?"

Hedges and his colleagues, who presented their research at SourceMedia's In|Vest conference in New York, note that pressures on fees have been mounting due to rising competition, including from robo advisers. In addition, he said, transparency has been increasing.

"We are in a multi-decade march in increasing the transparency around price. There's no reason to think that will decrease," Hedges said.

He adds that these trends will contribute to "seismic" disruptions in the industry.

"A basically satisfied consumer is about to wake up and understand that they shouldn't be satisfied because there are much better options available to them," he said.

GREENER PASTURES

Ignorance may be bliss, but once made aware of differences in fees, mass affluent clients aren't likely to stick around. A.T. Kearney's research showed that more than 70% of clients say they would ditch their current advisory model in order to get a better price elsewhere.

This will present opportunities for other firms to win new clients based on superior service and pricing. The likely winners aren't necessary pure robo advisory firms; A.T. Kearney said its research showed that clients – including both those who are self-directed as well as those who use the services of a fully dedicated financial adviser – would most likely migrate towards a firm that combines digital advice with a human element.

"The digital plus service model will be the dominant choice among middle age investors who switch advisory models," said Uday Singh, a partner at A.T. Kearney.

Digital advice solutions have been proliferating over the past two years. Several of the industry's largest asset managers and brokerage firms have rolled out robo advisers or announced plans to do so. And these digital platforms are attracting more than just young millennials with few assets. Neesha Hathi, an executive vice president of Investor Services Platforms, Strategy and Client Experience at Schwab, says 42% of clients on her firm's robo platform have more than $250,000 in investable assets. Half of those clients are 50 years of age or older, said Hathi, who also spoke to conference attendees.

According to A.T. Kearney's study, client movement is likely to come soon.

More than one in three clients under age 44 says they are likely to switch advisory models. But it's not limited to the young; 19% of mass affluent clients age 65 or older say they make a switch too.

"Investing will never be the same," Hedges said.