LPL Financial could pay a lower price than the company expected for the assets of National Planning Holdings if the firm’s current retention rate holds up.

CEO Dan Arnold had set a goal of moving

The rate “implies NPH-related costs at the low end of the range,” and the “resulting purchase multiple could be lower than we assumed,” according to a presentation released by the company at an investor’s day event in New York for the nation’s largest IBD. The exact figure remained elusive, though.

The specific number matters because terms of the $325 million purchase from Jackson National Life Insurance require LPL to pay more if it keeps more than 72% of NPH’s production. The firm could spend up to $123 million more in a contingency payment to Jackson, if it retains 93.5% or more of NPH’s business.

LPL has

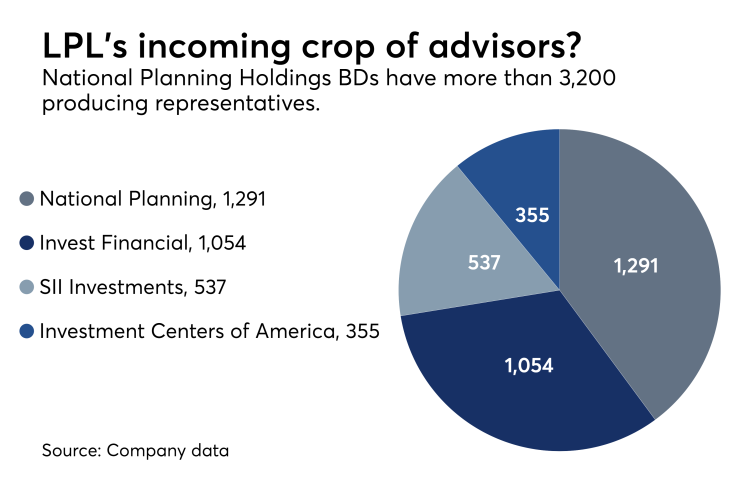

Ahead of the possible influx of 3,200 advisors with $120 billion in client assets, the firm has faced recruiting headwinds. LPL’s headcount has fallen by 124 advisors this year to 14,253.

-

CEO Dan Arnold said the acquisition of NPH’s assets will serve as a model for the future.

October 27 -

Woodbury Financial has peeled off more than 80 advisors in the wake of LPL’s giant acquisition.

November 3 -

New firm registrations have soared by 75% over the past five years, according to Schwab.

November 2

The wirehouses have lost teams overseeing more than $12 billion in client assets over the past month, according to recent hiring announcements.

LPL’s rivals have already announced grabs of 199 advisors with $8.9 billion in client assets from the incoming NPH group. Advisor Group’s Woodbury Financial Services alone

THE RIGHT FIT

LPL knew going into the transaction that it would be working in “a competitive environment,” Arnold told investors Wednesday. The estimated 70% retention rate, which might vary “slightly or marginally,” translates to about 80% of EBITDA production, he noted.

Arnold gave three reasons why executives think LPL lost out on some advisors from National Planning and Investment Centers of America to other IBDs, maintaining that none of the explanations was surprising.

Some NPH advisors’ track records did not meet LPL’s criteria, he said. Other advisors opted for “economic incentives that they received out in the marketplace that didn’t meet our standards,” Arnold said. And some advisors did not view LPL’s scale as the right fit, he added.

“They may have seen a different solution that may have been smaller in nature that may have had lesser capabilities as an alternative to them,” Arnold said, casting the overall rate in context. “I think this shapes up very similar to what we’ve seen with other historical transactions.”

The CEO’s presentation hinted that LPL will pursue more acquisitions like the NPH deal. The firm’s size, along with its status as a self-clearing firm with strong advisory platforms, add up to an economic advantage for it, Arnold said, though such options will wait until next year.

“We’re focused on making sure that we integrate this business really well,” Arnold said. “First and foremost, our priority is to get that done and to get that done right.”