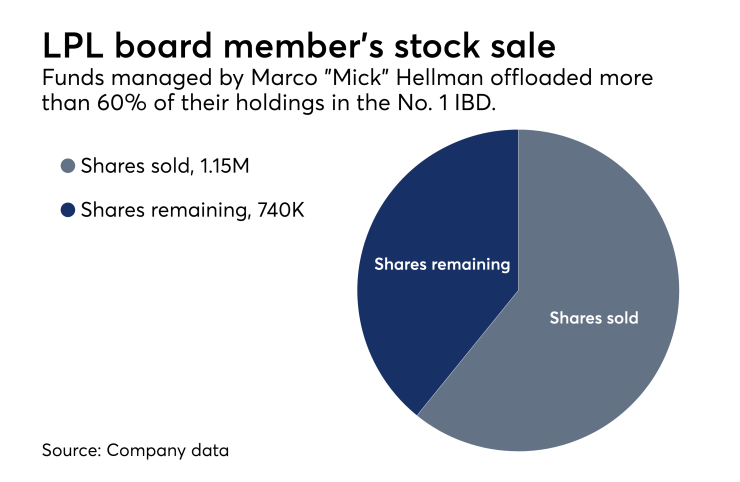

A major early investor and board member of LPL Financial has sold more than 60% of his investment firm’s stake in the nation’s largest independent broker-dealer.

Funds managed by Marco “Mick” Hellman, a senior advisor to

In a separate

TPG Capital and Hellman & Friedman, a PE firm co-founded by Hellman’s father Warren, acquired ownership stakes in LPL in 2005 and controlled about 32% each after the firm’s $469.7 million IPO five years later, Reuters

HMI and its hedge funds — HMI Capital Partners and Merckx Capital Partners — sold the shares at a price of $62.12 per share. The three entities last February offloaded

A spokesman for LPL declined to comment and Hellman didn’t respond to inquiries at HMI.

-

More than $34 billion in client assets moved into the No. 1 IBD’s fold in the first part of the acquisition.

February 2 -

Former head Mark Casady, new chief Dan Arnold and board member Marco Hellman each netted millions.

February 17 -

Mick Hellman, formerly of Hellman & Friedman, is elected unanimously in advance of LPL's annual shareholder meeting.

March 30

Growth funds have performed best over the past decade, outpacing value funds.

Hellman’s directly held LPL stock grew 62% to 5,167 shares under an award in May 2017, though his holdings represent a fraction of Arnold’s. LPL’s CEO sold part of his shares under a trading plan adopted in August while picking up options for 77,606 shares valued at $65.50 apiece under the award.

The LPL holdings of Hellman’s managed funds include 10,369 shares for HMI and 729,941 for the two hedge funds, where HMI acts as a general partner and investment advisor. Hellman assigned HMI its direct portion of the holdings after receiving them under LPL’s 2010 equity incentive plan.

As managing member of HMI, Hellman is an indirect owner of the shares. The hedge funds also list him and fellow HMI founding partners Justin Nyweide and Emily Brakebill as related persons in SEC Form D filings.

Hellman serves on the nominating and governance committee of LPL’s board. The firm’s stock has more than quadrupled in value to roughly $65 per share this week from a low of $15.38 in February 2016.

“In a complex and often volatile world, independent advice should be a key element of financial planning for investors,” Hellman said in a statement at

LPL spent $114 million to buy back 2.6 million shares at an average price of $43.42 while paying dividends of $90 million in 2017,

The firm’s earnings soared 54% year-over-year to $64.1 million in the fourth quarter. Arnold