Despite the cost of LPL Financial’s steep growth rising faster than its revenue in the third quarter, the firm isn’t showing any signs of removing its foot from the gas pedal.

The nation’s largest independent broker-dealer generated slightly less net income than the year-ago period even though LPL has reached an industry-leading headcount of nearly 20,000 financial advisors on the strength of record recruiting gains in the past 12 months. Onboarding and other acquisition expenses relating to LPL’s

In answering a question from an analyst after LPL disclosed its earnings on Oct. 28, CEO Dan Arnold said the firm’s “broadened available market” through investments in new affiliation models for advisors, technology and services “will only accelerate” the firm’s advantage over smaller or less capable rivals in a time of record consolidation in wealth management.

“At some point, when it hits one of those firms hard enough, then you'll see, as you say, the capitulation point of trading the franchise,” Arnold said,

Recruiting and client assets: LPL’s recruited clients assets of $83 billion in the past 12 months represents more than double the amount of the previous year. At 19,627 financial advisors by the end of the quarter, the firm’s headcount rose 14% year-over-year, or a net 2,459 representatives. That number includes roughly 900 planners and 280 associate advisors from Waddell & Reed. About $10 billion out of the $13 billion in recruited client assets for the quarter went to the firm’s traditional independent channel, while $2.5 billion went to the new affiliations, Arnold said in his prepared remarks. In terms of client assets, the firm set records with the total amount ($1.13 trillion), advisory assets under management ($594 billion) and AUM as a percentage of the overall number (52.4%). The number of subscriptions for corporate services to practices more than doubled year-over-year to 2,598, a new high for the firm. The subscriptions are only in the “early innings part of a nine-inning ball game around the existing advisors on the LPL platform,” Arnold told analysts.

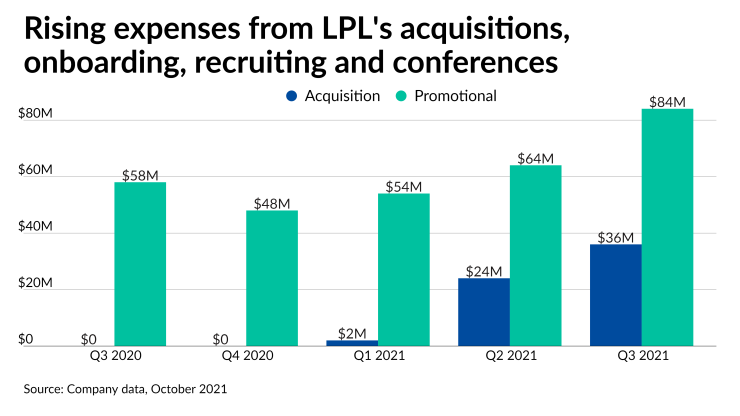

Rising expenses: The expenses in LPL’s earnings display the high costs of the firm’s substantial growth. Advisory fees and commission payments to advisors soared by 46% year-over-year to $1.37 billion in the third quarter, adjusted promotional costs relating to recruiting, transition assistance and conferences jumped by 44% to $83.6 million and acquisition expenses climbed to $35.9 million from zero at the same time a year ago. All told, the firm's operating expenses rose by 43% to $1.85 billion. Asked by an analyst about its expenses ratcheting up toward the higher end of LPL’s guidance, Chief Financial Officer Matthew Audette pointed out that the firm has an organic growth rate of 14%. “Where we land on our expenses within that range is really driven by organic growth and the cost and specifically the variable costs associated with supporting it,” Audette said. “That’s what’s driving us up to the higher end of that range, but I’d just emphasize it’s still within the range that we started for this year….We’re approaching it the same way we typically do and focusing in on the same core principles, which are investing to drive and support organic growth and at the same time, really focusing on delivering operating leverage.”

Bottom line: LPL generated net income of $103.1 million on revenue of $2.02 billion in the third quarter. The profit slipped 1% from the year-ago period, while the revenue surged by 38%. The non-GAAP earnings per share of $1.77 was five cents above the Wall Street consensus, analyst Devin Ryan of JMP Securities wrote in a note after the earnings. Although “the beat wasn’t to the degree of recent past” quarterly earnings from LPL, Ryan views “the majority of core trends heading out of the quarter as quite constructive,” he wrote. “Bottom line, both promotional and core [general and administrative] expenses are moving a bit higher in our model, and while we do expect to see related positive returns over time, we will be keeping an eye on trends as we recalibrate a bit.” Ryan maintained a “market perform” rating while reducing LPL’s expected EPS next year by 20 cents based on the higher expenses.

Downgrade: Another analyst, Kenneth Leon of CFRA Research, moved the firm’s stock from a “strong buy” to a “hold” after the call. The price of LPL’s stock tumbled by more than 5% the day after the earnings to roughly $165 a share after the change in ratings. In his note, Leon noted that the firm’s IBD model netted “operating margins of 10% versus 20%-30% for large wealth management firms” and described LPL’s valuation as “stretched.” CFRA raised its price target for the stock and its expected EPS for the year while reducing the projected number for next year by 21 cents.