LPL Financial's latest recruiting grab will create the largest bank investment program affiliated with the No. 1 independent broker-dealer in one fell swoop.

M&T Bank’s retail brokerage and advisory unit, which has 170 financial advisors and $20 billion in client assets, is rebranding and aligning its business with LPL by mid-2021, the company

Advisors at M&T who move to LPL will remain employees of the bank, but will be registered through LPL for FINRA and state licensing purposes. The bank’s BD, now called M&T Securities, will thereafter only service institutional clients under M&T Bank according to the firm.

“LPL is able to offer superior technology at the scale and pace that will help us differentiate our services and deepen our relationships with clients," says Matt McAfee, head of affluent wealth markets at Wilmington Trust, the wealth management subsidiary of M&T Bank.

Buffalo, New York-based M&T is the latest and largest of several firms that have moved their retail brokerage businesses to larger organizations over the last year.

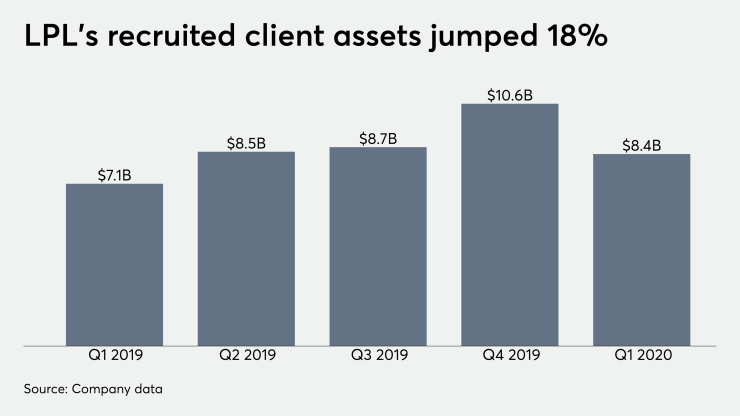

LPL has been a benefactor of this shift. It added nearly 300 financial advisors in the first

The firm has said it will spend $160 million on technology in 2020.

In total, LPL services approximately 800 banks and credit unions with over 2,500 financial advisors, according to the IBD’s annual

M&T’s $20 billion move is a loss for BNY Mellon’s Pershing, which is the bank’s current clearing partner, according to

A Pershing spokeswoman declined to comment.

M&T Bank had consolidated total assets of $120 billion at the end of 2019, according to the company’s latest annual report. The firm has more than 17,000 employees in eight states plus the District of Columbia.

—With additional reporting by Tobias Salinger