LPL Financial has made three major recruitment moves — unveiled over a two-day span — to add at least 125 advisors with about $4.5 billion in client assets to the largest independent broker-dealer.

The largest of the three moves in terms of assets and advisors was Exemplar Financial Network, with 105 advisors and a

Exemplar, whose move first surfaced this week in

LPL, however, managed to poach another team from Cetera Financial Group’s biggest IBD amid

Brennan Asset Management Group affiliated with LPL and joined its corporate RIA after three decades with Cetera Advisor Networks. The Redding, California-based practice’s four advisors manage about $300 million in client and retirement plan assets,

The firm’s founder and senior partner Bob Brennan is a 32-year industry veteran, having worked with only one other firm — First Affiliated Securities. Brennan joined the financial services industry in the late 1980’s after spending four years touring as a pro tennis player.

The practice aligned with LPL on Sept. 6, FINRA BrokerCheck shows. Brennan says the firm was drawn to LPL’s stability and the benefits of partnering with the No. 1 IBD.

“LPL's technology creates more efficiency in our practice,” Brennan said in a statement. “Also, the depth of resources and expertise they offer across the range of wealth management services, including support in specialized areas like high-net-worth investment management and retirement plan tools and resources, will help us to deepen the value we bring to our clients.”

Representatives for Cetera, which

Also joining LPL’s corporate RIA and BD — although this time not from Cetera — is Beltz Ianni & Associates, formerly of Cadaret, Grant. The Rochester, New York,-based firm’s 16 financial advisors manage about $500 million in client and employer-plan assets.

-

The No. 1 IBD added a practice with $520 million in client assets from rival Cambridge before walking back a new policy that has resulted in departures.

October 23 -

The practice transitioned in a week in which 15 advisors joined their new firm in three separate moves.

October 15 -

A team of four women is moving to LPL in pursuit of what they say is a less difficult, lower-fee alternative.

September 25

Beltz Ianni, led by managing partners Fred Beltz, David Ianni, Bob Judd and Mark Siler, saw LPL as fitting their criteria for a growth partner, they said in a

Just as with Brennan’s practice, LPL’s tech offerings served as a major selling point for Beltz Ianni.

“We wanted the support and tools from a large organization, and we wanted to have more choice in the products we can offer our clients,” Judd said. “Our concept here is to provide the under $20 million plan market with the same services that large plan clients receive.”

Representatives for Cadaret, Grant did not respond to requests for comment.

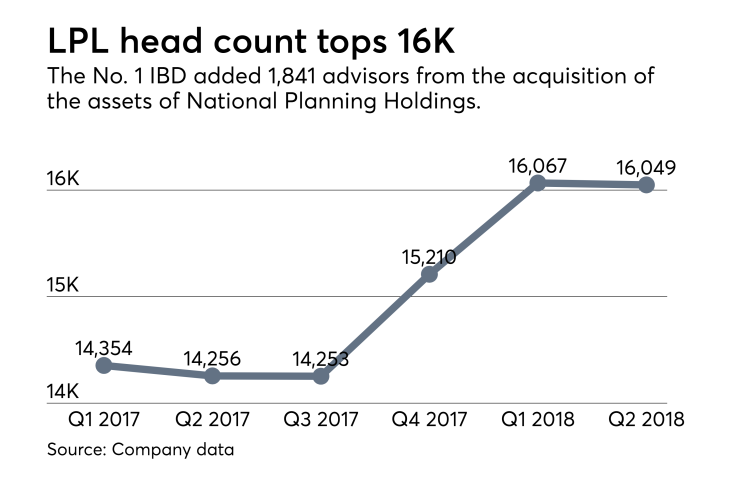

LPL has topped 16,000 advisors in its ranks, following

“As our industry evolves, we are committed to leading change through innovation and by investing in the resources, tools and support that can enable advisors to take advantage of market opportunities,” Rich Steinmeier, LPL’s divisional president of business development, said in a statement.