Nearly two years after a major acquisition by LPL Financial enmeshed it in a

Changes in ownership — especially those requiring extra work for financial advisors to fold into new firms — always causes them to assess their options, Arnold said in a call with analysts after the No. 1 independent broker-dealer

Considerations include how much leverage a PE owner is using to make the purchase, along with their investment timeline and ability to generate cash flow to put back into the business, he said. It also leads to “really fair questions” about firms’ leadership, according to Arnold.

“We think there’s a big transformation going on, in terms of the talent that is necessary to drive success going forward,” he said. “We think the bar is much, much higher, and you have to be much more thoughtful about that talent, their capabilities and how you ultimately go attract them and then position them to contribute going forward.”

Such transactions “can actually be quite disruptive to ever getting some continuity around building a leadership team,” Arnold added. It wasn’t clear which M&A deals he was referring to in the remarks. They came after LPL hit record levels of recruited assets and client assets while rolling out new outsourced home-office services for advisors.

PE-backed purchases are helping fuel

In the past 12 months, the respective agreements by Genstar Capital, Warburg Pincus and Reverence Capital Partners to pick up majority stakes in the IBDs altered the selling firms’ boards but not their executive ranks, for the most part.

Cetera CEO Robert Moore, a former LPL executive,

Advisor Group Executive Chairwoman Valerie Brown retired in May but remains an investor. The network’s largest IBD, Royal Alliance Associates,

In response to an analyst’s question about private equity activity’s impact on LPL’s recruiting, Arnold had said he finds it “interesting to see the transition of talent out in the marketplace.”

He didn't identify the specific sector of wealth management he was referring to in the remarks on talent or cite any examples where he viewed the PE capital as leading advisors to find new firms. Two PE firms took LPL itself public in 2010.

A spokeswoman for LPL didn't immediately respond to requests for clarification of Arnold’s comments.

-

In a bid to further enhance its capabilities for advisors, the firm is also slashing ETF transaction fees on select funds later this year.

May 3 -

CEO Dan Arnold pledged new tech-enhanced support for advisors as part of a larger cultural transformation.

February 1 -

The No. 1 IBD unveiled positive recruiting numbers for the third quarter, alongside an 84% jump in profits.

October 26

Advisory firms are generating "phenomenal" internal rates of return for PE buyers.

M&A deals do often lead to advisor turnover. LPL learned that lesson firsthand last year, after

It did fold in about 1,900 reps and more than $70 billion in client assets after acquiring the assets of the four IBDs. LPL has also since opened an employee-channel offering after

The firm appears to have put any recruiting or growth trouble behind it. LPL reeled in a whopping $33.3 billion in recruited assets in the past twelve months and took in $4 billion in net new assets in the quarter, even after losing an outflow of $1.2 billion when a major enterprise left in May.

LPL added a net 112 advisors year-over-year to reach 16,161 representatives, though headcount fell by 28 from the previous quarter. Without

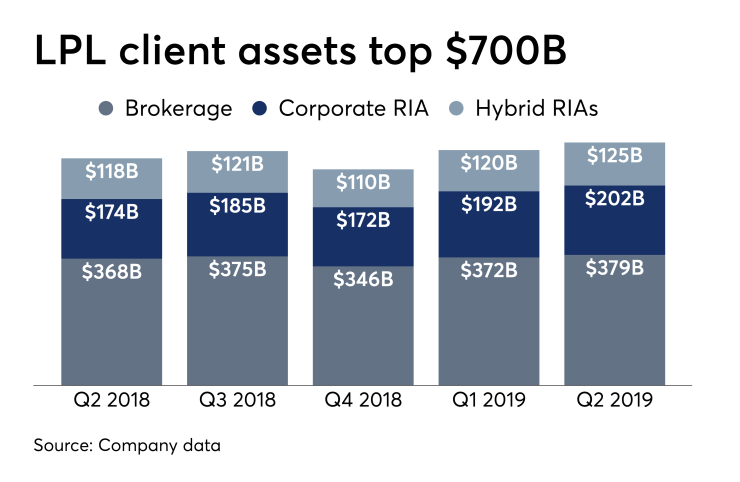

Client assets rose by 7% year-over-year to $706 billion, including $202 billion in advisory assets on the corporate RIA and $125 billion with LPL’s more than 400 hybrid RIAs. The corporate RIA’s AUM jumped by 16% year-over-year while AUM at hybrid RIAs increased by 7%.

About 30% of the asset flow into LPL’s centrally-managed

More than 50 LPL advisors also participated in a pilot program called Virtual CFO which enables them to get CFO services from the home office for a monthly subscription fee rather than hiring one. The firm has signed up 400 subscribers across a suite of outsourced administrative services, Arnold says.

“We hear from advisors that macro challenges are making it harder for them to operate their businesses. At the same time, consumer experiences in other industries are raising client expectations,” Arnold said in his prepared remarks.

“We are helping our advisors turn this challenge into an opportunity by offering them a portfolio of new services, including digitized workflows, virtual services and access to capital throughout their life cycle.”

LPL’s net income surged by 23% year-over-year in the second quarter to $146.1 million on revenue of $1.39 billion. Earnings per share of $1.71 surpassed analysts’ consensus by 12 cents.