LPL Financial bets that giving advisors more choices in outsourced portfolios with largely no strategist fees will bring more assets to its central platform.

But the No. 1 independent broker-dealer didn't

“What we’re trying to target is an outcome,” White said in a June 12 interview. “We want advisors to have the most amount of flexibility and choice and provide the flexibility to do what they want.”

White and other LPL executives spoke with Financial Planning after the firm announced it would

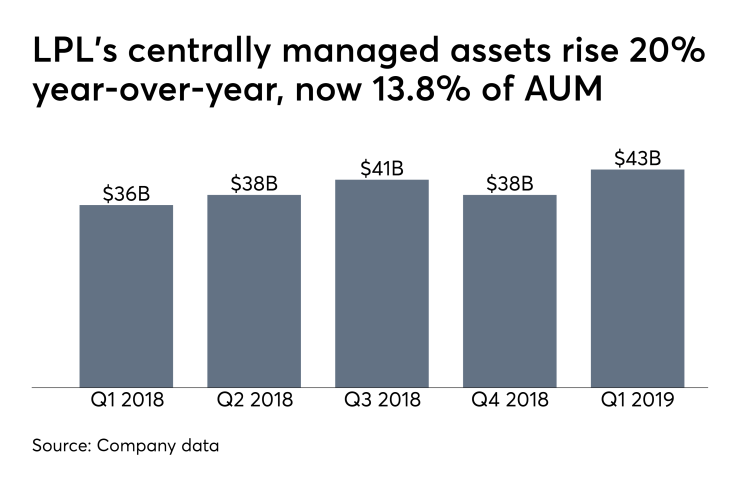

While centrally managed assets in LPL’s four main portfolio platforms have

LPL acquired modeling, proposal generation and analytics firm

Advisor Sleeve will give advisors the "best of both worlds," allowing them to step back and make note of trends, White said.

“The trends are for advisors to find more efficiency and therefore they’re using more advisory, and within advisory they’re using more centrally managed,” he added. “Our strategy is to let advisors tell us what is best for their business and for us to make sure we’re solving problems.”

-

The firm is “looking to aggressively compete” by lowering and simplifying the fees on its advisory platforms, a top executive says.

June 10 -

The No. 1 IBD aims to triple its potential target market reach, in part by adapting some aspects of employee services to independence.

June 7 -

One departing practice managed $100 million in assets.

May 30

About 1,500 advisors have started building up to 10 customized versions of outsourced models with automated trading, rebalancing and risk-tracking capabilities after LPL made Advisor Sleeve live this spring. LPL plans to bring more reps aboard in monthly waves while adding more customized models.

The permutations advisors can tap into are infinite. Director of Research Kirby Horan-Adams demonstrated how advisors and clients can adjust each allocation, asset class and fund family within a given portfolio choice. They can also toggle the risk outlook feeding into the portfolio.

LPL has moved $15.7 billion in brokerage assets to advisory accounts in the past two years. Advisors who have started using the sleeve have also moved 20% of their AUM from LPL's other main advisory programs to the one using the new customized models, Horan-Adams notes.

AdvisoryWorld provided the foundation for the risk tool, as well as generating proposals outlining each underlying investment, their expected returns and the fees. LPL also enables advisors to white-label the proposals with their own logo and practice name, rather than those of their IBD.

Allowing advisors, clients and any members of the teams serving them to access the portfolios will be much simpler than using emails and spreadsheets, White says, adding that advisors may eventually share customized models outside of their enterprises as well.

About 95% of the AUM in Advisor Sleeve is in funds that don't charge a specific strategist fee, so the average investment of around $200,000 into models comes with only a platform fee of 25 basis points, according to Rob Pettman, an executive vice president for products and platforms.

Pettman and the other LPL executives acknowledge that some advisors will prefer to use popular vendors that are already integrated into its

Indeed, with an estimated $2 trillion currently in rep-as-PM accounts, BlackRock's outsourced strategies already have more than 30,000 subscribers after launching its first one in 2012, Head of RIA and Retail Investor Platforms Hollie Fagan

Outsourcing is only moving through the “very early innings” of its ultimate scale, she said. Advisors who see investment management as their main value proposition still rate Excel as their No. 1 tool, Morningstar CEO Kunal Kapoor noted during the panel discussion.

“They’re simply not doing the job they should be doing, which is helping their clients achieve the outcomes the clients want,” Kapoor said. “Instead they’re in the back office doing work that, to them, seems inexpensive because they haven’t paid much for it.”

The lower administrative burden of outsourcing adds to advisors’ efficiency in their practices, White agrees. He rejects the view that LPL’s impressive $150-million tech spend — more than

About 75% of these investments are fueling new capabilities, according to White, who counts the Sleeve, ClientWorks, goals-based planning tools and the proposal generation among them. A new investor portal, mobile app and “many more” tools are on the way, he says.

“Whereas some people say ‘well, I don’t need to throw money at that,’ what that really means is, they rent it from someone else,” White says. “They can’t control the experience, which means they can't integrate it the way we do, and which means there’s another mouth to feed, which means they can’t be as price aggressive as we are...So that’s a competitive advantage for us.”