Wealth management firms are still on a buying spree, thanks in no small part to private equity funding.

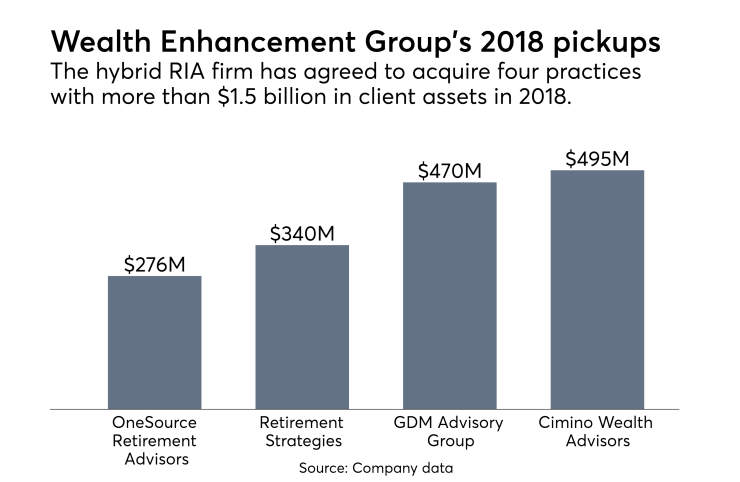

Wealth Enhancement Group, an LPL Financial hybrid RIA, recently announced its fourth deal of 2018, with its total purchased client assets set to top $1.5 billion this year alone. It's a sign of the record pace of M&A deals: Wealth management firms have made 137 acquisitions so far in 2018, on track

The 43 acquisitions in the third quarter of the year constitute the highest volume of any third quarter tracked by the investment bank and consulting firm. Private equity capital is behind many of the deals, including the latest one announced by Wealth Enhancement.

The Minneapolis-based firm is backed by private equity firm and Advisor Group owner Lightyear Capital, and will purchase GDM Advisory Group, the firms announced. The seller, advisor Glenn Meyer’s Philadelphia-area RIA, has about 250 clients with $470 million in assets under management.

On the strength of its recent M&A deals along with organic growth of $1 billion in 2017, Wealth Enhancement has expanded to more than 70 advisors and $9.7 billion in client assets. Pending deals by Lightyear’s other portfolio firm in the space, the 5,000-advisor independent broker-dealer network Advisor Group, would also

Meyer’s fee-only practice also represents Wealth Enhancement’s second acquisition from the Philadelphia area

“In seeking a strategic partner, my team and I were not looking to ride off into the sunset,” Meyer said in a statement. “Rather, we were looking for a platform that could help us further elevate our business, fast-track our growth and further strengthen the client experience we provide.”

-

Upon closing, the deal will push Wealth Enhancement’s advisor head count beyond 70 financial planners.

September 19 -

Wealth Enhancement Group would grow to nearly 70 advisors nationwide under its second major purchase of the year.

July 25 -

Wealth Enhancement Group has nearly doubled its assets over a two-year period.

June 15

Dynasty, Raymond James and Stifel are among the biggest beneficiaries of recent advisor moves.

Meyer launched the Fort Washington, Pennsylvania-based firm in 1993, according to its website. In addition to him, the practice includes one other CFP, Meyer's son Cory, who will be staying alongside his father under the Wealth Enhancement brand.

Wealth Enhancement has now agreed to acquire nine different practices in the past five years. An investment fund managed by a Lightyear affiliate purchased a majority stake in the Minneapolis-based hybrid RIA firm in June 2015, the firm’s ADV shows.

“Establishing a critical mass of advisory capabilities and clients in key markets has long been a crucial priority for Wealth Enhancement Group as we seek to build on the five-year momentum of our multi-faceted growth strategy,” Wealth Management CEO Jeff Dekko said in a statement.

The number of M&A deals in the industry could reach up to 183 this year as “RIAs remain attractive assets for buyers and sellers seek liquidity,”

“In a continuing theme, heightened deal activity in 2018 has coincided with a revitalized interest from consolidators and private equity buyers, as these firms increasingly are seeking and finding established businesses that fit their investment criteria,” the firm’s third-quarter M&A report says.