As complex questions surround LPL's hybrid RIAs and the power of the firm's scale, two of its largest enterprises made major recruiting grabs.

Private Advisor Group — a hybrid RIA which has

LPL’s some 420 hybrid RIAs have more than 5,200 advisors, but

Integrated Financial Head of Recruiting Robert Sandrew praises LPL for “swinging the pendulum” back to hybrids with the pullback of the corporate RIA policy on recruits. With LPL’s support, Private Advisor also expects

Advisors Natacha Smith and Mike Stieglitz of New Jersey-based CKW Wealth Management joined LPL and Private Advisor Group on Jan. 2, according to FINRA BrokerCheck. Smith had previously been with the hybrid RIA since 2011 before coming to 1st Global last year.

-

An analyst expects “solid” recruiting figures for the fourth quarter after the No. 1 IBD added the five-advisor group plus an ex-Raymond James bank program.

January 17 -

Private Advisor Group is “cautiously optimistic” it could recruit a dozen teams with about $500 million in AUM each this year, an executive says.

January 10 -

The No. 1 IBD is marshaling transition assistance, technology and other resources toward recruiting success across the firm and its bank channel.

January 4

Macroeconomic trends and matters of convenience will move advisors, assets and markets next year in the ever-changing wealth management space.

Stieglitz spent 14 years with 1st Global, while Smith had been with LPL for a six-year prior tenure out of her 14-year career in the industry, BrokerCheck shows. In addition to the wealth management practice, CKW Certified Public Accountants & Consultants has tax, accounting and business consulting services.

CKW Wealth opted to follow about 100 other advisors in Private Advisor’s office of supervisory jurisdiction who use LPL’s corporate RIA. Roughly 550 advisors with Private Advisor use its hybrid RIA, which advisors Pat Sullivan and John Hyland launched in 2011, for their advisory AUM.

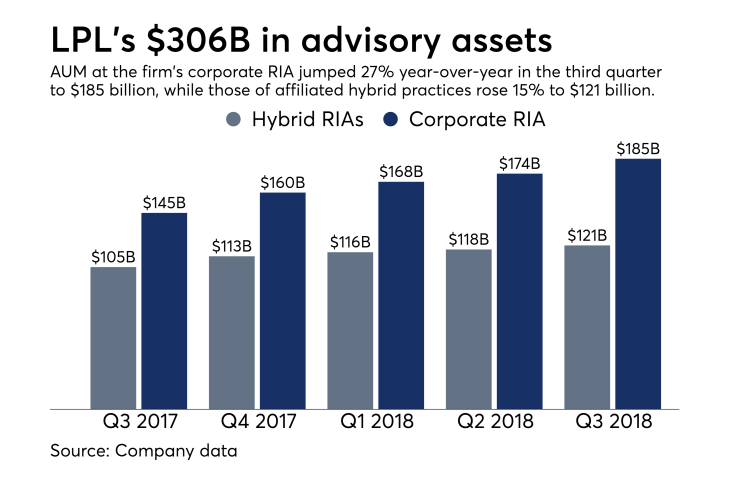

In a near-reversal from the same period in 2017, LPL’s corporate RIA assets rose by 27% year-over-year to $185 billion in the third quarter, versus a 15% increase to $121 billion on the hybrid RIA channel. Hybrid RIA assets were

Integrated Financial, which is based outside Boston but opened a new corporate office in San Diego last year, has 127 advisors managing $5.6 billion in client assets at 36 offices. Founder Paul Saganey came to LPL in September 2016 following a dozen years with Lincoln Financial Network.

The firm’s hybrid RIA has more than $1 billion in AUM, and it added TD Ameritrade to its available custodians in 2018 alongside LPL, Charles Schwab and Fidelity, according to its SEC Form ADV. Sandrew applauds LPL’s spending on technology, as well as the rollback of the corporate RIA requirement.

“That was a pretty aggressive policy shift, and I think that they’ve done a nice job of swinging the pendulum back and rebuilding some of those relationships and providing the proper resources to help the hybrids in terms of recruiting, in terms of just overall build out,” Sandrew says.

LPL, he adds, is “very cognizant of the RIA space and trying to understand where they fit and how they can successfully compete.”

In that vein, the firm has agreed to waive a fee of 5 basis points on off-platform AUM for Private Advisor’s new affiliation model. Smith and Stieglitz picked the more conventional LPL corporate RIA option with Private Advisor, while giving its OSJ two new offices in Sparta and Chester, New Jersey.

“Natacha’s familiarity with LPL played a role in moving her team back to LPL and PAG so they could have the support their firm needs to not only succeed, but to thrive,” Private Advisor Chief Marketing Officer Abby Salameh said in a statement. “It is wonderful to have her back as part of the PAG family.”

Stieglitz credits LPL for “spectacular” technology and other resources, noting they helped make Private Advisor and LPL the best fit after their practice began considering a new IBD last May. Advisors "still get that small community, family feeling" at Private Advisor, despite its large size, Smith says.

Ryan George, a spokesman for tax-focused IBD 1st Global, issued a statement wishing the practice well under their new setup with LPL and Private Advisor.

“We’re proud of the years of partnership we had with CKW Wealth Management and the many clients we helped them serve,” George said.