Four financial advisors managing $330 million in client assets left Lincoln Financial Securities for LPL Financial, as the No. 1 independent broker-dealer pitches prospects on its scale and bulked-up recruiting offers.

Richard Flood of Flood Financial Services

LPL CEO

At the same time, however,

LPL’s size offers advantages, though. In a meeting this week with analysts from William Blair, executives with the firm outlined their plans to spend $115 million on technology this year, according to a note by Chris Shutler. Experts have also identified LPL

The team led by Flood, a 48-year veteran of the financial services, wanted to move to the largest IBD “to be able to take advantage of their scale and stability that will allow us to further enhance the level of service our clients have come to know and expect,” he said in a prepared statement.

“LPL’s focus on providing advisors with technology and a depth of resources gives us the opportunity to operate more efficiently and to deepen our client relationships,” Flood said, adding that the firm was also impressed by a specialized team within LPL focused on succession planning and acquisitions.

-

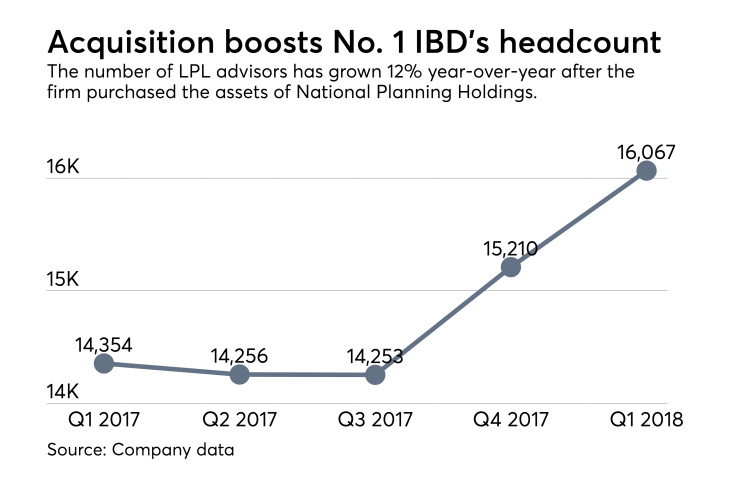

The No. 1 IBD has completed the NPH acquisition, but CEO Dan Arnold unveiled further growth initiatives amid challenges to its dominance.

May 4 -

LifeYield unveiled its second agreement with an IBD to offer its software, which had previously only been available to large institutional clients.

May 30 -

At least seven firms with outside RIAs have left the No. 1 IBD since it announced a change in policies last November.

June 5

Thirteen of the top 25 companies generated double-digit growth in 2017 as rivals close in on the perennial No. 1 firm.

A spokeswoman for Lincoln Financial Network, which is his former IBD’s parent and the No. 9 IBD overall, declined to comment. She notes a company policy against discussing departures.

Flood Financial has five other staff members, in addition to its advisors. Flood and his wife Teena, the firm’s business manager, launched Flood Financial back in 1982, and he first entered the field in the late 1960s, according to a bio on the company’s website.

Their new IBD has laid out strategies aimed at both organic growth and possible further acquisitions. The management team from LPL told the Blair analysts that they’re working on methods of assisting advisors with lead generation and services like a virtual administrator and a virtual CFO, Shutler wrote.

LPL’s willingness to raise its offers of transition assistance for prospective advisors reflects a better potential return on capital in a time of rising interest rates, the executives told the Blair team.

“While advisor recruiting is ‘going well,’ it is too early to say whether higher transition assistance is playing a role,” Shutler wrote. “Management does expect it will be able to gauge success of its new recruiting efforts later this year.”