As LPL Financial strives to bolster its RIA offerings, the No. 1 independent broker-dealer is cutting ETF ticket charges by nearly half for three major fund families.

Transaction fees for ETFs from State Street, Invesco and WisdomTree Investments will drop to $4.95 from $9.00 in the second half of the year. LPL

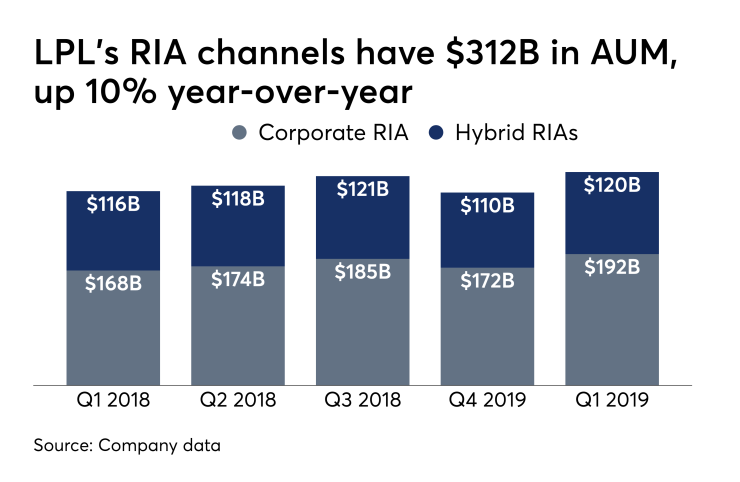

LPL’s corporate and hybrid RIA channels grew a combined 10% year-over-year to $312 billion in assets under management. Record recruiting of advisors managing more than $30 billion in client assets over the past 12 months is helping to fuel expansion.

The firm also aims to make its pricing for RIAs simpler and more attractive, according to Rob Pettman, LPL’s executive vice president for products and platforms. Since 2017, LPL has

ETF providers have been waging a

LPL is pursuing lower transaction fees for other ETF families, as well. Describing the 3,000 types of no transaction-fee shares of mutual funds as “an incredibly competitive offering,” Pettman says he wouldn’t rule out moving to ticket charges of zero for the ETFs too.

“That's certainly a possibility in the future,” Pettman says. “You're seeing us looking to aggressively compete in the RIA marketplace.”

-

The No. 1 IBD aims to triple its potential target market reach, in part by adapting some aspects of employee services to independence.

June 7 -

One departing practice managed $100 million in assets.

May 30 -

CEO Dan Arnold presented details of the firm's mounting ambition after announcing the acquisition of a brokerage and RIA with $3 billion in client assets.

May 22

Pettman spoke the week after LPL recruited three advisors with about $460 million in combined client assets to its brokerage and corporate RIA platforms over a two-day span. In the past two weeks, LPL has announced additions from Waddell & Reed, Raymond James and Ameriprise:

•Waco, Texas-based financial advisors Brian Davis and Brian Remson

•Jake Murray, Mike Canavan and Jill Phillips of Idaho Falls, Idaho-based Teton Wealth Management manage $185 million in client assets. The trio of advisors

•Advisor Mike Bensey

LPL and other IBDs near its size are adjusting to the growth of the RIA space,

“This is LPL using its size and scale to go about lowering price on our advisory platforms,” he says. “We're a lot more than that, if you think about our business model.”

The firm is betting that its overall size of 16,189 advisors and record client assets of $684 billion will force its competitors into a tough spot when it cuts prices. In

“We see the opportunity to continue to expand our capabilities and use pricing as a way to differentiate,” Arnold said. “We think that will put more and more pressure on our competitors in this part of the industry and will challenge them to follow. We think that will be difficult for them.”