Christian financial advisors aiming to provide faith-tailored planning services just got a boost from the nation's largest independent broker-dealer.

LPL Financial

The IBD made the move a couple of years after Ameriprise authorized the CKA designation — but it still constitutes a major milestone, according to Rob West, president of Kingdom Advisors, the title’s issuing organization.

Kingdom Advisors works "to serve the public by creating a recognized and credible specialty of Christian financial, legal, and accounting professionals within the financial services industry offering biblically wise financial advice," according to its website.

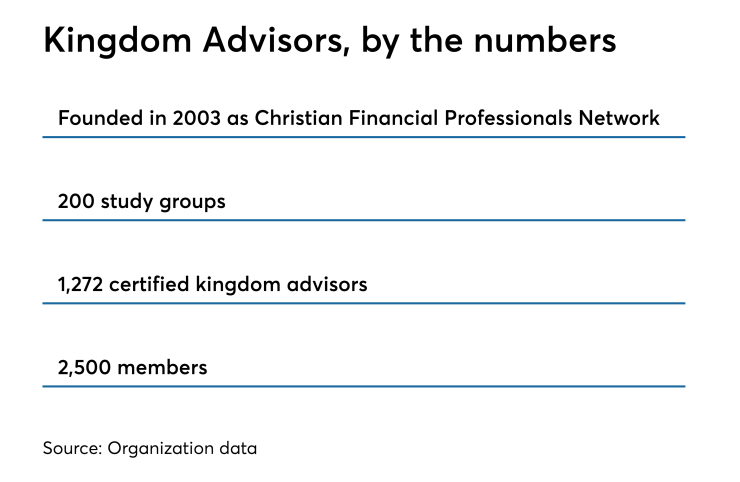

LPL’s decision also came as the group seeks to complete such approvals from wirehouse firms and grow its ranks to as many as 30,000 advisors holding the CKA certification, West says. Currently, 1,272 advisors are CKAs. The organization is also expanding its academic programs for future advisors.

LPL launched one of Kingdom Advisors’ more than 200 study groups for advisors across the country in early 2017. The non-denominational certification carries

Christians of all denominations make up more than 70% of the U.S. population,

“It’s a very unique opportunity in the marketplace to have a designation like this,” says Bryan Mise, an LPL advisor with Summerville, South Carolina-based Compass Investment Advisors. “When you can tie your faith into what you’re doing with your money, it becomes a more holistic approach to financial planning.”

-

These emotional topics tend to be bad for investment returns, Barry Ritholtz says.

July 3 -

One manager’s new group of funds will launch in collaboration with leading nonprofits.

July 19 -

This year’s Pro Bono Award goes to Amy Born, who gives one-on-one advice to Habitat for Humanity homeowners.

July 31

Mise traces his inspiration for becoming a planner to Crown Financial Ministries, a biblical financial study class he and his wife Julie took at their Baptist church in 2003. The Army National Guard veteran earned a college degree in finance and entered the field in 2010, garnering his CKA a year later.

Kingdom Advisors, which came out of an organization founded by advisor Ron Blue in 2003, spans more than 2,500 members. The organization started 60-hour college courses this past summer at two universities, and West says about 10 more are considering CFP programs with a CKA capstone.

“To have a major firm like LPL recognize the designation on the heels of the launch of a new course is a really big accomplishment, and, we hope, the first of many,” he says.

Merrill Lynch, Morgan Stanley and several other major firms also have study groups, and the organization is working to complete more approvals for the CKA title, he adds.

The Atlanta-based organization’s approach to planning includes Proverbs-based warnings about debt, a higher priority on transferring wisdom than wealth, charitable strategies and a different take on retirement, according to West.

“The whole idea of faith-based investing is really just one piece of this idea that there are clear planning differentiators that exist for this Christian market segment,” he says. “The Bible nowhere says that we save just to live a life of leisure. Their calling doesn’t have an expiration date.”

Mise participates in LPL’s Kingdom Advisors Support Group, which has two virtual meetings per month and quarterly conference calls with leaders in the field. LPL has 51 advisors with the CKA designation, according to the firm, but they couldn’t use it by their names or on their websites until it was approved.

“When an advisor is equipped to align financial advice with a client’s personal values, this not only impacts the client positively, but also creates a more meaningful advisor-client relationship,” Don Williams, LPL’s corporate liaison with Kingdom advisors, said in a statement.

Advisors in Oregon, however, still can’t use the CKA designation because state law prevents the use of certifications not issued by certain accreditation entities, according to Oregon’s financial regulator. FINRA