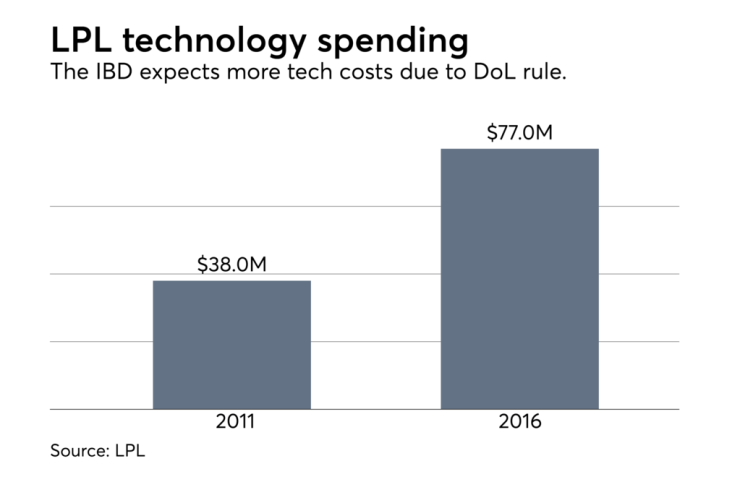

LPL isn't shying away from the task of building up a new technological foundation for a fiduciary-focused, digital advice era.

The

But even though LPL envisions a future where advisors are using automation and behavioral management alongside portfolio and planning services, its top technology executives say robo advisors like Betterment or Wealthfront aren't sources of inspiration.

"We've looked at market and are trying to think much further out, to develop something much more different and unique," says Chris Paul, LPL's senior vice president of technology.

As muses, Paul cites the new breed of microinvesting and PFM applications aimed at millennials, including Acorns and Trim, a bot that manages subscriptions, sends spending alerts and checks bank balances.

"The just-in-time micro transaction, for instance, is a fundamental part of the younger generation's experience. Those are the things influencing us. [LPL CEO Dan Arnold] has been pushing us to experiment more, to drive more innovation. We're big, but the attitude toward tech is very small, with focused teams and working directly with advisors and clients."

KEY TECH INITIATIVES

Thinking about generational approaches to wealth management has figured prominently in LPL's technology development plans, Paul adds, as the firm has built a service customizable for every type of client, from the savvy do-it-yourselfer to those opting for just basic digital interactions.

"We took a hard look at the generational aspects of the investor base we have today," Paul says. "We wanted to make the digital experience more engaging for current clients, and for the younger investor to feel like it's part of a modern ecosystem online."

-

The nation's biggest IBD believes macro trends are ideal to boost recruiting, says LPL managing director Bill Morrissey.

August 1 -

The firm is trying to show advisors how they can use LPL’s resources to “get more at-bats” with prospective clients, an executive said.

August 1 -

Dan Arnold says behavioral management, automation and portfolio and planning services need to be combined to win future clients.

July 31

Among the IBD's key advisor-facing tech initiatives is a transition in its work and CRM platform BranchNet to ClientWorks. The new platform will be able to handle client request tracking, show an institutional dashboard, assist with conversion from brokerage to advisory and offer device compatibility. It will also handle trading functionality, as LPL will soon phase out trading functionality from the old platform.

The IBD will also being delivering new, shorter account statements in October.

That statement streamlining effort generated a deluge of feedback from advisors and clients, Paul notes, an example of how the firm has remained open about all of its upgrade development efforts.

"We're not just in a dark room coding and drinking Mountain Dew," Paul says.

ROBO BUY-IN

In addition to gaining advisor buy-in to new upgrades, LPL also wants advisors educated about how best to use new technology.

That's why when it rolls out this month its new robo advice platform, Guided Wealth Portfolios, it will be done in waves with training requirements.

The expansion of hybrid platforms and bank digital advice promises big changes and fierce competition in automated wealth management.

There are already a few hundred advisors who have been using the platform since its pilot phase, says Rob Pettman, executive vice president of products and platforms at LPL.

"Some advisers have embraced it and it made it as an extension of their practice," Pettman says, explaining that the firm has taken a three-step approach to introducing the digital advice tool.

The first step is to acclimatize advisors with using the platform; the next is showing them how to build it into their practice, finding clients that could be suitable for digital advice. Some advisors graduated to the final step of full-scale adoption, Pettman says, proactively seeking out digital-first clients.

"Some advisors have over 50 accounts now," he says. "They are proactively going after business. We're suggesting the tool can be used assertively, instead of reactively."

LPL isn't recommending how much an adviser can charge for the digital service, but it has capped fees for the option at 1%. "Advisors are going to figure out what kinds of services they can offer to clients, and match that up," Pettman says.