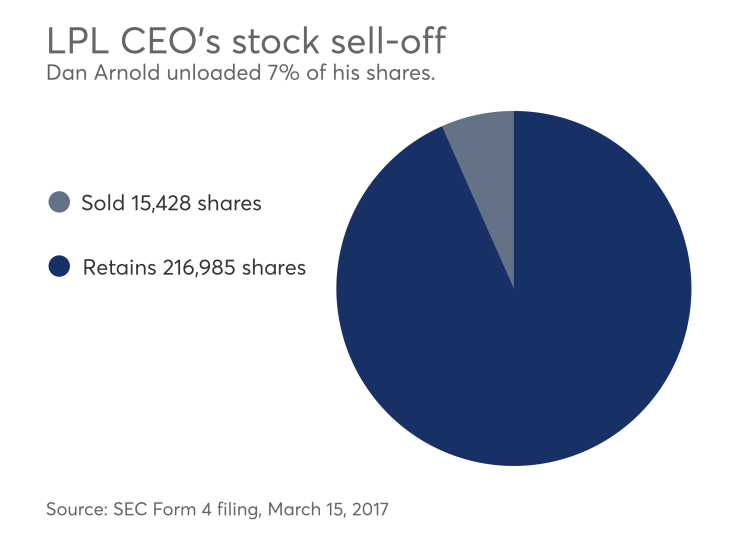

LPL Financial CEO Dan Arnold sold over 15,000 shares in the company for more than $600,000 two months after

Arnold also received stock options valued at $4.8 million in a series of grants to him and nine other executives following a $2.2 billion round of debt refinancing, LPL disclosed last week. The firm additionally gave eight managing directors and CFO Matthew Audette thousands of shares.

Longtime CEO Mark Casady

See which independent broker-dealers are managing the biggest asset base for client accounts.

“Dan continues to hold a significant amount of stock — higher than required by our equity ownership guidelines,” LPL spokesman Jeffrey Mochal says in an email, declining further comment and a request for an interview with Arnold about the transactions.

‘DOES STAND OUT’

LPL stock has more than doubled in value over the past year, to around $40 per share from less than $20 in February 2016. Arnold sold 15,428 shares in three transactions valuing the company’s stock at just over $39 per share, netting $603,831 in the process, the filings show.

The stock sale happened the day after the huge options grant, but it “does stand out for sure,” Aite Group senior analyst David Weiss says in an email.

“While this typically isn’t considered the most positive sign by leadership, there may be personal/private externalities that affected Arnold’s decision,” Weiss says.

-

The nation's largest IBD vows to take a “proactive approach” to the fiduciary rule.

February 9 -

Former head Mark Casady, new chief Dan Arnold and board member Marco Hellman each netted millions.

February 17 -

Carolyn Armitage joined the RIA M&A consultant after LPL eliminated the enterprise consulting division.

February 22 -

The firm has already standardized its variable annuities and alternative investments and is working toward doing the same for mutual funds as well as indexed and fixed annuities.

March 9

FLUSH WITH CASH

LPL announced it had closed March 10 on a seven-year, $1.7 billion loan and a five-year, $500 million revolving credit facility. The firm said it used cash, capital from the loan and proceeds from an offering of senior notes to repay its existing facilities, interest and fees.

Three days later, LPL granted Audette and the eight top executives a combined 38,737 shares valued at $1.5 million on the market-close price of $39.48 a share.

Audette (7,916) received the most shares, followed by managing directors Tom Gooley (5,937), George White (4,552), Andy Kalbaugh (4,193) and David Bergers (3,769). The shares will vest on a ratable system over the next three years.

The same group of nine executives, plus Arnold, also received options to buy a collective 258,708 shares at the March 13 market-close price. The stock options translate to a total of $10.2 million in value exercisable during the next three years as well.

The grants and options “may be nothing more than executive compensation plans typically used to retain talent,” Weiss says.

Late last month, LPL revealed that it would