A four-advisor team with about $200 million in client assets joined LPL Financial because its technology and services are better than the practice’s broker-dealer of more than three decades, its CEO says.

Founder Raymond Moore, his son Christopher and advisors Joseph Tuck and Ashwin Sharma of Moore Financial Services left Lincoln Financial Securities, a Lincoln Financial Group subsidiary, for LPL, the No. 1 IBD

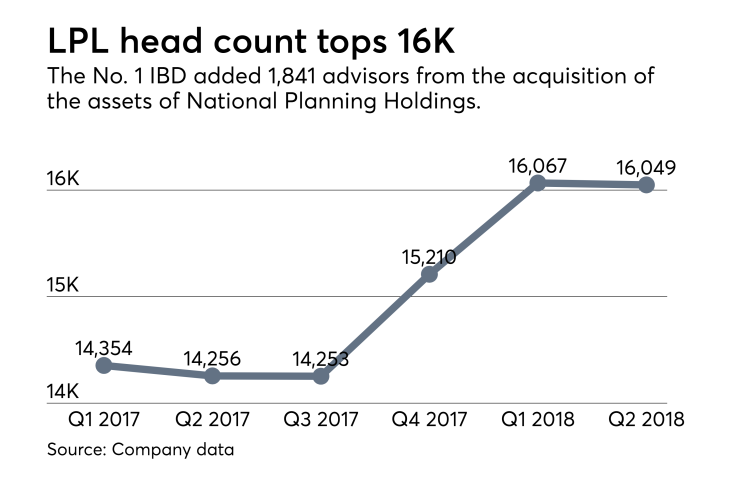

LPL’s head count has expanded

Service problems served as the “primary driver” of the team’s move to LPL’s brokerage and corporate RIA platforms, but the team had been considering a switch for about three years, Moore says. They still see Lincoln as “a great company when it comes to manufacturing life insurance and annuities,” he adds.

Moore praises LPL’s platform for advisory accounts as a superior tool. With LPL’s technology, his firm can go paper-free with e-signature capabilities, while also receiving more personalized service from the home office, he says.

“When you call the service center, you get an immediate response every time,” he says. “We have our own dedicated service team, which makes a huge difference as well. It’s like going from the darkness to the light.”

-

The issuing organization is working to expand the number of firms allowing the certified kingdom advisor title to be used in marketing materials.

September 6 -

Stratos Wealth and other OSJs are offering more types of affiliation and equity deals in a bid to stem a competitive threat.

September 5 -

The move by the multi-generational practice stemmed from LPL’s self-clearing capabilities, one of the advisors says.

August 30

Firms’ head counts show how they’re responding to a challenging time in which experts predict the number of advisors to fall in coming years.

A spokeswoman for Lincoln had no comment on the team’s departure.

Moore Financial officially aligned with LPL on July 31, according to FINRA BrokerCheck. The elder Moore launched the practice in 1985, and his son came aboard in 2000. They completed their succession plan for the practice about 15 years ago, says Raymond, 70.

Most of the firm’s clients are retired or close to retirement, and they have a significant amount of assets they donate to endowment funds and churches, he says, noting he is a holder of the Chartered Advisor in Philanthropy designation.

Tuck, an 18-year finance veteran, also had prior tenures with Wachovia, UBS and Wells Fargo, BrokerCheck shows. Sharma entered the field in 2016 with MassMutual’s MML Investors Services before coming to Lincoln last year. The practice also has two full-time support staff members.

LPL CEO Dan Arnold has made enhancements to technology and services to advisors

“We are committed to supporting our advisors by providing the resources, technology and innovative solutions that help them differentiate their businesses and serve their clients in the ways that matter most to them,” Craig Kamis, an LPL executive vice president, said in a statement. “We look forward to supporting Moore Financial for years to come.”