A hybrid practice with $900 million in client assets joined Triad Advisors, its third broker-dealer in the last two years after launching an affiliated RIA.

Partners Tim Kerrigan, Brian Damiani and Mike Kelly of Continuum Advisory bolted Signator Investors more than a year after Signator’s parent, John Hancock Financial Network,

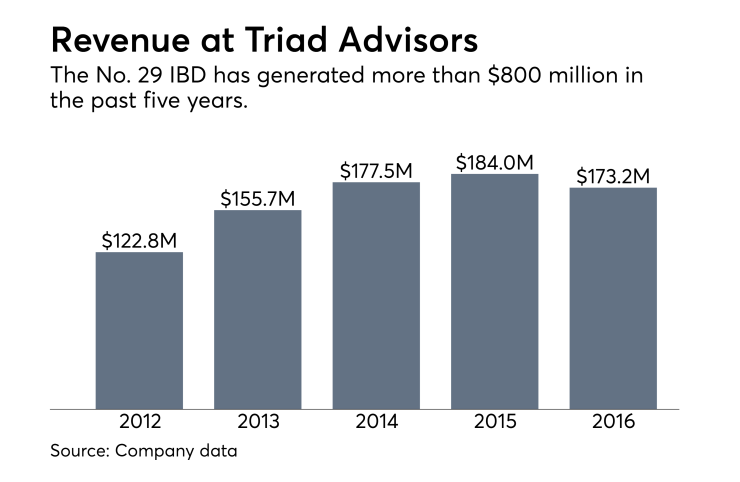

Triad, which is part of the Ladenburg Thalmann network and

“From our first meeting with their team, it was apparent that Triad not only shares our passion for client service but is committed to acting as a true empowering partner as we continue to work to ensure that our advisors enjoy great freedom and flexibility in how they run their businesses,” Kerrigan said in a statement.

-

The practice left its BD less than a year after John Hancock acquired Transamerica Financial Advisors.

September 21 -

Backed by the considerable resources of Manulife Financial, Hancock wants to be a player in an altered IBD marketplace.

July 6 -

The practice joined Triad Advisors after at least 25 years with its former IBD.

November 9

A massive acquisition, the possible end of the Broker Protocol and other issues will shape the industry in 2018.

A spokeswoman for Signator, which

The Pleasanton, California-based Continuum launched its RIA in April 2016 after five years of due diligence, talks with Transamerica and other preparations, according to its website. Chief Compliance Officer Jon Sullivan serves alongside Kerrigan, Damiani and Kelly as part of the executive team.

Damiani and Kelly had been with Transamerica since 2000, while Kerrigan started at the firm four years later. The team had formally aligned with Signator in May 2016, after the transaction

Continuum changed its custodian from Pershing to a dual relationship with Fidelity’s National Financial Services and TD Ameritrade, according to Triad. The Atlanta-based Triad, which specializes in hybrid RIA practices, had 600 advisors in 37 states with almost $26 billion in client assets at the end of 2016.

“At Triad, we are highly selective and we strive to partner with organizations that are innovative, entrepreneurial and have significant potential for growth,” Triad Chief Strategy Officer Nate Stibbs said in a statement, adding that Continuum “perfectly embodies these criteria.”

Triad constitutes one of the five IBDs that make up the segment of Ladenburg Thalmann known as independent advisory and brokerage services. The unit earned pretax profits of $8.4 million on revenue of $286.2 million in the third quarter,