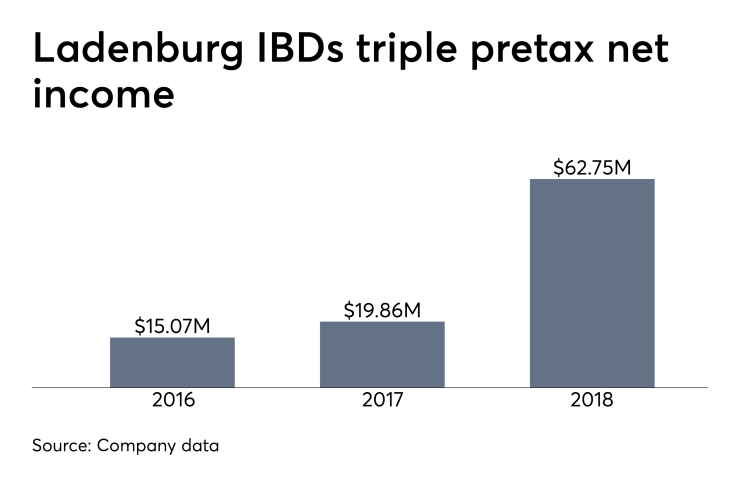

Ladenburg Thalmann’s five independent broker-dealers more than tripled their pretax profits in 2018 while boosting headcount to roughly 4,400 financial advisors.

An accounting standards change helped boost the bottom line at the network's parent to the tune of $8.7 million in extra net income in 2018, Ladenburg

Higher net income at the IBDs stemmed from new expense and revenue recognition guidelines, plus a surge of $32.7 million over 2017 in cash-sweep revenue and a rise in commissions of nearly $70 million from sales of annuities, mutual funds and other products.

Longtime chairman Dr. Phillip Frost

While the case tarnished the firm's then-primary shareholder, it did not appear to hurt its five IBDs. The network generated 83% of Ladenburg’s revenue in 2018 at $1.16 billion. IBD revenue ticked up 2% year-over-year, while pretax net income soared to $62.7 million.

“During 2019, we will continue to invest for both near and long-term opportunities that focus on growing our recurring revenues, increasing our operational efficiencies and executing successfully on our strategic initiatives in order to drive value for our employees, financial advisors and shareholders,” Ladenburg COO Adam Malamed said in a statement.

Ladenburg’s network includes Securities America and Triad Advisors — two of the top 30 firms on Financial Planning’s

-

The 4,300-advisor network is investing in insurance distribution after benefiting from rising interest rates and record client assets.

November 7 -

The IBD network’s parent repurchased the majority of Dr. Phillip Frost’s shares just before the SEC filed proposed settlements of its pump-and-dump case.

December 31 -

The network’s parent disclosed the results of its first year under a new accounting standard affecting the top line at many large U.S. businesses.

March 8

Thirteen of the top 25 companies generated double-digit growth in 2017 as rivals close in on the perennial No. 1 firm.

A spokesman for Ladenburg declined to provide information beyond those released in the fourth-quarter

The IBD did disclose it spent $14.1 million in additional compensation and benefits expenses in 2018 due to a 13% increase in headcount. The accounting change also sharply cut the reported costs of amortization of forgivable loans and commissions and fees.

In addition to a swell of cash-sweep revenue due to higher interest rates and new programs aimed at the business, the IBDs netted some $6 million in additional growth incentive payments from one of its clearing firms and extra marketing services and product incentives last year.

Sales commissions also drove the major increase in net income, beyond the impact of shifts relating to the timing and gross versus net basis of its revenue recognition. Variable and fixed annuities — as well as fixed-income, insurance and equity products — sold at higher volumes.

The parent firm has $253 million in shareholders' equity and $182.7 million in cash and cash equivalents, CEO Dick Lampen noted in a statement. He became chairman upon Frost’s retirement from the board last year.

Ladenburg earned net income of $33.8 million on revenue of $1.39 billion, resulting in a jump of nearly 340% over its net income for 2017. For the quarter, it took in $9.6 million in net income on revenue of $355.1 million, or about $0.01 per share.