Ladenburg Thalmann’s Triad Advisors grabbed a $325 million Royal Alliance Associates team as the hybrid RIA practice seeks to ramp up its recruiting and acquisitions efforts.

Joe Heider, a 41-year veteran of financial services and the owner of Cleveland-based Cirrus Wealth Management, brought the hybrid practice to Triad on April 24, according to FINRA BrokerCheck. The firm consists of four advisors, including Heider’s son Ryan, and four other staff members.

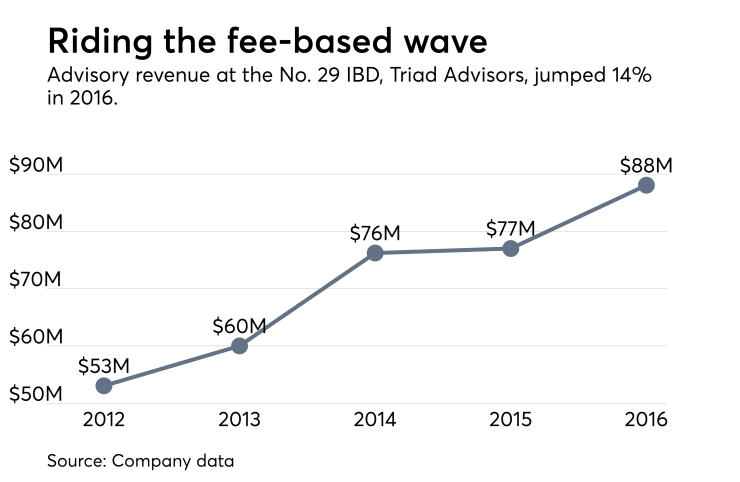

The No. 29 independent broker-dealer boasts a specialty in hybrid RIAs. Triad

Atlanta-based Triad saw record recruiting results in terms of gross dealer concessions in 2016, followed by a 50% rise in recruited GDC last year, according to Chief Strategy Officer Nate Stibbs. The firm, which is the second largest of Ladenburg’s five IBDs, kept up its 2017 pace in the first quarter, he says.

-

The No. 29 IBD has unveiled two significant recruiting moves in the past two months.

December 7 -

The practice joined Triad Advisors after at least 25 years with its former IBD.

November 9 -

The nation’s largest independent broker-dealer has had a net loss of 121 advisors this year, mostly to three major OSJs.

August 4

One of the biggest notable losses came from Merrill Lynch, which lost a team managing $1 billion to the independent space.

Heider plans to pursue non-organic growth by adding new advisors and purchasing other firms, according to Stibbs. The practice’s move fits broader industry trends toward hybrid RIAs, and resources like research, trust services and asset management from Ladenburg helped attract them, he says.

“They’re ready for the next chapter of their business. Like many advisors, they’re trying to find ways to drive scale, to increase efficiencies, to have more flexibility,” Stibbs says. “Those are the types of solutions that high-net-worth clients are demanding, and they have to be in a position to deliver.”

A spokeswoman for Royal Alliance parent firm Advisor Group declined to comment, citing the company’s policy against discussing advisors no longer affiliated with the firm. The four-IBD network itself

Heider had spent eight years with Royal Alliance after six years with Multi-Financial Securities and 20 years with Vestax Securities, BrokerCheck shows. He started in the financial services industry with Pro Services in 1976.

The practice had already been using Triad’s custodian, Fidelity Clearing & Custody Solutions, for its advisory assets, but its brokerage assets came over to the Fidelity platform from Pershing, according to Stibbs.

Cirrus’ RIA listed $188.7 million in advisory AUM in its latest Form ADV from early March. For portfolio management, Cirrus charges 100 basis points for the first $1 million, with lower prices for higher asset levels. It also collects hourly fees up to $300 or fixed fees up to $7,500 for planning services.

“As we sought a new strategic partner to help us take the next step in our firm’s growth, considerations like technology, product selection and gaining added flexibility played a huge part in our decision,” Heider said in a statement.

Since finding a firm with the right culture was equally important, he added, Triad won out because it also “offered a compelling partnership model that matched our future goals as a hybrid RIA.”