Amid growing links between investors’ faith and their money, a Catholic fraternal benefit society aims to work with RIAs by offering proprietary model portfolios using its ESG screens.

The Knights of Columbus Asset Advisors and wealth management technology vendor AssetMark are starting out with about 125 investment advisor representatives managing more than $30 million after a soft launch among the charitable society’s insurance agents, Vice President of Investment Strategy Thom Duffy said in an interview. After its formal

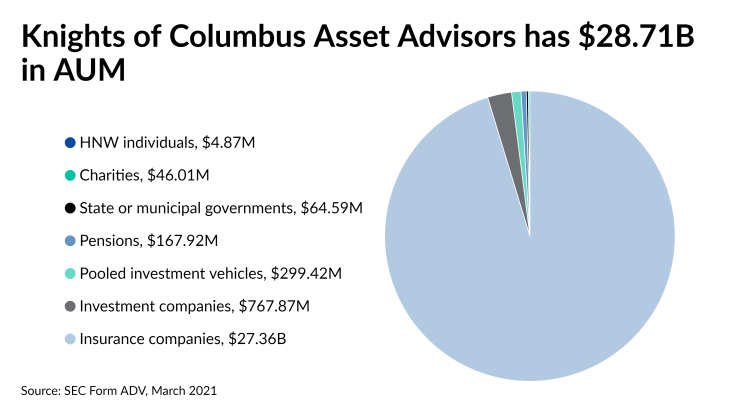

While the Knights and other religious groups such as Quakers and Lutherans trace the history of their investment arms back hundreds of years, clients increasingly want their advisors to help them invest according to their values — including their religious views. After building nearly $30 billion in assets under management through institutional investors such as Catholic dioceses, orders, foundations and colleges since launching the RIA in 2014, the Knights’ RIA started the new program “to be able to take this to the individual investor who were banging on the doors asking for it,” Duffy said.

“We're able to serve anyone who's interested in a Catholic investment approach,” he said. The Knights’ RIA uses proprietary funds with ESG criteria based on six major themes included in the investment

The Knights are open to the possibility of advisors using the advisor-as-strategist program while remaining affiliated with other RIAs or brokerages, according to Duffy. A firm with Lutheran roots, Thrivent, is also recruiting advisors to the hybrid RIA it launched in 2019, Thrivent Advisor Network. The firm

“Advice that’s purpose-driven is a powerful differentiator in today’s marketplace,” Armitage said. “Whether it’s protecting their loved ones in case the unthinkable happens, gifting strategies or ensuring their legacy is fulfilled, having an advice conversation that’s built on a person’s closest-held values can lead to increased financial clarity and intentional decision-making.”

In the ESG realm, the American Friends Service Committee’s Investigate project has emerged as a significant provider of free data about company practices as they relate to Israel and Palestine, prison companies and industries surrounding immigrant detention and deportation. Adasina Social Capital

It “would very much welcome” more collaboration with advisors, Perry said. “If they need our data formatted in a specific way for them to integrate it into their systems more easily, we've done that for multiple asset managers and advisors.”

The Knights’ RIA launched the models as part of AssetMark’s more than 400 enterprise agreements across wealth management for services such as model portfolios with billing, reporting, rebalancing and support staff, according to Tom McCarthy, AssetMark’s senior vice president of national sales strategy. The RIA “interviewed nearly 20 other providers (TAMPs, Custodians and Platform Tech) and found that AssetMark is uniquely aligned to serve their needs: a partner that could scale and serve 650+ new IARs offering advisory services,” McCarthy said in an email.

Unlike its insurance products and services, the RIA and its new models are open to non-members, even though Duffy predicts their initial growth will come from the Knights’ roughly 1,000 insurance agents and more than 1.9 million members worldwide. The investment advisor representatives and models have attracted 300 accounts since the pilot began in March.

“Finding a way to connect with clients based on what's truly important to them is perhaps the most important driver of growth in our industry,” Duffy said.