With the 1996 introduction of tax-qualified long-term care insurance under the Health Insurance Portability and Accountability Act and IRC Section 7702B, Congress affirmed that long-term care insurance benefits should be tax-free. Tax benefits for purchased long-term care insurance coverage followed.

However, the evolving landscape of both individual tax deductions and long-term care insurance tax preferences have created myriad options for filers, all of them confusing. What follows is a run-through of the choices, benefits — and indeed, drawbacks — of each.

DEDUCTING INDIVIDUAL PREMIUMS

Under

To be eligible for deductibility, the LTCI must be tax-qualified coverage as defined under

Premiums paid for tax-qualified LTCI are deductible if paid for the individual taxpayer themselves, spouses or any dependent as defined under

-

Expanding the fiduciary role of CFPs is a good thing — but the fine print is worth sweating.

July 13 -

You’ve proven your value to clients for years. Isn’t it time to give yourself a raise?

July 5 -

New research suggests we’re hardwired to crave substantial liquid reserves, but advisers can blunt it — if not outright quench it.

June 19 -

Advisers may think their firm’s credibility stems from a big number. That’s not to say they should misrepresent their assets under management, Michael Kitces writes.

June 5

While premiums are deductible, the amount of the deduction is limited, though.

First and foremost, the standard rule for medical expenses still applies — that is, in order to claim a deduction for both LTCI premiums and all other medical expenses added together, the taxpayer must itemize deductions on Schedule A, and only the portion in excess of 10% of Adjusted Gross Income (AGI) is actually deductible. The ceiling is owed to the expiration of the

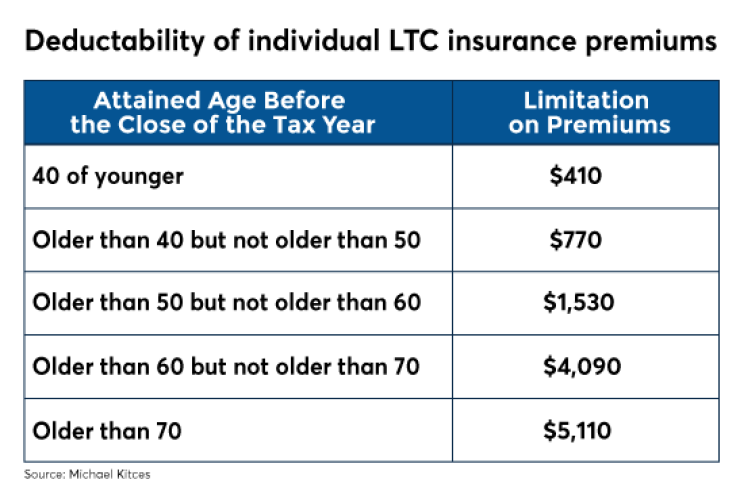

Second, in addition to the limitation on total medical expense deductions including LTCI premiums, there is a further limitation on the amount that can be counted as a medical expense.

Under

Example 1. This year, Allen and Jennifer turned ages 62 and 59, respectively. Each recently bought a tax-qualified LTCI policy. Allen’s costs $3,200 per year, and Jennifer’s costs $2,800. As a result, in 2017 Allen will be permitted to deduct $3,200, i.e., the cost of his policy, given it is below the $4,090 threshold, though Jennifer will only be permitted to deduct $1,530 of her premium, which is capped at the up-to-age-59 threshold. This means that in total, the couple can claim $3,200 + $1,530 = $4,730 of LTCI premiums as deductible medical expenses. To the extent that $4,730, when added to other medical expenses, exceeds 10% of the couple’s AGI, the excess above the threshold will be deductible.

Next year when Jennifer turns 60, her deductibility limit will rise to $4,090, which is more than enough for her to deduct her entire premium. Thus, in the future, the couple’s LTCI premium deduction will rise to the full $3,200 + $2,800 = $6,000, which again must be added to other medical expenses to determine how much above the 10%-of-AGI threshold is actually deductible.

Notably, because the couple’s LTCI premiums themselves are less than the $4,090 limit once they’ve reached their 60s, their deductions are still capped at the actual amount of LTCI premiums being paid each year.

As the above example illustrates, even if LTCI premiums have limited deductibility early on, the tax deductions may become more feasible later as the policy owner crossed the deductibility age bands.

In addition, because LTCI premiums are only deductible to the extent that they exceed 10% of AGI, premiums may be partially or fully deductible in some years but not others, simply due to unrelated changes in income that impact the AGI threshold. Conversely, significant shifts in other deductions can also indirect impact LTCI premium deductions, as none of them are deductible until/unless the taxpayer can itemize rather than claiming the standard deduction.

This also means that potential tax reform proposals, which may substantially increase the standard deduction, could also reduce the deductibility of LTCI premiums by making the standard deduction so high that few have enough LTCI premium, medical and other qualifying itemized deductions to reach the threshold.

In addition,

PAYING THROUGH BUSINESSES

The rules and limitations on the deductibility of LTCI are substantially different when premiums are paid through a business.

Under the general rules of

The end result? Akin to other employee benefits, a business’s payment of LTCI premiums on behalf of employees is a pre-tax expense for the business, without causing income to the employee that receives the coverage or claims benefits against it

To prevent abuses by owners who may also be employees in their own businesses, tax law also imposes several limitations on the deductibility of LTCI premiums.

SOLE PROPRIETORS

In the case of a sole proprietor,

However, because the self-employed health insurance deduction is claimed as an above-the-line deduction on

In the event that the sole proprietor purchases LTCI coverage for both themselves and a spouse, the age-based premium limits apply to both. But if the spouse is a bona fide employee of the business and the policy is purchased and paid for as employee compensation, the full amount of the premium can be deducted as a business expense — and only the owner’s LTCI premiums would face the age-based limitation).

Additionally, LTCI coverage provided to a bona fide employee-spouse, and that also covers the sole proprietor employer, may be fully deductible as employee-family coverage for both — i.e., where the business buys the employee-spouse individual coverage that has a shared-care family rider attached.

PARTNERSHIPS

Regarding business partnerships or an LLC taxed as such, LTCI premiums paid on behalf of partners may be deductible to the business as guaranteed payments under

Subsequently, the partners are still treated as self-employed, which means they can personally deduct the LTCI premiums as “self-employed health insurance” coverage on line 29 of Form 1040. As with sole proprietors, the deduction will be limited to the age-based premium restrictions, but as an above-the-line tax deduction, will not face the 10%-of-AGI or itemized deduction threshold requirements.

Example 2. Ashley and Sally are 50/50 members of an LLC that last year produced $200,000 of income, and the two want to purchase LTCI and route it through their business. Ashley is 57 and her LTC premium is $2,700; Sally is 62 and her LTC premium will be $3,700.

Absent the LTCI, their respective income shares as 50/50 partners would be $100,000. However, with the LTCI premiums being deductible as guaranteed, business income is reduced by $2,700 + $3,700 = $6,400 to only $193,600. With their 50/50 shares, this reduces income to $96,800. Then, Ashley and Sally must each include the premiums paid on their behalf in their respective incomes, which brings Ashley’s total income up to $99,500 and Sally’s up to $100,500. Notably, total business income is still $200,000, but Sally’s taxable share is now slightly higher due to the higher LTCI premium.

As a final step, Ashley and Sally may each deduct their LTCI premiums from their tax returns as a self-employed health insurance deduction. Due to her age, Ashley is limited to a deduction of just $1,530 of her $2,700 premium, while Sally is able to claim the entire $3,700 premium, since her age-based cap is as high as $4,090.

To get the favorable treatment for a partnership or LLC — where ultimately, the premiums are at least deductible as self-employed health insurance without the medical expense AGI or itemized deduction thresholds — the premiums must actually be paid by the business. If the business owners pay the premiums directly as individuals, they may still be subject to the standard rules for individual LTCI premiums, including the below-the-line medical expense limitations.

S CORPORATIONS

Under

In order to be treated as a more-than-2% owner, the shareholder must actually own more than 2%. The threshold is met, however, if he/she owns more than 2% on any day of the taxable year. Consequently, even if ownership changes intra-year, being a more-than-2% owner at any point in the year counts for that tax year.

Additionally, the family attribution rules of

C CORPORATIONS

When it comes to a C corporation, the standard rules for employees continue to apply, including that LTCI is deductible as part of compensation as an accident and health insurance benefit under

Again though, for favorable tax treatment, the premiums must be paid directly by the employer, not via a Section 125 cafeteria plan, as LTCI is explicitly denied favorable treatment under

In the case of a C corporation, there rules apply equally to owners and other employees, and there’s no less-favorable treatment for employee-shareholders. However, to substantiate the LTCI premiums as an employee compensation business expense under IRC Section 162, the shareholders must actually be employees doing bona fide work, and the compensation — including those LTCI premiums — must be reasonable compensation for the services rendered to maintain deductibility.

LTCI premiums generally are moderate enough that reasonable compensation shouldn’t be an issue, but be wary when trying to allocate deductible LTCI premiums to family-member employees who don’t actually do much of anything for the business, and be cognizant that limited-pay LTCI policies — e.g., 10-pay, five-pay, or single-pay policies — that lump larger premiums into fewer years could potentially run afoul of reasonable compensation, although in practice such policies are rarely even available anymore.

In addition, while LTCI is not subject to non-discrimination testing as an employee benefit — meaning it can be offered selectively to employees, including shareholder-employees — it’s still necessary to substantiate it as employee compensation and not just a shareholder dividend.

As a result, eligibility to participate in the employer’s LTCI employee benefit program should not be based solely on whether the participant is a shareholder; instead, it should be determined based on other factors, such as providing to a class of employees — e.g., officers of the corporation — based on a particular length of service, among other factors.

ALTERNATIVE STRATEGIES

Beyond the rules for deducting LTCI premiums as an individual or via various types of businesses, there are a few other ways that LTCI coverage can be purchased in a tax-preferenced manner, including via a Health Savings Account (HSA), an annuity 1035 exchange or a hybrid LTCI or annuity policy.

From an HSA

Under

However, since IRC Section 213(d)(10) limits the portion of LTCI premiums that can be treated as medical expenses to the age-based limits, only LTCI premiums up to those age-based limits can be withdrawn tax-free from an HSA as qualified medical expenses. This means that any excess premiums above the age-based thresholds must be paid out of pocket, i.e., not with HSA dollars.

It’s also notable that under IRC Section 223(f)(6), any medical expenses —including LTCI premiums — paid via an HSA cannot also be itemized later as a medical expense deduction. In other words, LTCI premiums up to the age-based limits can be deducted as an individual medical expense or paid for with a tax-free HSA distribution, but never can receive both favorable treatments for the same premium dollar.

Via a 1035 Exchange

The

Under the new rules though, an existing life insurance or annuity policy

Of course, given that life insurance or annuity policies often accumulate significant cash value, while the premiums on LTCI are far more modest at least on a relative basis, in most cases the exchange would just be a partial 1035 exchange

Fortunately,

Example 3. Charlie has a $120,000 existing non-qualified annuity contract with a cost basis of only $70,000, and thus an embedded gain of $50,000. He is also purchasing a qualified LTCI policy with a $3,000/year premium. Under the existing 1035 rules, Charlie can fund his LTCI premium with a partial 1035 exchange for $3,000, reducing the cash value of the annuity to only $117,000 and the cost basis to $68,250 — since the transfer is treated as $70,000 / $120,000 *

In practice, not all LTCI companies have the systems in place to do so, and thus may not be willing to permit or cooperate with a partial 1035 exchange. If the insurance company cannot facilitate the transaction, the opportunity is simply unavailable; it cannot be done by merely taking a distribution and rolling it over to an LTCI policy if the 1035 exchange is not facilitated directly.

For companies that do permit an incoming partial 1035 exchange, the strategy can help to whittle down otherwise taxable gains. This is especially appealing in the case of an appreciated non-qualified annuity, given such annuities remain taxable to the beneficiaries even after death, and do not receive a step-up in basis, providing no other alternative to eliminate the embedded gain.

Via Hybrid Policies

The last option for funding LTCI on a tax-preferenced basis, also introduced as part of the Pension Protection Act (PPA) of 2006, is

Specifically, PPA 2006 modified the definition of what constitutes a “like-kind” exchange under

The advantage of this strategy is that under

Given the premiums subtracted from the hybrid policy already receive preferential treatment, they may not also be claimed as a medical expense deduction under

This is likely to be a more favorable treatment than just taking a taxable distribution from the insurance or annuity policy directly, paying long-term care expenses and trying to claim a medical expense deduction later.

Example 4. Charlie decides that instead of doing partial 1035 exchanges to an LTCI policy from his non-qualified annuity with $120,000 of cash value and a $70,000 cost basis, he will instead do a full 1035 exchange to a hybrid annuity/LTCI policy. After the exchange, his $120,000 is invested into a new hybrid annuity/LTCI policy, and carries over his $70,000 cost basis. Shortly thereafter, his first $3,000 premium is subtracted from the policy’s value, which reduces his cash value to $117,000 and the cost basis to $67,000.

Notably, after the LTCI premium is paid, Charlie still has a $50,000 gain exposure. Unlike the prior scenario of exchanging to an LTCI policy directly, the potential gain is not reduced. But if Charlie subsequently has an LTCI claim and uses the $120,000 to cover his long-term care expenses, he will not owe any taxes on the liquidation of his entire cash value, despite the $50,000 gain, because the LTCI claims are still able to be distributed tax-free. On the other hand, if he never actually has a claim, Charlie or his heirs will still need to contend with the $50,000 embedded gain, plus any subsequent growth that occurs in the future.

Given that LTCI premiums in a hybrid policy are only subtracted from basis — and the embedded gain is only reduced when actual claims are paid — an exchange to a hybrid policy

Ultimately, the Internal Revenue Code provides a substantial number of different ways to purchase LTCI with favorable tax treatment.

In general, the most favorable rules encourage a purchase via a business that allows for the full deduction of LTCI premiums without any age-based limits — though that is only available for employees, C corporations and 2%-or-less owners of S corporations.

The next best alternative, which at least maximizes the deduction — albeit subject to the age-based limits — is to claim a deduction for LTCI as a business owner (self-employed, partner or LLC member, or more-than-2% owner of an S corporation), or via an HSA.

After that, the most appealing option that remains is to purchase as an individual, claiming a deduction for only the age-based premium limitation as a medical expense itemized deduction subject to the associated limits.

And in some cases as a last resort, it may be appealing to purchase the coverage either via a direct 1035 exchange or what is often the least favorable — but still better than nothing — treatment of using a hybrid LTCI policy. Though the greater the existing embedded gains, particularly in the case of a non-qualified annuity, the more appealing this strategy may be.

So what do you think? Do you explore tax-preferenced options for purchasing long-term care insurance with your clients? Is the landscape of tax-preferenced options too confusing? Please share your thoughts in the comments below.