For more than 20 years, remarkably little research has been done on the costs incurred to obtain clients and the cost-effectiveness of various client acquisition strategies.

It turns out those costs are substantial. In fact, the average total expense of acquiring a new client is $3,119, according to a 2019

For planners with recurring revenue models, that significant upfront cost is critical. After all, the cost to acquire a client may be equal to — or more than — the entire revenue generated by the client in the first year.

This suggests an inherent inefficiency in advisors’ marketing strategies for attracting and acquiring prospects. In the course of our team’s research, we examined numerous client acquisition tactics and their relative efficiency. Here’s what we learned.

The J curve

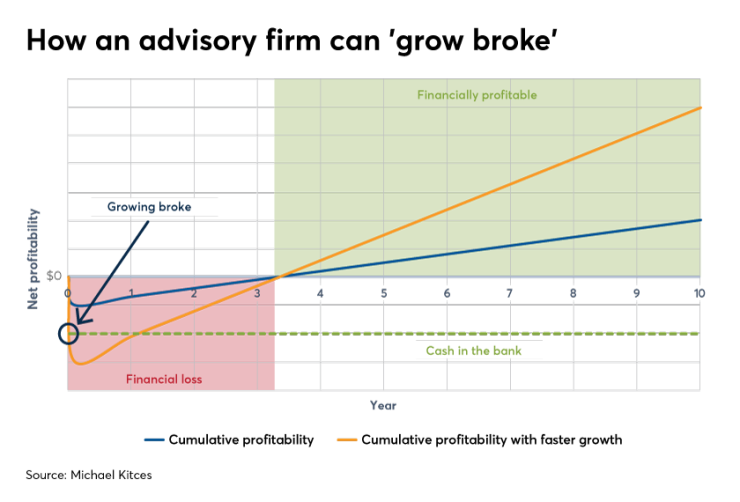

Firms on the AUM model may experience the so-called

For instance, if a firm acquired three new $500,000 AUM clients at the same time at an acquisition cost of $5,000 each, and presuming each of them generated $5,000 in fees at 30% profit margins, the firm’s long-term profits might increase, but short-term costs would be amplified as well. If the firm only had $10,000 of cash in the bank in the first place, it would be growing profitably with slow growth — and “growing broke” with fast growth.

In J-curve terms, the shallower the dip, the lower the risk of growing broke.

The fundamental risk in all such growth strategies is that clients must be retained for the long run to be long-term profitable. Fortunately, industry benchmarking studies show that advisory firms typically have 90%+ retention rates in the recurring-revenue AUM model, and top firms may see 97% to 98% retention rates, providing more than enough time horizon to recover those upfront marketing costs.

Uprfront acquisition costs

While there has been substantial industry benchmarking and research into client profitability, there has been virtually none into client acquisition costs.

Accordingly, we wanted to determine what advisory firms really were spending to acquire their clients. These are extraordinarily challenging things to measure, as historically advisors never spent much on client acquisition. Instead, given the transactional nature of the profession in its early days, the cost was borne not by the advisor, but by the insurance or investment product manufacturer trying to sell its products to consumers.

In turn, insurance companies and asset managers managed their client acquisition costs by using a commission-based system, ensuring advisors were only compensated when clients who could be profitable in the long run came into the firm. But because advisors — and salespeople in general — didn’t typically command much budget to sell their company’s products, the primary marketing cost for most advisors was the time required of the advisor to cold-call and network.

This tendency still holds today, even as a recent Kitces Research study showed advisors spent

That means advisory firms likely allocate a more business-to-consumer–typical

Accordingly, our study examined client acquisition cost

On that basis, the average client acquisition cost of an advisor is $3,119 per client — of which $519 is hard-dollar costs and $2,600 is the time cost to the advisor themselves.

Cost-effective strategies

Advisors engage in a number of marketing strategies, some of which are more cost-effective than others.

In

Notably, and as the results reveal, client referrals are a very cost-effective marketing strategy for advisors, due in no small part to the fact that most of the time required to cultivate the referral relationship is already baked into cultivating the primary client relationship.

This means that while client referrals themselves are time-intensive, referrals represent a very time-efficient growth strategy, at least at the margin — i.e., for clients with whom the advisor has already established a deep relationship, with a little additional time to ask for the referral or an introduction over lunch.

That said, a number of more commonly hard-dollar strategies also proved to be remarkably cost-effective, including

All that being said, other upfront-cost strategies were significantly less cost-effective, including paid advertising, radio and paying for third-party marketing consultants at a whopping $25,403 per new client.

On the other hand, the results reveal that once the advisor’s time is folded into the cost of acquiring the client, a number of low-cost-but time-intensive strategies for advisors are also remarkably ineffective.

To wit: Networking had an average client acquisition cost of $4,494, client appreciation events $4,933, networking with centers of influence — i.e., where advisors try to get referrals from key attorneys, accountants or other influencers in their community or target market — had an average acquisition cost of $9,144 due to the extensive time it takes to cultivate the relationship. And when considered on its own — i.e., not part of a broader integrated marketing strategy — social media had one of the worst client acquisition costs, at a whopping $11,937.

The most cost-effective strategies for an advisor’s time, beyond generating referrals from existing clients, were all related to educating prospects — i.e., writing a book,

Client considerations

Our research also showed that not all strategies generate the same kind of client in terms of affluence, needs and ability to pay for advice.

If it costs $10,000 to acquire a client who pays $10,000 per year in fees, it’s just as efficient as one that costs $1,000 but only generates average revenue of $1,000 per year. Viewed through this lens, a more nuanced perspective on the relative efficiency of various advisor marketing strategies can emerge.

In our study we assessed marketing efficiency as new revenue generated in the preceding year for every $1 spent on marketing efforts, which included both advisor time and hard dollars used. Not surprisingly, from an efficiency standpoint client referrals finished at the top, given their time and cost efficiency are complemented by the quality of leads the tactic tends to bring in.

Meanwhile, working with centers of influence looks substantially better when viewed from a marketing efficiency perspective than on the basis of client acquisition costs alone. Our research also indicates that investing in SEO is likely more cost-effective than other tactics because a one-time SEO investment may generate leads for months or even years thereafter.

At the other end of the spectrum, inefficient strategies include generic drip marketing — e.g., canned newsletter content — blogging, social media, creating a firm brochure and investing in a marketing consultant.

It’s also notable that some strategies proved especially effective among the top 25% most marketing-efficient firms. The most scalable standout strategies included — again, no surprises here — client referrals, but also books, direct mail, paid web listings, centers of influence, marketing lists and SEO.

On the other hand, a different subset of strategies was more efficient among the lowest-performing self-marketers, given some advisors just aren’t so marketing-inclined. Yet even among advisors who struggle with marketing, a number of strategies still netted at least some clients. These relatively low-risk tactics included client

Finding satisfying strategies

As our research suggests, a list of the most popular marketing strategies reveals little correlation between what advisors commonly do and what actually works.

Instead it appears there is an undue reliance on time-based strategies and an avoidance of those that rely on hard-dollar costs — but that may actually be far more efficient, e.g., marketing lists and paid web listings.

Stated more simply, advisor marketing strategies appear to be inefficient because advisors are putting too much emphasis on generating high-quality leads — ostensibly with a high close rate — and not enough emphasis on strategies that may be more cost-effective but also may require filtering first through some bad fits.

When the top-line average client acquisition cost is $3,119,

These results also help explain why advisor business models have struggled to take off. For example, with an average client acquisition cost of over $3,000, it would cost a typical advisory firm $1.5 million in marketing and sales efforts just to get 500 hourly clients that generate $300,000 of

That’s not because clients can’t be served profitably, but because acquiring sufficient clients to make it work would either require the advisor to spend so much time marketing that they wouldn’t have any hours left to do the work, or would require so much hard-dollar marketing expenditure that the advisor simply wouldn’t be able to generate enough revenue to make it back.

Instead, advisors tend only to take hourly or project planner fees when the leads come in. Otherwise the firms remain stuck with lower average revenue and lifetime value per client than AUM or recurring retainer models might offer.

The other notable implication of our research is that there’s still substantial room for advisors to reduce their marketing costs and grow more effectively. Robo-advisors already know this, and that’s why they enjoy average client acquisition costs of

On the other hand, the relative inefficiency of advisor marketing suggests there is significant room for

Before we get there though, it may require the cultivation of

Clearly, the marketing challenges facing advisory firms are formidable. That’s partly why the largest firms

The key takeaway from our research is that calculating the true cost of acquiring a long-term prospect is not just about dollars and cents. As long as undue emphasis is placed on marketing strategies that substitute the advisor’s limited dollars for the advisor’s limited time, the balances will never tip. But by thinking more critically about their marketing’s efficiency — and mapping their spend to the tactics that are most likely to bear fruit — advisors can begin to feel that they’re growing smart, rather than growing broke.

Michael Kitces, MSFS, MTax, CFP, a Financial Planning contributing writer, is head of planning strategy for