A Kestra Financial team with $600 million in assets under management from a client book including “well-known household names” in sports, music and entertainment has bolted to launch a new RIA, according to a managing principal of the firm.

Lee Rawiszer, David Halper and Paul Volpe of Paradigm Financial Partners aligned with hybrid RIA-serving Purshe Kaplan Sterling Investments on May 11 as part of the

While Kestra CEO James Poer and Rawiszer praise the two firms’ 15-year relationship, Paradigm “felt that we needed to take the next step and evolution in our firm to independence,” Rawiszer says of the New York-area practice. Charles Schwab will act as primary custodian, with a service-provider firm called Merchant taking a minority stake in the new RIA.

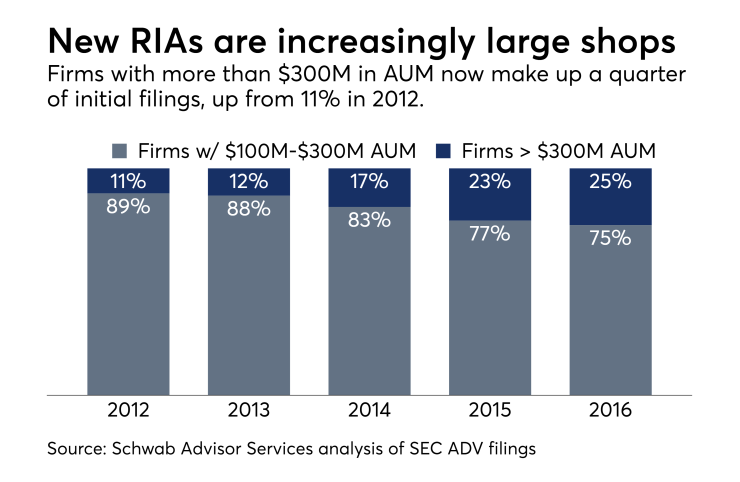

New RIAs with at least $300 million or more in AUM make up 25% of new filings with the SEC, Schwab

Paradigm, which will be multi-custodial with Fidelity and Pershing as well, has set a goal of expanding from Westport, Connecticut, to a new West Coast office near their Los Angeles clients, Rawiszer says. Schwab’s technology and support also figured in the move after more than two years of research.

“We were just greatly impressed with everything that they could offer our clients,” Rawiszer says. “We want to add some young but experienced advisors to our company to grow our business and help our clients as well.”

Rawiszer says the firm left on good terms with Kestra after “some of the best years of my career,” and Poer wished Rawiszer and his partners success with the new RIA.

“We greatly appreciated the opportunity to serve their business,” Poer said in an emailed statement.

-

The buyer of the broker-dealer to some 1,200 hybrid advisors is not a private equity firm.

December 5 -

-

New firm registrations have soared by 75% over the past five years, according to Schwab.

November 2

An inside look at which firms are attracting assets and advisors.

Paradigm is still working to transfer its clients’ assets, so the firm’s SEC Form ADV does not yet reflect their AUM, according to Rawiszer. Schwab has agreed to pay $400,000 for transition expenses, with part of the payments in increments based on the amount of net new assets, Paradigm’s

“Paradigm will periodically review its arrangements with the BD/Custodians and other broker-dealers against other possible arrangements in the marketplace as it strives to achieve best execution on behalf of its clients,” the document states.

Former clients of Rawiszer’s collectively received more than $1 million in eight settlements, according to FINRA BrokerCheck. The nine total complaints stemmed from a mezzanine housing investment fund that tanked in 2008, he says, noting the partners have no other disclosures across 84 years in the business.

Paradigm owners Rawiszer and Halper followed their fathers into the financial services and Volpe joined in 2003, when they became partners at what was once Halper’s father Chuck Halper’s practice. The firm also includes advisors Traci Saxon and Richard MacGregor and nine other employees.

The practice has boasted a large clientele among doctors and dentists in the area for decades, but one physician’s son grew up to be a pop star’s manager. Paradigm added the musician as a client about 10 years ago, and the practice now has many sports and entertainment clients alongside its medical industry customer base.

“It was like a domino effect. Once you represent one person in music or pop, word sort of gets around,” Rawiszer says, calling the referral from the client’s son “a little bit of luck” but also noting Paradigm now has relationships with career and business managers in the entertainment fields.

Equity partner Merchant will provide strategic services to the new RIA under the arrangement, according to Rawiszer. IBD holding company Wentworth Management Services acquired the firm’s new IBD, PKS,

PKS and Merchant have “a longstanding strategic partnership” and the IBD is “gratified to have been chosen to be a part of their overall strategy,” Flouton said in an email. Merchant, she added, “has considerable resources and relationships throughout the industry and only chooses the best advisory practices."