An Invest Financial advisor with $245 million in client assets has joined Kestra Financial amid the massive movement following LPL Financial’s acquisition of the assets of National Planning Holdings.

Michelle Bender’s Potomac Financial Consultants bolted for Kestra, the No. 13 independent broker-dealer, rather than join LPL, the largest one, Kestra

All together, advisors who have spurned LPL have taken roughly $30 billion in client assets with them. LPL’s CEO Dan Arnold has acknowledged the tough recruiting fight, but the firm predicts

Rivals such as

Earlier in March, for example, Kestra unveiled a hybrid practice with $270 million in client assets

-

At least three dual practices with nearly $1.5 billion in client assets have left since the No. 1 IBD unveiled the new guidelines.

March 8 -

Kris Chester led two major business reorganizations in her time at Wells Fargo Bank.

January 23 -

Kestra Financial’s James Poer offers advisors his three predictions for the new year.

December 22

Among recent career changes, Merrill Lynch lost brokers managing $2.2 billion to rival J.P. Morgan Securities.

Bender sees Kestra’s business development services as “strong enough to help launch my firm to the next level,” she said. Potomac has acquired two firms in the last three years, and Kestra’s similar product offerings to Invest, as well as the same Envestnet platform, also played a role in the decision, Bender says.

“When I interviewed LPL, I personally didn’t feel that complete independence was going to be possible,” Bender said. “I utilize third-party money managers for a large portion of my assets under management. Even though they said they would support them, they did seem as if they only wanted us to use their platform.”

A spokesman for LPL had no comment on her exit.

Bender formally aligned with Kestra on Nov. 29, according to FINRA BrokerCheck. In her 18-year financial services career, she spent seven years with Invest following tenures with PWA Securities, Mutual Service and 1st Global.

Kestra’s home office performs supervision of the Germantown, Maryland-based practice, which has also completed a custodial transition from Pershing to Fidelity. About 65% to 70% of the firm’s assets fall on the advisory side, with an average client account size of $1 million, according to Bender.

“Potomac Financial Consultants was looking for a partner who understands the ever-changing advisory industry and the dynamic nature of technology,” Kestra CEO James Poer said in a statement. He added that Kestra has “the resources needed to provide excellent client service while simultaneously growing.”

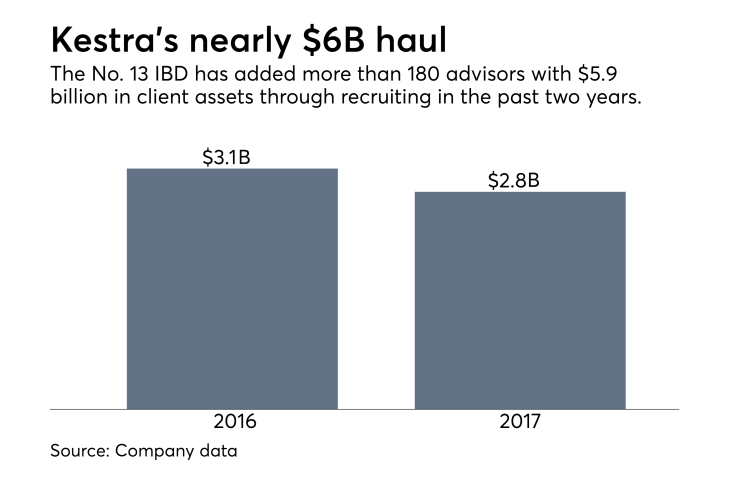

Poer has said his Austin, Texas-based firm, which has