With two independent broker-dealers, as well as a breakaway RIA channel and a trust company, the freshly recapitalized Kestra Financial has introduced a fifth subsidiary business.

Bluespring Wealth Partners went through a soft launch at the beginning of the year prior to its official

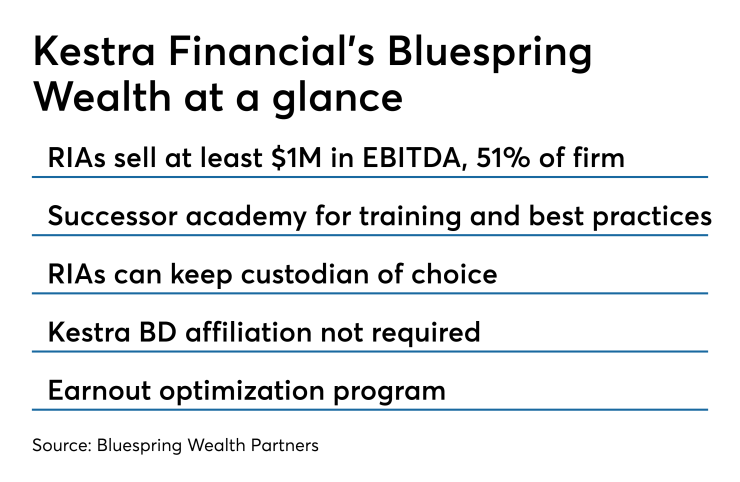

The firm requires RIAs to sell at least $1 million in EBITDA and 51% of their firm but doesn’t mandate any changes to their custodians, technology or BD registration status, Silverman says. A group of eight RIAs and other wealth managers purchased by Kestra are now with Bluespring.

Private equity funds managed by Warburg Pincus closed June 3 on the

Kestra

The firm is ramping up a training and coaching program it calls its successor academy, along with events like one scheduled for next month in Dallas bringing together founders and next-in-line advisors. Bluespring will also offer RIAs consultative programs around technology, operations, marketing and compliance.

“We're not going to tell you that you have to use it; we're just going to give you options, and our technology team is going to go in and do a very deep dive on how you could create more efficiency,” Silverman says. “The end result is, if you can either create more efficiency or create more profitability, they're going to max out their earnouts.”

Silverman declines to state how many RIAs the firm expects to attract, saying only that Warburg has given Bluespring “very deep pockets and a very, very big upside.”

-

The practice made the move as reps say they're more likely to breakaway now than at the end of 2018.

July 22 -

The team made the transition with Kestra Private Wealth Services.

June 26 -

The advisor trio joined the firm after its best recruiting year ever.

March 20

Advisory firms are generating "phenomenal" internal rates of return for PE buyers.

M&A transactions have set records each of the past six years, and they’re

Kestra’s structure “helps them have a breadth of offerings that's unprecedented out there in the marketplace, when you consider that some of the other consolidators are pure-play consolidators,” she says. “It’s really looking at the breadth of the wealth management industry in trying to have a spot for everybody.”

Silverman can also speak from the experience of

Executive Vice President of Strategic Initiatives John Vanderheyden joined Bluespring as its COO, and Silverman says the firm is aggressively hiring staff.

It’s “only natural” for Kestra “to establish a separate business concentrated on streamlining advisor succession planning,” CEO James Poer said in a prepared statement. “Bluespring Wealth will help advisors both within and outside of our network elevate their businesses to the next level of growth.”