Over the past five years, FINRA and the SEC leveled more than 50 enforcement cases involving share classes of mutual funds — and Kestra Financial is the latest firm to reach a multimillion-dollar settlement.

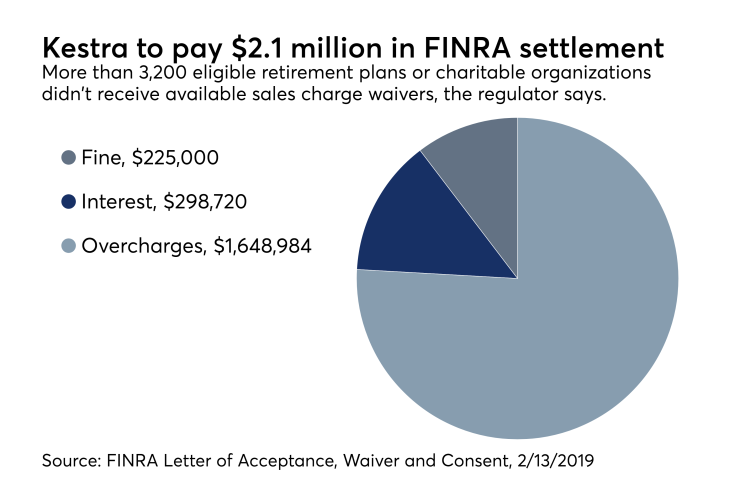

The independent broker-dealer agreed to pay more than $2.1 million in restitution, interest and a fine after failing to give 3,205 retirement plans or charities available discounts on upfront sales charges in their shares of mutual funds over nearly a nine-year span, according to FINRA.

Austin, Texas-based Kestra did not admit or deny the allegations as part of the Feb. 13

The FINRA case stemmed from the results of a 2015 examination. Since that year, the regulator has brought 36 enforcement actions over firms’ supervision of advisors responsible for applying sales charge waivers, according to FINRA spokeswoman Michelle Ong. Firms have agreed to pay $80 million in restitution to 107,000 clients.

RIAs subject to SEC oversight have also faced scrutiny over higher-priced share classes of mutual funds. The SEC has charged more than 15 firms with failing to disclose 12b-1 fees paid by advisory clients in mutual funds in the past five years,

The Kestra settlement became public as the firm considers a new ownership structure, but it also marks the end of a four-year investigation that followed the cycle exam. The firm overcharged clients $1.6 million and didn’t properly train its advisors or put controls in place, FINRA says.

“The firm relied on its financial advisors to determine the applicability of sales charge waivers, but failed to maintain reasonably designed written policies or procedures to assist financial advisors in making this determination,” the Letter of Acceptance, Waiver and Consent said.

-

Payouts from advisory firms have reached nearly $80 million as the regulator targets excess fees.

August 24 -

The IBD aims to be a 17,000-strong firm, but not every advisor will want to join up, experts warn.

August 22 -

The rarely dinged firm joined peers grappling with two issues: mutual fund fees and supervision of advisors who've been sanctioned multiple times.

December 6

From the SEC to the Supreme Court, here's what could be playing out this year.

Representatives for Kestra declined to comment on the FINRA case or

Kestra Investment Services, the BD entity charged by FINRA, spans 682 branches with 1,874 registered representatives. Between that, its hybrid RIA subsidiary Kestra Private Wealth Services and IBD subsidiary H.Beck, Kestra has some 2,300 affiliated advisors.

In its last FINRA case in 2016, Kestra agreed to pay a fine of $475,000 after the regulator accused the firm of other supervisory failures of consolidated reports sent to clients and the sale of $52 million worth of L-share variable annuities. National Planning Holdings and Advisor Group settled similar L-share VA cases with FINRA

The SEC’s enforcement division was pursuing nearly a dozen investigations — which usually take about two years — when it announced

“We believe that by pursuing this Initiative, we will identify, address, and remediate many more violations — and will do so much more quickly — than if we had continued to pursue these violations on a case-by-case basis,” the enforcement report states, predicting “scores” of RIAs will participate.

Last month, FINRA said it would launch