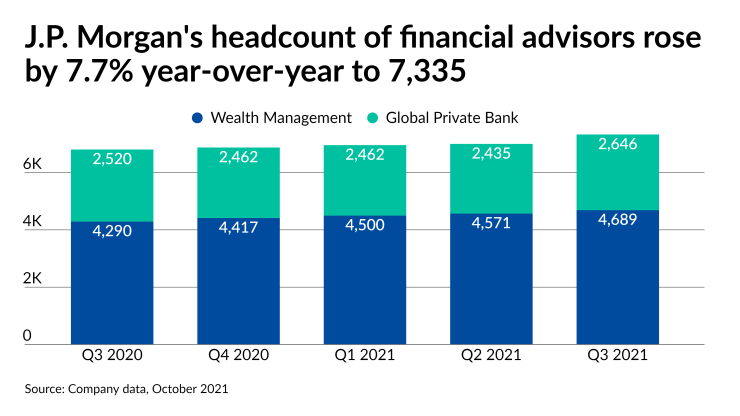

J.P. Morgan Chase’s recruiting is paying off in both its wealth management and private banking units, to the tune of more than 100 net new advisors for each division in the past three months.

The megabank’s Asset & Wealth Management segment generated record revenue while its number of Global Private Bank client advisors jumped 5% year-over-year to 2,646 in the third quarter, J.P. Morgan

Note: The firm doesn’t break out specific wealth management metrics across its organization, which includes the Global Private Bank in Asset & Wealth Management and the client advisors in the Consumer & Community Banking segment.

Growth goals: J.P. Morgan, which has ambitious

Client assets and advisor counts: In the last 12 months, the two units added a combined 525 net new advisors to boost their overall headcounts to 7,335. Compared to the prior quarter, the number with J.P. Morgan Advisors, bank branches or servicing online investors surged by 118, and the amount of Private Bank representatives surged by 211. Client investment assets in Consumer & Community Banking climbed 29% year-over-year to $681.5 billion in the third quarter, while Private Bank client assets rose 28% from the year-ago period to $1.82 trillion. Ultrahigh net worth clients, as well as certain high net worth accounts, remained with the Private Bank when J.P. Morgan transferred much of the rest of its wealth management arms to the Consumer & Community Banking segment in 2020.

The bottom line: The Private Bank reeled in revenue of $1.96 billion in revenue, which helped drive the $4.30 billion in gross sales across the Asset & Wealth Management unit and represented a steep 20% increase from the year-ago period. The segment’s expenses stretched 13% year-over-year to $2.76 billion due in part to higher compensation and distribution expenses for the larger business. Its net income jumped by more than a third to $1.19 billion. In the Consumer & Community Banking segment, revenue from fees relating to asset management, administration and commissions grew 27% year-over-year to $893 million. That unit generated net income of $4.34 billion on total net revenue of $12.52 billion.