Retail banking clients like receiving financial advice from their primary institution, even though few of them express interest in the services, a new study suggests.

Banks and third-party firms eager to solve the longtime riddle of how to convert savings or checking account holders into wealth management clients might look to the seemingly paradoxical findings of J.D. Power’s 2021 U.S. Retail Banking Advice Satisfaction Study, which the market research firm

Despite attempts by banks spanning decades of trying to “gain wallet share” among account holders through any number of products and services, experts say they still often struggle to figure out wealth management. The survey offers some signs of optimism that the banks could be starting to make progress: Overall customer satisfaction among retail clients soars by 229 points, on average, out of a 1,000-point scale when they receive advice or guidance that meets their needs. At least 52% of retail banking clients receiving the tips reported that the institutions met their needs, and 69% acted on the advice or guidance.

They aren’t likely to admit they would like those services, however. Only 19% say they’re very interested in getting advice or guidance and a third said they’re not at all interested. Despite the subtleties in the figures, banks and wealth managers tapping digital tools and offering guides on savings and paying bills are garnering high marks from clients, says Paul McAdam, J.D. Power’s senior director of banking intelligence.

“It does show the opportunity for banks — when customers receive these services, they're largely satisfied,” McAdam says. “This big group in the middle, they can be swayed.”

To compile the survey, the research firm spoke in March with 5,491 U.S. retail bank customers who confirmed they got any form of advice or guidance from their primary institutions in the prior 12 months. Their other answers displayed how much they could benefit from wealth management services: Only 38% passed a basic financial literacy test, and, out of the 51% reporting they weren’t financially healthy, 27% are vulnerable, 13% are stressed and 11% described themselves as overextended.

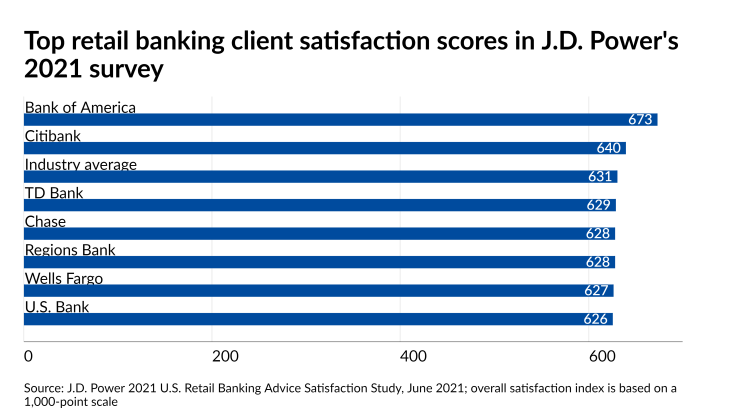

A little guidance and advice could go a long way towards happier customers as well. Clients rated just two firms as above average in overall satisfaction, with fewer than 100 points separating the No. 1 firm, Bank of America, at 673 out of 1,000, and No. 15, Key Bank, at 578.

Citibank (640), TD Bank (629), Chase (628) and Regions Bank (628) made up the rest of the top five, while Citizens Bank (597), PNC (608), Fifth Third (608) and Huntington (616) rounded out the rest of the bottom-ranked firms in the survey.

Wealth management conversions would represent a departure from the norm, though. Banks and credit unions currently provide investment management advice to “a small minority” of clients, who may be in effect thanking the institutions for information they’ll use when taking their business elsewhere, according to Gavin Spitzner of Wealth Consulting Partners. He recommends that banks “flip the paradigm” by leading with planning, rather than the typical approach of treating it as “just another ‘product,’” Spitzner said in an email.

“People like banks for their convenience, service and rates,” he says. “But when it comes to wealth management, they're looking for something very different. It's not to say that some banks don't have excellent advice offerings, but, while being part of a retail bank offers potential referral benefits, it's difficult to get clients to look to the same firm for the best rate on one hand and the best advice and guidance on the other. One is a transactional business and the other is a relationship business.”

Personalized advice about clients’ specific goals, challenges and achievements leads to “deep and meaningful relationships” and buying three to four times as many products and services as those not receiving wealth management services, according to Valorie Seyfert, the chief executive of CUSO Financial Services and Sorrento Pacific Financial, sister firms that work with banks and credit unions.

The institutions face challenges because they’re not as well known for investment services and often don’t have outside broker-dealers supporting their operations, she says.

Third-party firms can provide credit unions and banks services such as “integrating client access to account statements and other information in the home and mobile banking platform, offering easy funding and settlement options to and from a client’s banking account and access to service in the branch or remotely so that the client’s needs can be met in any situation,” Seyfert said in an email. “These are the things a client will expect and how a bank or credit union can achieve higher adoption rates for the wealth management services.”

Megabanks have their own BDs, and some have managed to gain clients’ approval through their digital tools, according to the survey. The top-performing firms were the ones giving out the advice and guidance most frequently in a targeted manner, while the lowest scores went to firms trying to provide the services without the same personal relevance to an individual client, McAdam says.

“One of the things they tell us is, ‘Boy, that was good, we wish we could get more advice,’” he says. “It could be the topic, it could be the staff person, it could be the way the information is represented on the website. A lot of things play into that.”