Most retirement plan participants aren’t finding what they’re looking for in the digital tools of their 401(k) providers, according to a new J.D. Power survey.

Only 24% of retirement plan participants strongly agree that their 401(k) provider “offers proactive guidance and help,” and just 43% find it very easy to locate the information they’re seeking on the firms’ websites and mobile apps, the first ever U.S. Retirement Plan Digital Satisfaction Study found. The global market research firm unveiled the findings Sept. 16 after polling 5,363 retirement plan participants between May and June.

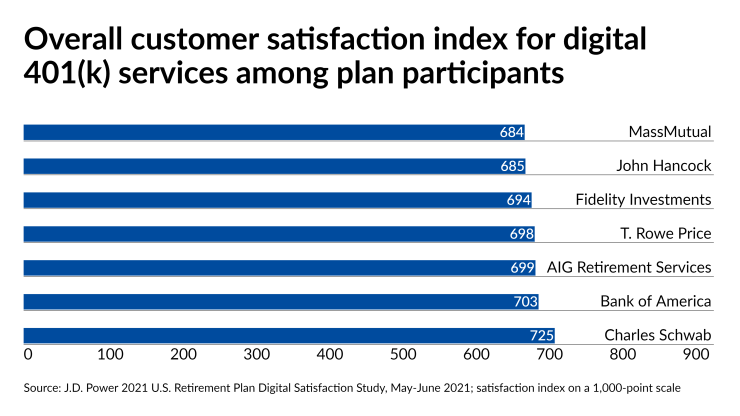

The rankings included in the results provide a look at which large 401(k) firms are getting the best grades from participants for online services on J.D. Power’s 1,000-point satisfaction index. Charles Schwab (725) and Bank of America (703) beat AIG Retirement Services (699), T. Rowe Price (698) and John Hancock (685) in the top five scores among firms with at least 100 plan participants in the sample. Voya Financial (633), ADP Retirement Services (640), Nationwide (646), Transamerica (662) and Lincoln Financial Group (668) had the lowest scores.

Providers are investing in services and tools that “are really intended to provide the participants with the ability to make better and informed decisions about planning for retirement,” Mike Foy, J.D. Power’s senior director of wealth management intelligence, said in an interview.

“A lot of these resources and tools are just not getting used,” Foy said. “You can't take an ‘If we build it, they will come’ type of approach to these guidance-related assets. You have to be more proactively engaging with clients to drive them to use these resources and get value from them.”

To that point, participants’ satisfaction with the mobile app came in 69 points higher than for websites, but only 35% of respondents had downloaded a provider’s app. That’s lower than the 52% of residential utility customers who have downloaded their energy company’s app.

The participants who did agree that their provider gives them proactive digital guidance were much more likely to recommend the firms and retain the same 401(k) or IRA company in a rollover. On the other hand, participants describing themselves as “overextended, stressed or vulnerable” financially gave much lower scores than those who were better off. The finding suggests their concerns “are not being addressed as effectively as they could be,” Foy said.

Low marks for digital 401(k) service shouldn’t be particularly surprising for the wealth management and retirement industry, according to Aaron Schumm of Vestwell. The digital 401(k) recordkeeper works with between 20,000 and 25,000 small businesses. The largest providers are operating on platforms that “were essentially built pre-internet,” in the days before clients could find their specific product or answer in seconds from their phones, Schumm said.

“The technologies that have gotten the industry to where it is today don’t have the capability to do that,” he said. “There hasn't really been a modern way of engaging.”

Highest scores in the J.D. Power 2021 U.S. Retirement Plan Digital Satisfaction Study

Charles Schwab: 725

Bank of America: 703

AIG Retirement Services: 699

T. Rowe Price: 698

Fidelity Investments: 694

John Hancock: 685

MassMutual: 684

Principal Financial Group: 680

Prudential Financial: 680

Industry average: 675

TIAA: 674

Empower Retirement: 671

Vanguard: 670

Lincoln Financial Group: 668

Transamerica: 662

Nationwide: 646

ADP Retirement Services: 640

Voya Financial: 633