(Bloomberg) -- It was a December to remember for U.S. ETFs as a record $62 billion flooded in last month.

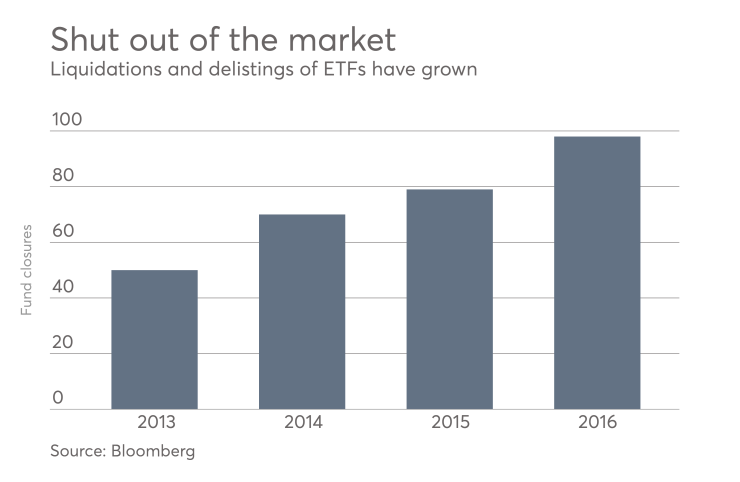

Yet, the rising popularity of ETFs masks the rising number of funds that aren't making the grade. Liquidations and delistings reached 98 in 2016, an all-time high, with funds from BlackRock and State Street among those getting the ax — even as other products from the money managers led inflows.

The reason? With a more than 10% growth in the number of funds over the last 12 months, not all strategies can win investors over. And in ETFs, performance counts, but gathering assets counts more.

"We're entering a range that's higher for liquidations," said David Perlman, an ETF strategist in New York at UBS Wealth Management. "Somewhere around 100 funds per year is more likely going forward."

BlackRock, the world's largest asset manager, shuttered 10 ETFs in August, one of which returned almost 40% in the preceding eight months but was struggling to bring in cash. State Street scrapped 16 products in 2016, with smaller providers WisdomTree Investments, ProShares and Direxion also closing funds.

Weeding out funds that don't attract investor interest isn't necessarily bad for the ETF industry. Culling unsuccessful ETFs is a natural part of the business by simplifying the choices for investors and eliminating maintenance costs for fund providers and market makers. It also leaves a larger pie for the remaining funds. More than 200 new exchange-traded products started trading in 2016, boosting the number of funds in the U.S. to nearly 2,000.

State Street's S&P 500 ETF, which goes by the symbol SPY, saw the biggest inflows in December, absorbing almost $14 billion and capping a year in which it took in $25 billion, data compiled by Bloomberg show. BlackRock's high-yield debt fund, HYG, was the most popular fixed-income ETF in December, adding almost $2 billion, according to Bloomberg data.