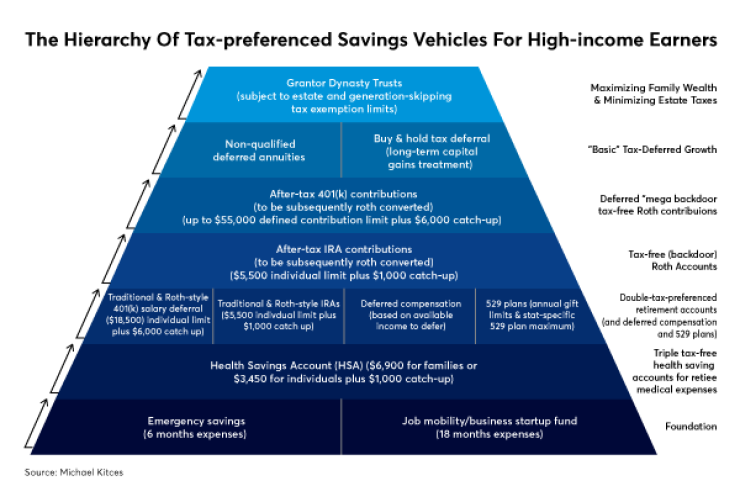

The federal government has long incentivized saving by offering some combination of three tax preference types: deductibility, deferral and tax-free distributions. Yet for more affluent households, it’s a question of dialing in an optimal mix of tax-preferenced vehicles. To do that, a hierarchy is in order.

An optimal approach feeds the best preferenced accounts first, and as contribution limits are met, spills additional savings over to the next tier. When used in a holistic planning strategy, this hierarchical model can help high-income earners limit their tax liabilities and maximize growth.

At their core, tax-preferenced retirement accounts fit two archetypes: traditional accounts, which provide a tax deduction for contributions but ultimately tax the distributions; and Roth-style accounts, which are not deductible when contributions are made but are tax-free when distributed.

These retirement accounts are effectively double-tax-preferenced, in that they receive both tax-deferred status on assets in the account, plus either a deduction upfront or tax-free distribution treatment at the end.

Notably though, some tax-preferenced savings accounts are even better. HSAs are

Vehicle preference is simply based on whatever goals an individual is pursuing — whether it’s paying for medical expenses and health insurance deductibles, sending kids to college or saving for retirement. To the extent that dollars are limited, this is an exercise in building up an initial emergency reserve, then allocating scarce resources to whatever goals have the greatest priority, while hoping to make the rest up with future savings — and

Households that might be earning $300,000 or more, however, tend to apply a different lens on these goals — whether it’s

TIER 1: HSAs

The first and best place to commit to long-term tax-preferenced savings for high-income individuals is an HSA. The key to maximizing the HSA as a high-income savings account is to pay all actual medical expenses out of pocket, while also contributing to the HSA to cover future medical expenses. Treated in such a way, the HSA effectively becomes a

These include most long-term care expenses, co-pays and deductibles under Medicare in retirement, plus long-term care insurance premiums up to the

Of course, the caveat to having an HSA is that it’s only permitted for those who have a

TIER 2: RETIREMENT

After the triple-tax-free HSA, the next tier consists of various double-tax-preferenced retirement accounts. High-income individuals tend to feel the pressure and impact of the top tax brackets, and as such typically prefer

Ironically though, for most high-income individuals it’s actually

For those who are already in the top tax bracket, it’s difficult to achieve higher future tax rates. Even very affluent married couples have trouble reaching the $600,000 annual ordinary income level that would place them there. And despite fears of rising future tax rates given current budget deficits, the trend in Washington is toward actually

Consequently, the Roth-style account really only suits those who are not just in the top tax bracket now, but will be there for life. These are households with $15 million-plus levels of net worth. For the rest, it’s better to get the tax deduction now, at top rates. Those who want a tax-free Roth in the long run should

In practice, this means not contributing to a backdoor Roth IRA or Roth 401(k), and saving instead the

For high-income individuals who either own businesses or at least are sole proprietors filing a Schedule C, there are even more savings opportunities. Total contributions to a 401(k)-salary-deferral-plus-profit-sharing plan in the aggregate

Notably however, business owners with employees must make contributions to other employees as well, which may reduce the value of making additional profit-sharing or defined benefit plan contributions, causing alternatives like a

It’s also worth leveraging 529 college savings plans at this tier to maximize the opportunity for tax-free growth, especially for younger children who have a decade or more to benefit from tax-deferred compounding. In fact, for those who anticipate more than enough wealth to cover the family’s needs, additional funding into a 529 plan — up to the plan’s

TIER 3: TAX-FREE ROTHS

As noted earlier, most high-income individuals should maximize pre-tax retirement accounts first — and at best, only contribute to Roth-style accounts later via a

In such situations, making an after-tax contribution

There are no such limits to backdoor Roth contributions, but it is still important to navigate around the IRA aggregation rule that can cause non-deductible IRA contributions

TIER 4: GOING MEGA

The next option is a deferred Roth contribution, also sometimes called the mega-backdoor Roth.

Popularized after

As the name implies, the contribution limits are significantly higher — starting above the $18,500 pre-tax salary deferral limit and extending all the way up to the

However, several caveats reduce its appeal relative to the preceding tiers.

The biggest: While IRS Notice 2014-54 permitted after-tax contributions to be converted to a Roth account, the tax-free status doesn’t begin until the dollars are converted to a Roth. This means they need to leave the employer retirement plan.

Consequently, the mega-backdoor Roth is often considered a deferred Roth contribution, a distinction that isn’t earned until either the employee retires or at least separates from service — unless the plan allows in-service distributions.

In addition, the $55,000 limit for all contributions includes both the $18,500 salary deferral limit, after-tax contributions and profit-sharing or other employer pre-tax contributions. Employers that make profit-sharing or salary-matching contributions reduce the remaining availability of making after-tax contributions.

There is also at least some risk that Congress will eliminate the ability to convert after-tax dollars.

TIER 5: BASIC GROWTH

These high-income savings vehicles don’t provide any upfront tax deduction or tax-free distributions, but do allow for tax-deferred growth.

The most common vehicle at this tier is the non-qualified deferred annuity, which when held outside a retirement account provides tax-deferred growth. That said, as an annuity there is an additional cost for the annuity guarantees and the tax deferral wrapper.

The good news is that for high-income individuals who just want tax deferral, there are a growing number of Investment-Only Variable Annuity, or

Classically, permanent cash value life insurance has also been used as a tax deferral vehicle, absorbing the costs of life insurance death benefits to access the tax-deferred growth treatment available, where the growth

Yet it’s impossible to borrow and use all the cash value, lest the policy

As a result, cash value life insurance is more commonly used for at least those who have a blended need for savings and a death benefit, for ultra-high-net-worth investors who can access lower-cost

The good old-fashioned taxable brokerage account can also be a tax-deferred growth vehicle, at least for long-term growth assets — because capital gains aren’t taxable until holdings are sold. In fact, a zero-dividend growth stock held until liquidation gets the same tax-deferral treatment as an annuity, but without the cost of the annuity wrapper.

Unfortunately, investments with a

TIER 6: DYNASTY TRUSTS

For those who want to further maximize tax-preferenced growth with additional savings, there’s the grantor dynasty trust.

These are not necessarily income tax savings vehicles. In fact, trusts face a top tax bracket of

Instead, the tax savings appeal of a dynasty trust comes in structuring it as a

This approach allows the grantor to use dollars in their estate to pay the income tax bill for a trust that is growing outside of his/her estate — permissible under

CAREER CONSIDERATIONS

Notwithstanding these six tiers, having a healthy emergency fund and disability insurance are paramount.

Income can drop unexpectedly even for high earners, and being compelled to liquidate tax-preferenced accounts can leave a household worse off than having just skipped tax-preferenced accounts altogether. That’s not to mention the

And the ideal may not just be the classic six-month emergency fund, but an additional 18 months to allow for job mobility and business/career opportunities. There’s nothing more freeing about making good career decisions than knowing you can take risks and still have an ample cushion to fall back on.

The greatest wealth creation opportunity for those who are still working is the chance of finding a job or starting a business

Businesses also create enterprise value that is tax-deferred until the business is sold. Moreover, a business converts ordinary income into capital gains, and potentially introduces special tax benefits under

And so while it’s important to maximize the tax-preferenced vehicles available for high-income earners, it’s also critical to create a job mobility/business start-up fund as well. It has clear tax benefits, and arguably the greatest wealth creation potential of all.

So what do you think? How do you help clients prioritize savings within the hierarchy of tax-preferenced vehicles? Where do you see individuals make the biggest prioritization mistakes in the hierarchy? Please share your thoughts in the comments below.